Costa Coffee employs people who can not speak or hear to serve customers and they do it with a smile. I think that I am never going back to Coffee Day unless there isn’t a coffee shop nearby.

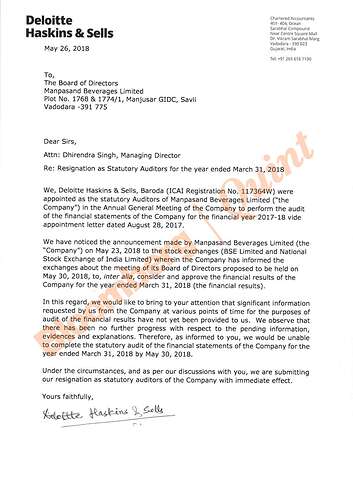

Deloitte resigns as statutory auditor of Manpasand Beverages, co appoints Mehra Goel & Co as new statutory auditor.

Is it a clear red flag?? I don’t know whether any fraud involved or not but one think I learned that when ever we get any clue of red flag we must stay away from such companies despite of holding of any big players (Motilal oswal hold 5.49% stake in Manpasand beverages)

This news remind me 2point2 capital report the Curious Case Of Manpasand Beverages in 2016

https://2point2capital.com/blog/index.php/a2016/12/06/the-curious-case-of-manpasand-beverages/

I think you should also post this on the Manpasand Beverages thread. Its imperative that the shareholders of the company know about this.

I came across an interesting piece in a book on the contribution of business leaders and management to the outcome of a firm.

I’ve tried to summarise the portion and tried to the best of my ability to curb errors. If any, please excuse me.

Do business leaders play a role in a company’s success?

They definitely do. It has been established by research that correlated characteristics of the CEOs and of their decisions to the performance of the company.

CEOs, without a doubt, influence a company’s performance. But, their contribution is much lesser than we/ the business newspaper would imagine.

The strength of relationships is measured using a correlation coefficient. It varies between 0 and 1. In this case, the correlation coefficient between success of the firm and quality of the CEO is 30%.

Let’s develop an intuition for this number-

a) In an ideal case, the better CEO led company will outperform other similar companies 100% of the times.

b) In another case, where success of firms is determined by factors beyond the CEOs control ( luck), 50% of the time, the more successful company would be led by a weaker CEO.

In the research performed, it emerged that stronger CEO led the stronger firm in 60% of the cases. Just 10 % more than random guessing. CEOs probably don’t deserve the adulation.

Most people overestimate the contribution of CEOs.

10 percentage points is definitely a substantial difference.

But, a CEO, who performed hardly better than chance is probably not deserving of the extensive press coverage by business magazines and hero worshipping by shareholders. Believing that a CEO exercises greater control on a company’s performance adds structure to our lives and alleviates stress. It’s the illusion of control.

When people are asked to assess the management of a company, their opinion is influenced by the performance of the company.

If a company is flourising, management will be termed ambitious, visionary, flexible, innovating, enterprising.

If the very next year, the company goes through a difficult phase, the very same management will be termed inflexible, unfit, incapable.

What changed in a year?

Our perception. Management is the same.

It’s a powerful concoction of the halo effect and the outcome bias.

Since, luck plays a significant role, it’doesn’t be imprudent to evaluate management quality on the basis of company performance.

Even if we know that the CEO is skilled and has great plans for growing the company, we won’t be able to predict company performance better than chance.

We might as well flip a coin.

Reading business magazines elucidating the role played by top leadership in growing the company sure is a good pastime.

But, drawing conclusions on management quality would be a massive error. We like coherence. But, ignoring the role of luck and regression and basing our investment decisions on the article is probably imprudent.

To summarise- CEOs are important. But, much, much lesser than often believed.

Person who called Manpasand Beverages before time.

Interesting, can you share the name of the book please. Thank you.

Thanks for sharing. A very authentic interview by @Mantri !

Came across this list of books on the topic on twitter…hope this is useful…

Few details about NSE co-location case.

find attached a really good presentation I came across. [Uploading…]. The examples are really good and are worth thinking about.

One aspect that most people get fooled on is companies that are used as laundering vehicles - the names of those in india must be self explanatory by now. The cash is real and the business shows more than normal profitability because well. guess what, there;'s an invisible hose pipe that feeds into the cash tank - because this is laundered cash and friction needs to be minimized in terms of indirect taxes, these are usually prevelant in businesses like B2C healthcare (which have no indirect taxes), agri inputs/seeds (which have no income tax or service tax - ridiculous) or in companies with temporary tax breaks (eg., in north east, himachal). once the laundering is complete, profitability falls off the roof and collapses on MSH’s heads.

