Good initiative! Have filled in the responses - would be great if you could share the insights from this

What you need to become a full time trader/investor -

- Rationality: High IQ alone is not enough. You must be open to the possibility of your fallibility, and must be able to recognize situations where evidence points to you being wrong. Consider Einstein. He had extremely high IQ, but also had a rigid deterministic world view, making him unable to accept quantum mechanics despite all the experimental results to the contrary. He would have made a poor trader. Good thing he didn’t have to make a living from it.

- Independent thinking: At the end of the day, we are social animals, and we tend to seek conformity with the rest of population. This group think is the reason behind extreme mania in financial markets, and it is extremely uncomfortable to stand apart from crowd and have your own opinion. Independent thinking must not be confused with being always contrarian. A lot of times, market is right and it pays to go along with the crowd.

- Temperament for solitude: Full time trading means you will lose contact with your professional network. You may have very few peers, or possibly none. Most of your work will be done alone, and you may not receive any feedback apart from the markets.

- Creativity (Unorthodox thinking): To make money, you must have an edge. It could be because of insider information, or ground level information obtained through hard work. But equally important is your ability to slice and dice the available information to obtain insights that the rest of the market isn’t even considering.

- Grit: You will be wrong on many investments (even Warren Buffet admits to be right only on 60% ideas). Your net-worth will be volatile and you will lose money on many days. We tend to feel twice the amount of pain when losing money, then the happiness felt when making the same money. You will not survive (as trader) those gruesome days without grit.

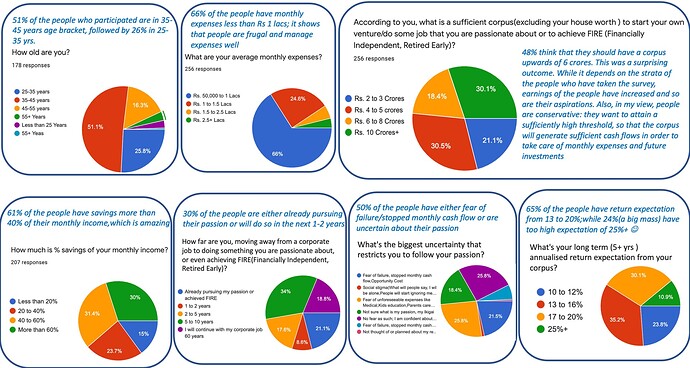

- Decent Corpus: Initial capital is the least important factor, though it is one which gets most discussion. Many successful traders/investors started with a small corpus. On the other hand, if you don’t have skills or lack any of the quality discussed above, no amount will ever be sufficient. In India, a corpus of 1 crore should be enough, assuming you own your house, and have a monthly expenditure of 50-60 k.

There are many, some of them already elaborated in this thread by me and others.

The most important one is that one should not take this option because the job/profession feels difficult/unfulfilling. If you don’t like your current profession, find a different one. Do not jump into being on your own because your organization/boss/profession does not give you your due. The equity market is more ruthless than all of them put together.

A better option is to test things out on a small scale before taking the plunge full time, assuming there is no conflict of interest with your employment contract there is no reason why a good investor can’t work with a small set of 15-20 customers over 2-3 years and see how this feels. People tend to underestimate the operational and compliance aspects of any business, they tend to focus only on the 20,000 foot philosophy when they sit back and dream of a life where they can do what they want to.

It is like taking a vacation to a place you’ve always wanted to go to. I always wanted to go to Ladakh after seeing the beautiful pics but the pics did not prepare me for the altitude sickness, headache and the cold weather one will experience there.

Similarly when one dreams of being wealthy and owning many properties, they tend to focus only on the status and the steady cash flow it generates. They rarely think about the operational aspects of property upkeep, tenant churn and a few other niggles that come associated with being a property owner. No photo of a rose ever focuses on the thorns that surround the rose.

I am big fan of taking baby steps and steadily calibrating rather than taking a big bang approach. Make mistakes that you can recover from, there is nothing worse than cutting short a budding career too soon. Financial Independence usually tends to happen to those who care about it the least, the money they make is the outcome of a process that pushes them to excel at something the world is willing to pay for. Even billionaires need a purpose that calls for them to wake up in the morning and hit the ground running. Else there is no reason why anyone worth more than 100 Cr should spend any time working, on the contrary some of them work very hard and take large risks.

