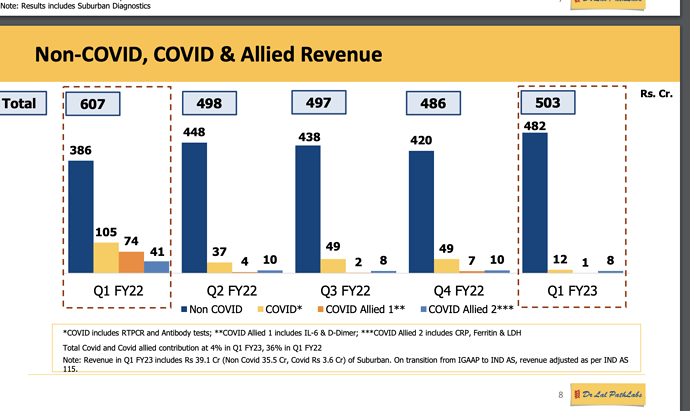

is pain only in the perception. Healthy QoQ/YoY non covid growth

There is continuous market sell of Dr. Lal path lab shares by directors and key management personnel to the tune of several lacs. Is it something to worry or just to leave it as en-cashing by employees for their personal need?

There also a report from Credit Suisse.

Credit Suisse has initiated “underperform” call on Dr Lal Pathlabs with a target of Rs 1,400 a share.

Dr. Lal PathLabs: A look at the ROE of the company 2022

Dr. Lal PathLabs: Return On Equity Analysis

The Oracle of Omaha, Warren Buffett, famously said, “The best investment you can make is an investment in yourself. The more you learn, the more you will earn.” With this in mind, in this article, we will look at how we can use Return On Equity to gauge a company’s profitability and how efficient it is in generating profits.

How is ROE calculated?

The basic method of calculating ROE is:

Return on Equity = Net Profit ÷ Shareholders’ Equity

But this method does not tell the whole story. We should also look at how efficiently the company is using its assets and what is the company’s debt level relative to equity, because a high debt level relative to equity may also make ROE appear high. So, we can use the DuPont ROE formula to analyse the ROE in a better way.

DuPont ROE = (Net Income/Net Sales) * (Net Sales/Total Assets) * (Total Assets/Total Equity)

DuPont ROE = (Profit Margin * Total Asset Turnover * Equity Multiplier)

Let’s look at Dr. Lal PathLabs’ income statement and balance sheet, and then we will calculate the ROE.

Required data from the Standalone income statement and balance sheet of Dr. Lal PathLabs for the year ended 31 March 2022 and 2021.

Return on Equity calculation using basic ROE formula:

Return on Equity (2022) = 3,440.54 ÷ 14,764.69 = 23.30%

Return on Equity (2021) = 2,801.06 ÷ 12,170.85 = 23.01%

Sorry I am not able to bring table here. See ROE table

As we noted above, the basic ROE formula and DuPont Formula provide us with the same answer. However, by using DuPont analysis we can see that the company is using its assets efficiently to generate high revenue and the company is also able to turn a good percentage of revenue into net profit. Here we can also see that the equity multiplier of the company is also not so high. It means that the assets are mostly funded by equity and retained earnings and the company does not use so much debt.

Now, to know whether an ROE of a company is good or bad, we will compare it with its industry average. The average ROE of companies in the healthcare industry having similar market capitalisation as that of Dr. Lal PathLabs is approximately 18%. So, the ROE of Dr. Lal PathLabs seems more impressive when compared to the average ROE of its peers.

Conclusion:

Although Dr. Lal PathLabs does use debt, its debt level is still low. The company has a high return on equity of 23.30%. It means the company is reinvesting its retained earnings efficiently to generate a high rate of return. This has caused substantial growth in the earnings of the company. The net Profit of the company has grown from Rs.168.00 crore in 2018 to Rs.344.10 crore in 2022.

How is it placed when compared to its nearest competitor like Metropolis Healthcare… This will bring out the reasons for higher PE for Dr Lal

The current share price fall is due to the increasing competition.

That period had covid revenue too, which may not be there going forward. And as @Tella asked if a comparative study with metropolis, thyrocare will give better picture. The analysis so far is good. Your finding of 23% ROE shows why Dr. Lalpath labs is industry leader.

The path forward is unclear. With low entry barrier in the industry, whether lalpath will grow at a pace which justifies it’s PE valuation.

Repeating the growth from COVID quarters is not possible.

Hi,

I have been analyzing Diagnostic sector after recent market correction, since valuations of few stocks look reasonable as compared to 2021.

I believe that, ROE could be lower for most of the diagnostic stocks going forward, but it may not drop to a large extent. In last 2 decades, we have seen various viruses emerging right from years 2001 to 2022, and some of these viruses may remain or new variants may emerge after few years. In general, people are becoming more cautious and now-a-days, Doctors also recommend more medical tests probably than they used to recommend 10-15 years back. Growing health awareness trend may also support the growth of this sector for multiple years.

Having said this, Valuations of Dr. Lal PathLabs is higher as compared to others, so in-depth comparison with other companies could certainly help.

Disc : Under watch list.

