Good set of numbers from Bhageria, ST borrowings have reduced from 72 to 38 Cr in the half year.

Company has reported its best ever quarterly revenue and profitability. See the results

here.

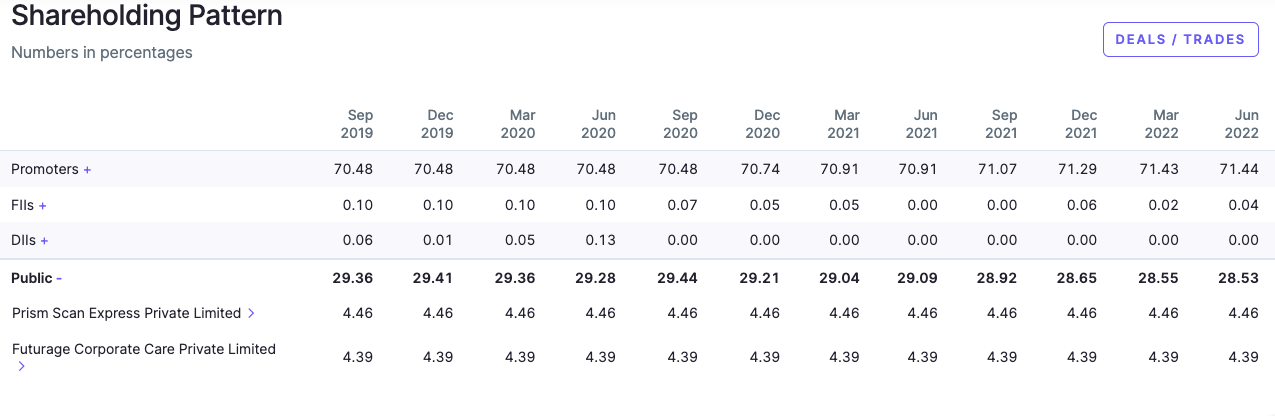

Noted that the current promoter holding is at 70.74%. They seem to have a relatively clean balance sheet and good credit rating.

Disclosure: Have a tracking position.

AJ

Quarterly Result Update :

They have also mentioned entering into Pharma segment :

"Board approved acquisition of 51% equity shares of Bhageria & Jajodia Pharmaceuticals Pvt. Ltd. ('BJPPL’), leading the way for Company to enter pharma segment "

Disclosure : Have a tracking position.

9.5 MW Solar project commissioned.

Promoter share holding was increased to 71.07% as of September quarter from 70.48% year ago. Also last few months promoter continuously buying from market as below.

Thank you @hitesh2710 bhai for bringing Bhageria Ind to focus as a techno gunda bet.

Disc:3% of PF at higher than current levels.

CARE Ratings Update ::

Also, commissioned 4.50 MW Solar Power Project as a turnkey EPC Project(s) for client for their captive consumption.