Purpose over financial independence any day. I am starting to think that we have some of these Financial Independence and Retire Early concepts backwards.

There is huge difference between Full time investor ( with your own money ) and managing other people money …

Full time investor managing your own money -

I have covered this in my earlier post . It is all about passion of studying industries / sectors / firms and financial independence . You are answerable to yourself for both success and failure . But for this you need to develop a portfolio size that justify you doing it full time … The annual dividend income should be 2X your annual expenses before you jump on to this journey . This MOS is required so that you don’t have support yourself with other Jobs in case of major market meltdowns

Full time investors managing other people money - It is like any other job/ business … Here you get into multiple admin task + you need to manage your customer emotions so that they don’t panic at wrong times … It require multiple skills beyond pure equity investing … Here there is no concept of freedom as your customers don’t like to you see vacationing when they are losing money in market …

Choose options with care … and know why you are doing it …

I am full time investor since 2015 and manage my own money …

Don’t you think 2x annual expenses = dividend income is way too much. Assuming many of the city folks would have 1L as monthly expenses including medical emergencies. So 12L of annual expenses. That means one has to have dividend income of 24L per year. In India, on an average most cos have annual dividend yeild of 1-1.5%. So that means one needs to have AUM of Rs16-24cr? That sounds insane and overly conservative. Not sure if I am missing anything.

Well for someone who has been working for the past 20 or 25 years and who has been in the market for 10 or 15 years, having a portfolio of high dividend yield stocks, built over a few years of time, whose yield of 5-6%, if not more, substitutes for salary is entirely possible. Replicating this starting now is tough, may not even be possible at all.

And when one has been in the market for at least 10 years, one would have seen many market falls, blood on the street so to speak, where these dividend yield stocks too tumbled down, one would have accumulated more such stocks at very low prices.

Not to mention the prerequisite of understanding the businesses of these stocks, because with decreasing cash flows or top line, the companies may not give as much dividends as they did in the past.

There still are such high dividend yield stocks but the past may not necessarily get repeated I guess.

I am interested in the concept.

Yes and No …

Yes … Dividend income = 2X annual expenses may seem high for some one who has just started his career , family and w/o inheritance wealth .

When I started my career w/o any inheritance wealth but with luxury of self funded good education … I just could not have imagined I could built this kind of corpus - But if you invest in self in early part of career and stick to living in middle class lifestyle , this kind AUM is possible by age of 40 . ( In my case my salary compensation increase 200X over 18 years of work life ) . I was 43 when I quit corporate life

No - Dividend income = 2x is not being conservative … Annual expense which one budgets for is with current lifestyle … but as one ages and family grows - expenses can grow dramatically … More so when service inflation is as high as it is in across the world . In your own example of a person who has 1 lac monthly expense - one extra international trip with family can be equal to 60% -80% of annual expense or one health tragedy like COVID in a family can upset family budgets …

See once you decide to become full time investors - after 5 to 6 years you will not be employable in your earlier job unless that was in investment management . so you need to plan for a journey where you limited other options to earn money other than through investments

Thanks for clarification

Whats your opinion on replacing the “2x Annual expenses via dividends” by “Rent from House” or “interest from FD”

Because in the above approach, i would be diversifying my money (very important if one is going to live off just by his investments ?)

and also House rent and FD will yield higher money, which will require lesser capital…

And then equity can be focussed on value or growth or whatever suits ones style…but need not depend on the markets for the basic expenses to get covered.

Any pitfalls you see in this approach ?

This thread is on “equity investing as a full time career”

Passive income from equities is dividend income and hence the context . Dividend income from set of good companies @ portfolio level has proven to be inflation proof , more so when one has knowledge of fundamental investing and one monitors stocks on regular basis .

++ Dividend income is one of good outcome measure in addition to overall equity capital gain appreciation to see if you ability to take up this as career option

While one can earn passive income from multiple sources you need to check following

-

Will it be Inflation proof ie grow faster than inflation - Fixed income fails this test

-

Sustainability of income ie if you don’t have tenant for say one year while you have to bear the property related cost - etc so you need diversified mix of properties across micro markets - Typically > 20 well diversified rental properties across multiple locations/ countries will ensure sustainability - REITs can be better alternative in this context but one needs to see REITs whose dividends increase over period of time

Hope I have clarified your doubts

Could someone guide me what should one write in US VISA form for occupation if one is a full time investor in equiity?

valid options looks like -

- Business or

- Others or

- Not employed

But for Business and others it ask for Employer details.

