Saakshi Meditech and Panels Ltd

Came across this SME Machine Tools company with Market cap of Rs. 469 Cr, CMP 266, P/E of 37.9 basis FY23 numbers.

Total number of shares 1.76 Cr with promoter holding 73.6%.

They got listed on 3rd Oct on NSE platform, 1200 lot size at Rs. 150/- (Issue prize of Rs. 97).

Company is in business of making medical device, Electrical Panel, Mechanical HLA assemblies, Wiring harness, catering to Industry like, Health Care, Renewable, Aviation, Locomotive, Compressor in its 9600 SqMtr Leased premises.

They don’t own any manufacturing facility.

Indian Machine tool industry is to grow at ~10% YoY as per iMARC report.

This company is growing at ~30% YoY Sales (122 Cr in FY23 Sales). The Net Profit margin is at 10% (PAT), EBITDA at ~16%.

Company growth projection is in line with its past performance of 30% YoY. No Capex is planned as present 3 facilities in Pune are running in 1 shift only (8hrs work) with 37 Engg. They can scale up for 3 shift operation if business comes.

Their 90% business is from top 5 clients of Short term fixed price and delivery period order based:

- Atlas Copco (India) Ltd

- OTIS Elevator Company (India) Ltd, Long term Contract till 30th June 2024.

- GE Oil & Gas India Pvt Ltd, Kirloskar Oil Engines Ltd,

- Kirloskar Pneumatic Co.Ltd.

- GE India Industrial Pvt Ltd,

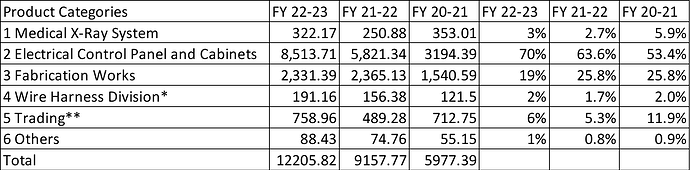

Business Category revenue contribution:

All values in Rs. Lakhs

The above data shows that they are mainly into contract manufacturing and a dependency on getting contracts on competitive bidding basis. This works for them as a major risk.

In X Ray segment they are into Assembly of the equipment they source the components, only outer units are made, USA, China, Germany. A risk they have.

The company is having long term association with its top 5 clientele and that is the advantage they enjoy in this segment.

The peer comparison companies have similar profit margin (PAT).

If they grow at 30% rev as projected and PAT at 10% like past performance the stock could do good for the investors. Being SME stock 6 monthly performance report is to be looked at.

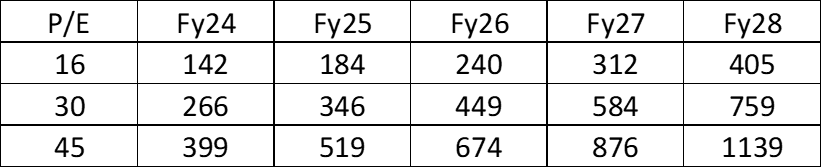

Current MP Rs. 266 per share is already high and has accounted the growth of 30% for next 5 years at 16 P/E. Industry Avg PE is ~22* (Range 37 to 11).

Fwd P/E rerating can follow based on YoY performance and Expansion (Liner or Non Linear way)

Assuming 30% Sales growth and 10% PAT YoY

Disc: Not invested