@jana_n

This is a very involved topic. And as Hitesh is fond of saying “Beauty lies in the eyes of the Beholder” there is a wide range of answers that you get from people. For a proper perspective on Valuation, there is no better thread at ValuePickr than the ART of Valuation thread - where we have captured our Learning over last 5 years - that’s one of our most appreciated threads.

Everyone is encouraged to read that thread, and if you gain a new perspective from any of the posts, don’t forget to use the Like button. That’s the only way the community gets to know - what most folks find most useful for their needs.

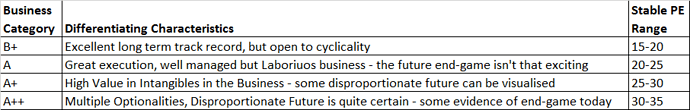

Meanwhile, just to get you curious, will share the essence - the gist of what we think is at the heart of the subject - what are the attributes that drive valuations for a business ( In Mr Market’s eyes). When we talk about a stable PE Range - we are talking about Mr Market differentiating one business over the other (over the longer term) on some key Metrics

- Size of the runway (Opportunity Size)

- How difficult it is to dislodge the business from its perch (Sustainability of Competitive Advantage)

- How consistent can the earnings be (Predictability)

- How much can it trust the management to execute - faced with all types of business challenges (Management Competency)

If you read the ART of Valuation thread with care, you will see how we were prompted to check out business from different sectors - why a Pharma company gets even 9x Sales valuations (IP? ), and why a commodity chemicals company cant get more than 1.5x Sales (Cyclicality?). We found that a very useful construct in thinking about Business Value Drivers, and Valuations. Everyone must read the Copeland Book on Valuations.

The other thing we all need to appreciate is the role Intangibles play in Valuations - and how we can get better at quantifying the Intangibles - Strategic Assets, Business Architecture (The Porter completive forces model). The importance of thinking like a 100% acquirer of the business with a choice can not be over-emphasised (if you had the money and had to choose between buying out entirely - Astral over Mayur, or Ajanta over both). It helps us dissect Valuation from an entirely different perspective - overlooking the numerical valuation metrics and ratios for cashflows, price to book, or earnings.

Turning through a lot of practical examples we have witnessed in last 5 years, and active brainstorming at VP and with senior investors and gurus, we progressively defined the current VP view on Business Valuations as below.

This is obviously work-in-progress, we reserve the right to refine these based on more practical learning, as we gain more experience in Markets.

Don’t forget Valuation is ART. We need to develop and use the right side of the brain a lot (skilfully moving a little away from the left side of the brain - predominantly numbers led - which primarily should serve only to help us avoid mistakes)