Q3 result highlights.

Revenue up by 25% YoY and 4% QoQ

PAT up by 28% YoY and 27% QoQ (Note: Q2 PAT was low due to deferred tax payment)

Another good show by Chola during auto slow down.

Q3 result highlights.

Revenue up by 25% YoY and 4% QoQ

PAT up by 28% YoY and 27% QoQ (Note: Q2 PAT was low due to deferred tax payment)

Another good show by Chola during auto slow down.

Very good numbers

Just curious How long chola can grow like this ?

Can it grow like this for next 5 years

Has management projected any long term growth in any of their presentations

Chola has strong and diversified customer franchise. Most of the customers are repeat customers and the brand has strong trust factor associated with it.

It has been steady compounder since many years now. They don’t give long term guidance, but in my view it can grow its PAT for 20-25% CAGR for next few years.

Q3 Results link

Cholamandalam Financial Holdings, the parent company of Cholamandalam Investment & Finance, seems a lot more attractive in terms of valuations. It is also into general insurance and health insurance. Is it better to play the Cholamandalam Investment & Finance growth story through Cholamandalam Financial Holdings? Please share your thoughts

I have been tracking Chola for a few years now and it’s a decent company with good tieups with most of the large dealerships. Currently they seem to do well in the used vehicle markets and CV space. I think this is a good medium term candidate for next 3-5 years with decent growth. On auto slowdown I think we need to wait until May/June based on bs6 to see whether we have some traction or its a prolonged down cycle. Other than that I see company is well managed so far and management seems competent enough.

Dis 7% of my portfolio.

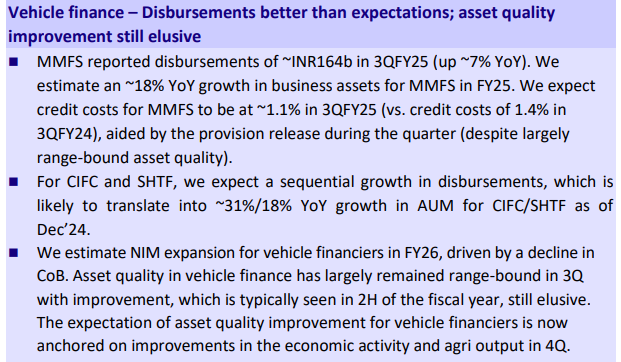

Feedback about vehicle financing from NBFC Guy :

Used vehicle financing is continuous to be good.

New vehicle financing: presently the business of new commercial vehicle financing is down by 60 to 70%. Most NBFCs, banks are not funding new vehicles which are BS4. After buying the commercial vehicle owner has to make changes like building body,tank etc as per the intended usage and get it registered accordingly before 31st March. In case the owner is unable to complete the whole process he can’t use it. In this scenario it’s very risky to do new commercial vehicle financing.

Some companies have already come out with BS6 models but customers are not ready to buy by paying more. Most of them want to wait for another 6 months to see how the new vehicle is doing. Expect only new vehicle sales to pick up only from Q3 fy21 festive season.

May be we should speak to more dealers to confirm this as generally lot of prebuying is expected before March and to know about time taken to do modification for commercial vehicles.

@spartan My friend who works for an NBFC told the same. Huge discounts are being provided for BSIV but getting it registered after body building is difficult. Heavy vehicle market is in passive mode for now.

Hmmmm…![]()

"Chola partners with Maruti Suzuki for vehicle finance.

The ‘Buy Now Pay Later’ offer is aimed to provide customers with easy financing options.

A two-month deferment of EMI will bring advantage to car customers who currently are under resource crunch amidst the COVID-19 pandemic."

https://www.bseindia.com/xml-data/corpfiling/AttachLive/2b10f412-0c90-449b-a252-eedbbed25a95.pdf

Chola

Management Commentary

Freight rates are keeping up with diesel prices and seeing capacity utilization improve in

certain areas. Expect freight availability and utilization both to improve even further in

November i.e. post harvesting season. Disbursements to existing customers have reduced as many were under moratorium.