I am not an Investor in this company…

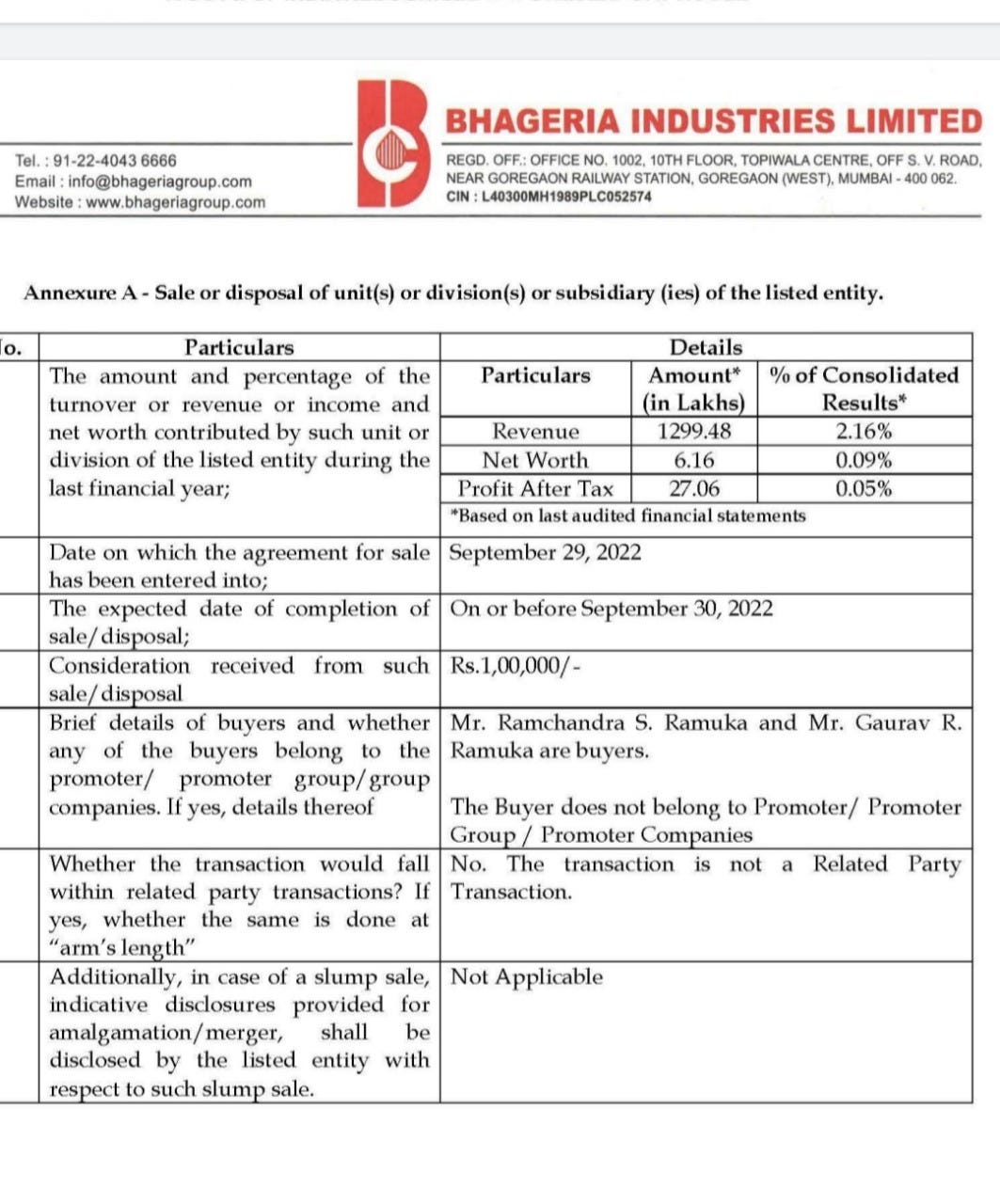

Well, this really captured my attention !!!

Were you also able to find it interesting…

Still looking for clues, let me make you life simpler.

Details of the above company are :

Revenue of 12 Cr

Profit of 27 lakh.

But, here is the twist, the company is sold for Rs 1 lakh.

Wow.

I am ready to buy, if someone can sell me this business even for 1.5 lakh. This is really crazy

I just reminded of a Meme “Kaun hai ye Log, kahan se aate hai”

Corporate Governance. For me, it looks like it has an issue.

Okay, let me deep dive further. Who bought it.

Two gentlemen, I guess who are related and are from same family -

Ramchandra S Ramuka

Gaurav R Ramuka.

The next statement says buyer do not belong to Promoters. Nice.

Lets check.

Went to Screener: Bhageria Industries Ltd financial results and price chart - Screener

Well this is right.

I further checked on Screener for Public Shareholding. Looks clean. Isnt it.

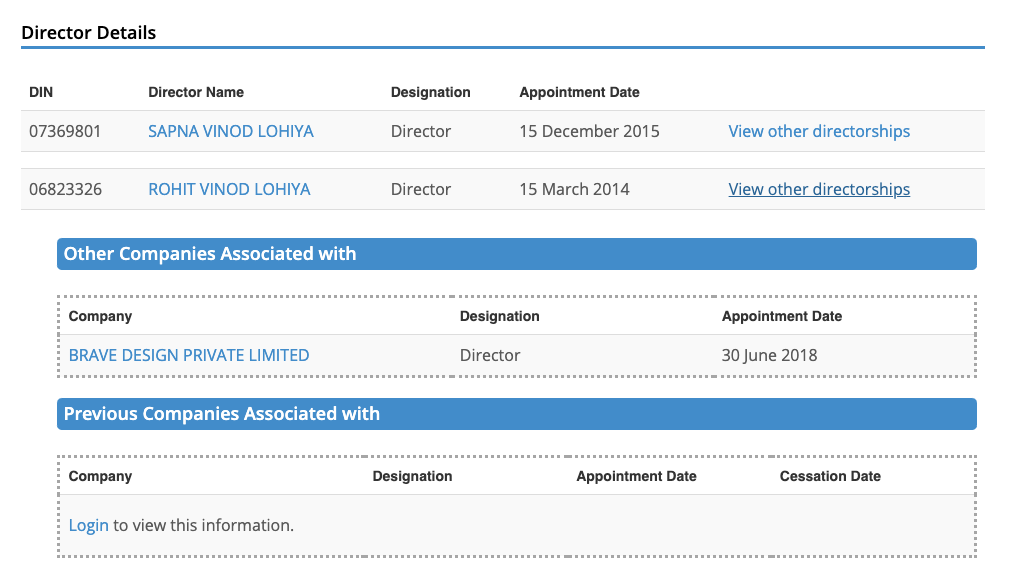

Lets go a step further. Who owns the 1st company Prism Scan (it holds 4.46% of shares). Zauba Corp filing says this :

Good, again clean.