Case in point was a famous B2C healthcare chain which showed 40 %+ EBITDA for a few years before going into CDR straight. it was well connected to a few politicians and it was anyone;s guess how much of the real income was supplanted by laundered cash.Final - Asiamin SMU talk 17 Mar 2015 - full-ilovepdf-compressed.pdf (1.1 MB)

@varadharajanr I think the presentation is missing from the post.

Dear Forum members,

It was a great initiative taken by varadharajan, but we have not been able to use this thread to its maximum benefit. Reading Mr. Varadharajan comments- I think he has given up when people has criticised him for kitex.

If some how we will be able to aggregate the company specific management quality at one place it will be great. Hope few senior people will take some initiative on this. This will be of great help in case of new stories, not in discovered one.

I have tried to write in detail what I mean in Vakrangee post. However, Thanks Varadharajan for trying. If it was arranged in some sort of way then only it was of any use.

Vakrangee- Quality of Managment discussion resurrected.pdf (42.7 KB)

I have attached the whole discussion from Vakrangee thread to save your time.

This pdf is worth its megabytes in gold! Thank you.

Good pdf vardha. Thanks for sharing. The movie " The accountant" is also nice - money is siphoned off and then pumped back into the co to give a picture of growing cash flows. Difficult to catch these things if one is focused only on financials. Too good to be true margins is one way but easier said.

I re-posted it. Earlier when i had begun this thread in 2015, I was amazed with the amount of criticism and trolling some of my posts on individual companies received. it seemed like people only wanted to hear good news. Now with some sanity returning ( and of course I’ve burnt my fingers too), I thought of stepping up on this thread to post on a few things that I’ve learnt myself

-

triangulating on number of employees/reviews/statutory payments:

-

checking # of employees on linkedin

-

triangulating it with employee reviews on facebook, employee reviews websites and

-

checking on statutory dues - professional tax and provident fund payments mentioned in AR

-

comparing average productivity of employees on both revenues and costs with the industry benchmarks - highest and the lowest.

for eg., in an IT services company that I analyzed recently, I was quite surprised to find only 400 odd employees on linkedin across all of the group companies- for a $ 300 MM turnover that seems absurdly low. That triangulated with the fact that much of their revenues get booked outside of India and they pay low taxes on it - lower than indusry average by 1000 bps and their receivables are much higher than the industry. While none of this per se points to anything, its a path that’s worth pursuing further.

Similarly, in a company which claimed to have 50 patents filed across the world, I was quite intrigued to find out that there were no other KMP earning more than Rs. 5 lakhs an annum and the company had zero Ph.D.'s working for them. Again, they made stuff that’s a food product and they dont seem to have a FSSAI registration number in India strangely. To top it off, their PF payment for the entire year was Rs. 1.5 lakhs (that’s low by any standard - assuming even Rs. 1000 pf contribution a month for each employee its low).

of course, no one single method for all - also, another way to triangulate is to look at number of employee. Especially in knowledge based industries like pharma/IT/R & D led where a lot of employees are IT savvy, this triangulation of # of employees, PF payments, professional tax payments works well.

(contd…)

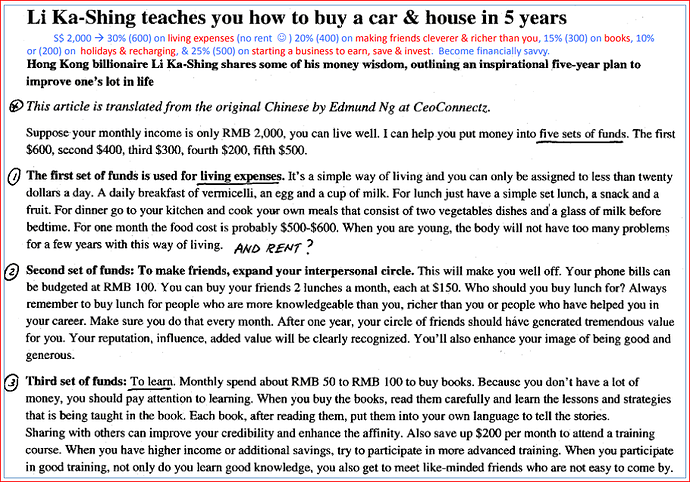

While the whole Hemant Amin talk is fantastic, what also stood out was lessons from Li Ka-Shing, a Chinese rags-to-really rich guy, and does not talk much. He began his business as a flower seller.

Here they are:

I loved the “always smile” philosophy ![]()

Cheers,

Needs Subscription

Nice thread on twitter about P2P lending