But then is filling not employed correct?

Others seem to be best option (as not employed does not seem right).

It has been more than 6 years since moving out of a formal corporate gig. I am not a “full time equity investor” since I’ve been managing money for others

The biggest difference has been the flexibility to choose what priorities to focus on, rather than someone else setting the objectives for me. When you have no one pulling the strings in the background, you can genuinely think long term and make decisions accordingly.

If anything, my experience has cemented my earlier belief that full time investing isn’t for everyone. It is often a lonely journey with no great excitement or activity on a daily/weekly basis. It takes a different kind of personality to run with this for years and not lose your mojo, even if you are financially better off than being in a full time job. By nature, you should have a strong sense of individuality and purpose to pull this off

On a lighter note -

You don’t need to wake up/sleep at odd hours when you have book your flights tickets yourself

You can get yourself a drink anytime of the day

You aren’t obligated to tone down your views to appease some one else

Your calendar isn’t full of meaningless tasks

Every meeting/discussion you do ends up being productive, no brownie points for “being there”

If you are considering going the full time investing way, plan your transition out so that you don’t face a situation where you might need to reverse your decision within 2-3 years. That will be one hell of a problem, I can assure you. Rather delay the decision/process until you are sure that you can stay the course.

Good to hear your honest views on this sensitive topic. I can relate this to myself as i am a full time equity investor for a month now as I accepted VRS last month, at the age of 49+ and 27 years in corporate career, I could not do much on rising corporate ladder apart from earning a good packege and staying in a role for 16 years flat as i loved that role, was scared to devote much time in engaging myself for no reason and show the leadership that I am also one of candidate to rise up, untill you involve yourself in corporate politics, its next to impossible to rise after certain level, being a pyramid structure, if you don’t rise up than will be shunted out:joy:![]() .

.

End of the day if company doesn’t have business and performing poorly than even loyalty also will not work which is justified and 10-12% increments never encouraged me.

I shifted my focus to stock markets, start ups after 2008 when being Head APAC in an MNC, was informed to quit on the day of my younger sister’s marriage.

Never gave earned income a priority and developed passion for long term investing, from that day till now, i floated 4 start ups, one was a huge success, three flopped however it changed all fortunes.

I don’t know how many employees are happy in corporate Jobs once they cross 20 years experience as it makes you vulnerable if something happens bad and you loose your Job without much assets and keeping yourself motivated honestly is a big question mark as all corporates 70-80% leaders ars assholes and self ego is much more for them than company.

Earning your living becomes a “Majboori” despite compromising in your dignity on a daily basis in toxic environment.

I love markets and its not just about making money, i am independent on my judgements and capital allocation, once you take a large bet against herd and that performs as per your estimation and vision, the happiness and sense of accomplishment you get is “just WOW” . Main problem is maximum people will not be happy with this is shared because of Jealousy, thinking being inferior and low feeling hence you will find lonely after some time.

Decision is ours weather we want to indulge again and accepting selling our time to corporates or we want to use our time as per our will and enjoy much more gains with less efforts once skills are developed. It can ve developed by anyone with dedication, hard work and learnings.

Since your one startup was successful, I assume you must be busy in making it big…so you have become a businessman, not retired…or I am reading it wrong?

I think the very term “full time equity investor” is a misnomer. If I am fully invested in a basket of funds, am I a full time investor? The right term in terms of it being a career is a full time wealth/money/fund manager where one manages and invests other people’s capital.

@sandeep17

Yes.

If one invests 10 Cr in Nifty and do nothing, one makes 1-1.4cr p.a.

If one earns the same return of 1-1.4cr with 5 cr, managing the fund actively on his own, then it is called full-time investing.

Hi Mudit

Had to wind up startup in 2016 after running successfully for 8 years, it was into telecom and arrival of whatsapp killed business.

You are interpreting it wrong. Full TIME investor has an important word Time in it. How much of your time is involved in the activity will decide whether your are full.time or not. It doesn’t depend on whther you are fully invested in equity or partially.

Also if you are managing other people’s money, then you are no longer full time investor…Then you become money management professional. And its a 24 hours occupation just like doctor, CA or lawyer. Many people , when their corpus is ready, they quit their job and declare themselves as full time investors only to find themselves within few years being money mangers and indulging into full time profession of managing money for others.