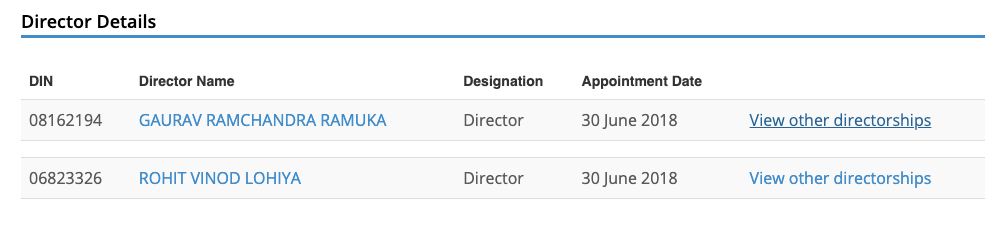

But, wait Rohit Vinod Lohiya has another directorship in Brave Design. Lets click on this.

Voila. Done. Its co-owned by Gaurav Ramchandra Ramuka.

Cool.

Isnt he the same person to whom has bought the business.

Is he the promoter. No.

But, does promoter knows him. Yes. (I think so).

Why would someone sell a 12 Cr Revenue & 27 lakh profit company just for Rs 1 Lakh.

Billion Dollar Question.

Disclaimer : These are purely my thoughts. The companies mentioned are neither buy or sell recommendation but only for Education purpose. I am not a SEBI registered analyst. These are my learnings which I wanted to share.

First posted on Substack.

Did you recieve any reply?

Does anyone has more info on this SEBI penality?

Anyone who closely follows or is in this industry ,can it be a turn around story?

The questions i want to ask are:-

- what are the reasons that the margins have fallen so much in the past 1 year?Are they temporary just like in a cyclical buisness?

2)Can strict pollution norms disrubt the industry like it did to china in 2014 what is the future of this industry?

The reason what got me interested is this is a small cap which trades at historically low valuation(price to book).promoter has been constantly buying from the open market and in the thread it says the promoter holding was around 50% back in 2015 which stands at 71% currently in 2023.The company has become debt free due to the super normal profits it has had since 2014.These things do negate the risk of it being a smallcap but it is hard to get any other info on the internet ,only thing i found i was prices of gamma acid has been constantly falling but i see not much change in the topline and in investor presentation it says the fall in margins are due to increase input cost.

Technically, the underperformance started on 8 Oct 21, looks like turning around and the stock closing above 200 DMA today. The peak on that day was around 308 and now 50% below that price.

Promoter also increasing the share holding consistently bringing from 70.48% in Sept 2020 to 71.75% in March 2023. Earlier in march 2017 it was mere 50.17% and went up to 70.48% by March 2019. The promoter also did not gain much (other than dividends) in almost 6.5 years.

Disc: Took at 2% opportunistic bet today just based on technicals.

The increase from about 50% to 70% was by way of a merger of a promoter co Nipur chemicals. It was not a very minority friendly move.

Now, their entry into Pharma with only 51% holding is also a bit worrying. But other than that their capital allocation and dividend payout has been very impressive historically.

what got me interested was it is cyclical stock,at 115 it traded at almost covid price of below 80ies as it had made super natural profits during these times and before.

I think the more worrying part would be if india stricken it’s enviromental norms highly unlikely but if it happens it will be very bad for this stock,holding as a cyclical investment and not a long term bet.

I believe that we are at the cusp of an upcycle. The company seems interesting too.

I noticed that this company is also in the Solar space.

Hey can you tell me what did you find out about its solar business?

The company is present in solar power generation. Bhageria Industries Limited has 39MWdc Solar Power Plant at Ahmednagar, Maharashtra (They won the 30MW Solar Power Project from Solar Energy Corporation of India in 2016; they commissioned 9.50 MW solar power project at Kombhalne village in Akole taluka, Ahmednagar district of Maharashtra).

Besides, they have a 4.78 MW operational Solar Rooftop project in Chennai.

The upcycle will take time ,on a recent interview nikhil kamath with cnbc told us that the entrepreneur he has been talking to all are saying that demand for goods has been falling and on top of that we are also seeing crude prices going up and this is going to lead to margin erosion for all dye companies also another headwind is china coming back again increasing supply and fighting for already low demand.

At current price i think everything is not priced in for me it would be somewhere around 110 to 120.Even at this price my major cause of concern would be how long chinese suppliers are going to be there for because the company enjoyed super normal profits for a long time due to china closing factories beacuse of pollution norms.

Agree with your views. I exited from this stock recently mainly because of Chinese opening up. I bought it in 2020 and enjoyed some decent returns on it but I think the past growth may not be sustainable in future.

By the end of the solar implementation project, APM Terminals Bahrain will have installed 20,000 solar photovoltaic panels capable of generating 18.5 Gigawatts of electricity per year.

More scope for Bhageria Inds?