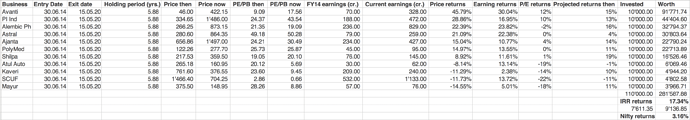

I have computed what would have happened if one were to simply invest equally in all the companies then

A few key insights:

- The portfolio massively outperformed Nifty (17.34% vs 3.16% in terms of price returns, ignoring dividends)

- The company which was trading at rich multiples was Astral Poly which was then trading at 49 P/E and is still trading at 50 P/E. All its returns (~22% total returns) have come from earnings growth of 22.38%.

- The highest returns of 45% IRR came from Avanti feeds, this was partly due to earnings growth of 30% and the rest from valuation re-rating.

- The worse returns was from Mayur Uniquoters (-14.55%) which came on the back of PE derating (-18%) vs earnings growth of 5%

- Also, the projected returns column shows how bad we are at forecasting!!!

In a nutshell, if one is sure of earnings growth of 20%+ over the next 5-years & is able to buy at reasonable multiples (20-25 times), odds are in their favor of generating >20% price returns. However, if one pays a fair multiple (20-25 times) and the company ends up generating <15% earnings growth, odds are against them to be able to generate >15% price returns as was seen in the cases of Mayur Uniquoters, SCUF, Kaveri, Atul Auto, Shilpa.

The excel sheet is below

Test.xlsx (11.9 KB)