Company shall restructure loans of those customers whose cash flows are taking time to rebound such as bus operators and MSME; expect ~1% of AUM to get restructured. Collection efficiency was better this quarter with LAP segment doing better. Management may reverse CoVID related provisions by Mar20 depending on the situation while macro related provisions to the tune of INR 8bn shall continue to stay.

Latest Q3 segment wise breakdown, vehicle finance/LAP have shown a drop in results. Unallocable segment revenue is 73cr and Unallocable segment result is 84cr (16cr last Yr). What could be explanation behind this? Unallocable assets are 8459cr.

Hey everyone, I just noticed that on August 31st, 2021 shares have been pledged by some Key personnel and promoters, the pledge is just 0.09% (yes mind you the number is very small) of the entire promoter shareholding. Is this anything to be concerned about?

29 Oct. please check corp announcements in BSE or any app like moneycontrol. This forum can better be used for more information on business updates or insights rather than such straight forward queries.

Is this report available in public domain?

Cholamandalam Investment and Finance Q1 FY25 Analysis: Key takeaways!!

𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐢𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐯𝐞𝐬

Diversification of product mix, with new businesses (CSEL, SBPL, SME) expected to contribute 15% of AUM in the future

Expansion into rural markets, particularly in the Home Loan segment

Focus on high-yield businesses and small ticket sizes in Vehicle Finance to improve yields

Continued branch expansion, with plans to add 150-200 new branches this year

𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐓𝐡𝐞𝐦𝐞𝐬

Shift towards used vehicles and smaller ticket sizes in Vehicle Finance

Growing contribution from Home Loans and Loan Against Property (LAP) segments

Increasing focus on unsecured lending through the CSEL business

Emphasis on maintaining asset quality while pursuing growth

𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐓𝐚𝐢𝐥𝐰𝐢𝐧𝐝𝐬

Strong demand in vehicle retail segment, particularly used vehicles

Robust growth potential in affordable housing finance

Increasing credit penetration in Tier 2-4 cities and rural areas

𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐇𝐞𝐚𝐝𝐰𝐢𝐧𝐝𝐬

Potential moderation in wholesale vehicle sales

Intensifying competition in the used vehicle finance space

Concerns about unsecured lending segment overheating

𝐀𝐧𝐚𝐥𝐲𝐬𝐭 𝐜𝐨𝐧𝐜𝐞𝐫𝐧𝐬 𝐚𝐧𝐝 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐫𝐞𝐬𝐩𝐨𝐧𝐬𝐞

Credit costs: Management expects credit costs to normalize to 1-1.2% levels by year-end

Unsecured lending risks: Management highlighted strong credit profile of borrowers (97% with 700+ credit scores)

Opex ratio: Expected to moderate as new businesses scale and productivity improves

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐥𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞

Chola maintains a strong position in Vehicle Finance, particularly in used vehicles. The company faces increasing competition from banks and fintech players in unsecured lending and SME finance segments.

𝐆𝐮𝐢𝐝𝐚𝐧𝐜𝐞 𝐚𝐧𝐝 𝐎𝐮𝐭𝐥𝐨𝐨𝐤

25-30% AUM growth over next 5 years

Aspiration to reach 4% ROA in 5 years

Credit costs expected to remain in 1-1.2% range

Opex ratio likely to moderate as businesses scale

𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐀𝐥𝐥𝐨𝐜𝐚𝐭𝐢𝐨𝐧 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲

The company anticipates potential capital raising in the next 2-3 years to support growth plans. Currently comfortable with Tier 1 capital above 14%, supplemented by Tier 2 capital raised through subordinated and perpetual debt.

𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 & 𝐑𝐢𝐬𝐤

Opportunities:

Expansion in rural markets

Growth in used vehicle finance

Scaling up of new business segments (CSEL, SBPL, SME)

Risks:

Asset quality deterioration in unsecured lending

Increased competition in core segments

Potential economic slowdown impacting vehicle sale

𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐒𝐞𝐧𝐭𝐢𝐦𝐞𝐧𝐭

Management indicated positive customer sentiment, particularly in vehicle retail and affordable housing segments. However, some caution noted due to upcoming elections and potential economic uncertainties.

Cholamandalam Investment and Finance company

Q2 FY 25 results and concall highlights -

Q2 Disbursements @ 24.3k cr, up 13 pc YoY

Loan book @ 1.64 lk cr, up 33 pc YoY

NII - 3055 vs 2205 cr, up 39 pc

PAT - 963 vs 762 cr, up 26 pc

NIMs @ 7.5 vs 7.4 pc

Expense ratio @ 3.0 vs 3.0 pc

Losses and Provisions @ 1.4 vs 1.3 pc

RoA @ 2.2 vs 2.4 pc

**Gross NPAs @ 3.78 vs 4.07 pc **

**Net NPAs @ 2.48 vs 2.59 pc **

RoE @ 18.24 pc ( healthy levels )

Segmental performance -

Vehicle Finance -

Company has a well diversified VF portfolio financing CVs, 2Ws, PVs, Tractors and Construction equipment from their wide network of 1461 branches

Disbursements @ 12.3k cr, up 5 pc YoY ( account for almost 50 pc of company’s disbursements )

PBT @ 631 cr, up 26 pc

LAP -

Lending to SME customers against the security of their immovable properties from 779 branches. 78 pc of the lending book in this segment is against self occupied residential properties

Disbursements @ 4.3k cr, up 35 pc YoY

PBT @ 295 cr, up 26 pc

Home Loans -

Providing Home Loans in the affordable segments from 697 branches

Disbursements @ 1.8k cr, up 16 pc

PBT @ 171, up 79 pc

SME Loans -

Providing SME loans for financing of Supply chain materials, term loans for Capex, LAS, funding against equipment and machinery from 88 branches

Disbursements @ 1.9k cr, up 1 pc

PBT - 27 cr, up 30 pc

CSEL ( consumer and small enterprises loans ) -

Providing personal loans, professional loans, business loans to salaried, self employed and small businesses through 482 branches. In this segment, company does tie up with fintech’s, partners like Samsung Finance ( for Samsung products ) etc

Disbursements @ 3.6k cr

PBT - 100 cr, up 118 pc

SBPL ( secured business and personal loans ) -

Provide Secure business and personal loans against self occupied residential properties through 414 branches

Disbursements @ 312 cr, up 27 pc

PBT - 35 vs 2 cr

Company is currently serving aprox 43 lakh customers from a total of 1508 branches ( most business segments mentioned above operate from same branches except for a few )

Branch Network -

South India - 29 pc

North India - 23 pc

West India - 23 pc

East India - 25 pc

Cost of funds in Q2 was @ 7.1 pc

Collection efficiency in Q2 was hit by prolonged monsoons which led to a delay in harvests which eventually reduces the money in the hands of the consumers. This should reverse in Q3

Slippages for Q2 @ 930 cr ( that’s an annualised slippage ratio of aprox 2.3 pc )

Second half is always better vs H1 on collections and recoveries because of the harvest of Kharif crops and release of a lot of payments from GoI

Company has added aprox 7k new employees in Q2. Employees have been added across all segments and the company believes they have a good opportunity to ramp up all their business verticals ( almost half of these employees have been added on the collections side of the business )

CV business should pick up as the Govt capex picks up. Seeing descent demand revival in PVs an 2Ws in Oct. Overall, disbursements in Q3 are always much better than Q2. Same trend is expected to continue for this FY as well

Aprox 25-30 pc of company’s work force is employed in the collections division

Company aims to grow the CSEL business but still keep it below 10 pc of overall business as its the only unsecured business that they are operating

Asset quality trends for the company in used vs new CVs are very similar

Disc: holding, biased, not SEBI registered, not a buy/sell recommendation