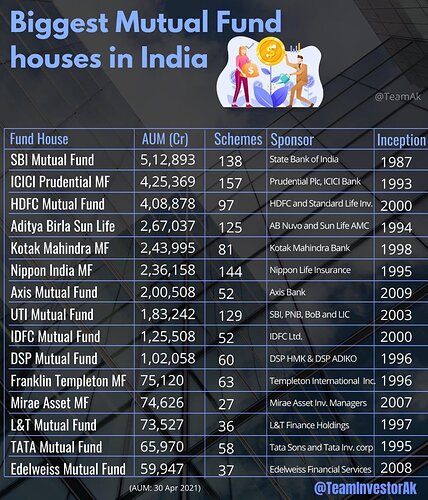

Edelweiss is a top notch mutual fund house. This business will also be demerged by Edelweiss once they find someone to buy stake in it.

One risk factor in potential demerger - what if the company demerges the EWM business and makes it a private company ?

Can it happen ?

No,it’s not going to happen. They already said that they are going to list it on stock market.

so finally an intimation for Q4 on 11th June ( its been a long wait since march ended ) …but what is perplexing is that there is a proposal for another fund raise …which i thought is already done as per Promoter in the Q3 or Q2 call …if i remember correctly …so dont understand what is the need for another fund raise ( this time & i quote " raising of funds by way of issue of securities including but not limited to Equity Shares and/or any other securities convertible into or exchangeable with Equity

Shares and / or Non-Convertible Debentures with or without warrants and/or

American Depository Receipts and / or Global Depository Receipts, through

Rights Issue/ Further Public Offer/ Qualified Institutions Placement (QIP) /

Preferential Issue or through any other permissible mode or a combination

thereof, as may be permitted under applicable laws"

Edelweiss.pdf (151.0 KB)

Does anyone have an idea on PAG deal status? I heard that the deal is completed only the listing new company is pending and edelweiss already received the amount in this quarter.

Is this true?

I agree, but i dont have much information on management. If they want they can change. Similar to PAG deal, initially they said that they will sold only 49% stack to PAG, later they have given more to PAG.

I can only see mutual-fund and insurance are the only good businesses in edelweiss. I bought only because of these.

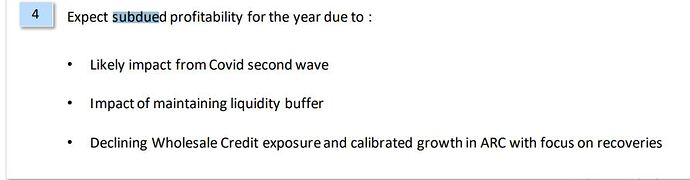

Insurance is losing money, Mutual fund is not generating any meaningful profit in edelweiss. Their main profitable business is ARC, Edel Wealth management. Other business are just kind of free.

Edelweiss has received the money last month and listing is expected in feb22-jun22

Thanks for the information

I feel that 60 is strong support and valuation is very cheap as per my understanding.

One thing is conserning here is low promoter holding and insiders are selling shares. Also, I listen old AGM videos and management is not able to give concrete answer on debt question which reduce my trust on management. Though I have invested

Insider might have been selling because of margin calls. And Promoter is unpledging their share that’s a plus, low promoter holding is because they build their franchise by selling stake in company, nothing to worry about it. Only negative thing is credit business which will be completely scale down by 2022, even I trust on that.

But according to me what really negative for company is continuous allegations on management quality, it could be sign of big fraud. Second negative is continuously find raising even after saying that they don't need fund anymore.This started last year as far as I remember. Any idea what’s new this time? Any progress.

last year fund was differentm this is different. well i welcome this fundraising, i hope they were talking about this fundraising in their disclosure to BSE/NSE

Demerger plan delayed once again- to Sept-Dec’22

Please read the press release again as it talks about demerger and subsequent listing by Sep-Dec 2022 which is barely 15-18 months away. Any demerger process, approvals and listing takes upwards of 9 months as it is, so I don’t see where the delay is.

Rashesh Shah’s statement

“During the year, we will continue to focus on strengthening balance sheet and liquidity; Invest in our retail credit, asset management and Insurance businesses and progress on the EWM demerger, in preparation for listing by Q3FY23, thereby unlocking value for our shareholders. Robust equity, comfortable liquidity and agile operating platforms will give us a solid foundation as we look towards economic revival and growth in the years ahead”

can anyone explain me how they got 456cr at BMU and Corporate ? is that the same money which they got from PAG? or this is kind of profit?

“Largest fund raise in a year - over INR 8,000 Cr”

“Deployed INR 4,100 Cr in FY21 across fund strategies”

Where it went? any idea? This is concerning too.

It is very difficult to understand their balance sheet. I think, they are making it complicated intentionally

Other income (Refer Note 17) 1,423.07 (Generated from PAG deal)

This is one time income and once it go away then result will be negative.

Without other income company has loss of 868 Cr. More than last quarter.