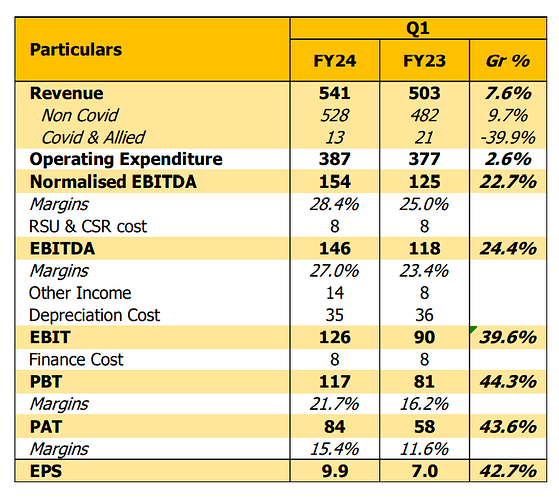

Really don’t understand the reason behind such deep corrections in the diagnostic stocks today. The results are positive, in fact exactly what one should expect from the company. Covid revenue now accounts for only 2% of the total revenues this quarter and margins also look stable. Even with covid revenue going down, non-covid revenue has been considerably higher than the pre-covid levels and also shows 9% growth this quarter. With increasing reach to new markets by the way of introducing newer labs and given the poor healthcare conditions in our country, growth of diagnostic sector is very important. But still don’t understand the reason behind the fall.

The commentary was extremely pessimistic from management this quarter. A complete turnaround from last quarter or last few years. It was almost a Sequent Deja-vu.

All brand value, customer trust and doctor preferences narratives were broken amid pathetic volumes. Suddenly new entrants have become competitive despite being unable to maintain margins, raising prices etc. and are eating organised market share instead of unorganised.

Diagnostic narrative of 15%+ growth, huge unorganised mkt share, organised going after only & only unorganised, packaged tests yada yada are in dust at least for this business. Need to hear peer commentary to cross verify.

Posted above so it’s available in journey thread of this business and we have something to reflect back on in future.

I will still wait for 1-3 quarters more to understand if this business has really lost it’s mojo.

Disc: Invested and evaluating. At this rate, slower ( not 15%) growing branded generics look a better option. Still diagnostics were always a proxy play from so many angles.

Update as on 8/2: Sold all holding with minor profit. I think any mgmt won’t make such statements without carefully evaluating and this is an old business too.

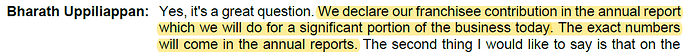

As i was reading the report, came across the Franchisee contribution of Lal.

From : Conference Call Transcript for Q4 & FY22

i cant find the revenue contribution in Annual report. Anyone have any idea on this.

Thanks in advance.

Perhaps JIO moment for diagnostic sector !!

These genetic tests are high margin business as most local labs dont have the resources to do such complex tests and hence, outsource it to larger labs on incentive basis.

Now, a larger player with deeper pockets is going to disrupt it !!

Interesting times indeed !!

Regards

I have stopped following Lal path labs for a while and looks the stock price has gone down significantly. Overall numbers of December where not that great but it was quite obvious citing the competitors entering and trying to disrupt the market.

Reliance entering the space will surely be other pain area as there deep pockets will be causing disruptions and then power of advertising in all there platforms. Also diagnostic is not a completely cash buring business as people who go for a test will surely pay money and Reliance can place the test at competing prices. One contrary, presence of testing centers as Reliance will have to build those and then partner with doctors. I have seen a few private hospitals which are sending there tests to Dr Lal exclusively for almost all patients in tier 3 city. So Reliance will need ground work which will take time and is not easy as distributing sim cards. Still they have money to endure that and whole celeb to advertise it.

Funny how commentary of management changes with market dynamics in matter of months. Overall in current scenario with new entrant I feel growth will be difficult for at least a 4-5 quarters unless management finds a way

Positives of Lal pathlab

- Margins are intact and cash is there in balance sheet.

- Some of the new markets like south can be leveraged with great execution to get the growth back

- Diagnostic space is big and will get bigger with time.

That said the current valuation seems high. I had added up Lal path lab during highs and it didn’t prove out to be a good decision overall from portfolio perspective. All pharma stocks have beaten up and overall market sentiments are not helping either.

I still see a good potential of growth in south markets but valuations are still tricky here. Funny with almost 50% drop in prices and PE is still 63.

Overall the era of cheap money seems to be over and high PE stocks will surely get beaten causing long term pain for retail investors. Dr Lal, Laraus and Divi’s are prime examples where growth went out of the window in matter of quarter and markets didn’t like it.

Disclaimer: Invested

Amazon also entered into food business in India but it had to shut down, so big players entering doesn’t mean end of road or they will be successful, RIL is entering everywhere these days, I feel they are trying out new business and see if anything clicks.

I use practo as it provides me one stop solution for appointments, medicine and tests. I believe that’s where the industry has to move to, although practo is still a small player likely to grow in future.

Practo isnt available in tier 3 cities where Dr Lal have its presence. I won’t be surprise if Dr Lal implements the similar model going forward, let’s wait and watch.

Hi everyone, I had attended Dr Lal Q4FY23 earnings call, below are the highlights -

-

Scale & Accuracy is the most important aspect in Diagnostics, going ahead player with accuracy & more reach will grow faster than the peers.

-

FY24 will have a clean base of FY23 that has very neglible covid revenues.

-

Bundled packages have become a way of life with Swastfit contributing to around 22% of the revenues now.

-

Have taken price hike in Q4FY23 on the specialised tests & not on routine and health packages.

-

Will be aggressive in south & west with Suburban being more active.

-

Major focus areas would be Tier 3 & Tier 4 cities.

-

Price increases should increase revenue by 2.5% on a full year basis.

All in all, FY24 should be very much in focus for investors invested in Dr Lal as FY23 is now a clean base & real growth rate can be measured. If the business is not able to scale in FY24 as well, would mean that competition from VC funded players is indeed making it difficult for organized players to grow & maintain profitability.

Disc - Invested & tracking closely.

have they provided numbers on opening new labs, PSC in new location count for these? How are these new centers performing?

They have guided to open 10-15 labs annually, mainly in tier 2 cities & below. PSCs & PUPs guidance was not given in the recent con call.

Regarding performance of new centres, I do not have any data on that. However, suburban’s EBITDA margins were 11% this quarter compared to 7% Q3FY23.