Not sure but if you see 2016-17 results, company had done well where revenue went up in high single digit and PAT went up 20% but employee salary hike was only 2-3% ,so, we should not expect a linear correlation unless there are some strong diassociation on a longer term basis. Just guessing. All the numbers highlighted r in AR. Also, i think the 16000 kg per day knitting facility will come live ,so, that could be reason. Furthed, promoter had taken small salary of 24 lakhs which stayed constant last year and also daughter was inducted at a lower salary , so, it would not be a surprise if they give themselves a well deserving raise. Once AR is out, the details of emplpyee headcount , promoter salary n business vertical expansion should throw some light. Infact today i was updating my notes and was thnking looking FY17 salary vs PAT growth that wont employees be a but unhappy

I hold Ambika Cotton. However, 2 factors have been troubling me and will be good to receive some researched views:

-

Promoters age and competency, ambition of daughters. Has anyone met daughters and interacted with them ? Are they as capable as Mr. Chandran ? Are they ambitious to want to continue and grow this business ?

-

One of the competitive advantages of Ambika Cotton is their expertise in handling high wax cotton and spinning high quality yarn. My understanding is that competitors have not been able to master this process so far. With increased automation and use of sensors, etc., this should be possible going forward and if a machine supplier is able to produce this kind of machinery and supply to other textile manufacturer’s, this MOAT of Ambika will be gone. For example, one of the start-ups I know of, uses sensors to measure some parameters of tyres in roadways buses and advises roadways to go for re-treading of these tyres at just the right time. If roadways is late in assessing this, the tyres cannot be re-treaded but need to be changed at much higher costs. What I am hinting at is that automation can help master the process led MOAT that Ambika has. Would be good to understand some educated views on this from people with deeper understanding of textiles and textile machinery sector

I think it difficult to get answers to both the questions, there are no conf call and little info available like any other micro-cap.

Best way to monitor the progress will be to check the fundamentals on a qtrly/yrly basis for any deterioration of topline/margins/receivables…etc. This is the best way till more info is available…

Disclosure : Invested

My consolidated notes on Ambika. Have some questions/areas to validate my understanding. Feel free to comment, specially on questions part

Core Product: Specialized Cotton Yarn

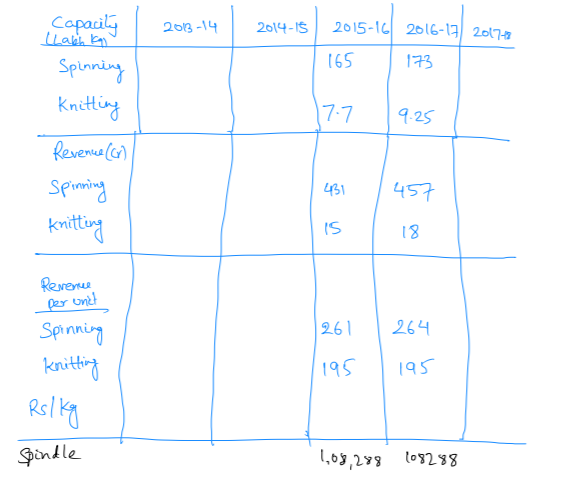

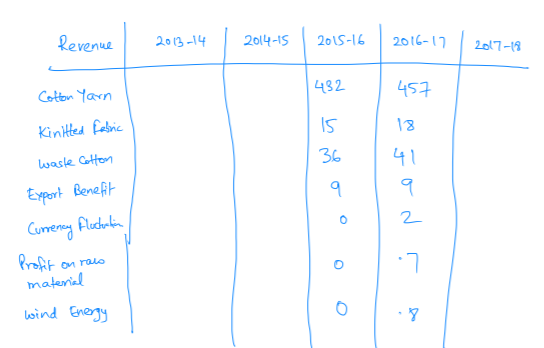

Revenue streams: spinning, knitting, wind power

Business Details:

- Approx 50% export 2016 and 2017

- Export has fallen a bit

- Low working capital business with low debtor days compared to industry

- works on 10% PAT margin and 15% cash profit

- One of few companies stable in adverse industry condition

- Debt free

- focused on Process and efficiency improvement

- wind energy to support captive power needs

Promoter Detail?

- Conservative and honest promoter

- Takes conservative salary, mainly divided

- Inducted daughters on board but no special treatment

- Recently conducted buyback without self participation (Rs 15.7 Cr)

key Risks?

- Cotton Price fluctuation

- Better interstate policies

- Key man risk

- AI and Robotics in textile industry

- Usually, exchange inflow & outflow are balanced but without hedge could cause damage

- Proposed spinning expansion has been delayed for long due to land issues

Capex Details

- Fy 16-17, Rs 10 cr for spinning improvement

- Fy 16-17, Rs 20 crCapex for 16000 kg/day knitting facility for 90% export over and above 8000 kg / day done earlier at Rs l0 Cr. The new 16000kg facility should do Rs 35 to 40 Cr additional turnover.

Edit :

However , as per calculation , at 70 % utilisation, this amounts to 24 Lakh kg n with 195 RS per kg realisation this should lead 90-95 Cr additional revenue

Other Details:

- Marque investors like catarman, valuequest etc. are invested

Balance sheet details

- As per 2017, on a balance sheet size of

- Rs 476 Cr, Rs 253 Cr tangible asset are Rs 150 cr inventory

- Zero debt

- Clean balance sheet

- 19 years life for plant & machinery and is 9 ease for wind assets

- Rs 534 Cr of gross assets deployed with net valve of Rs 253 Cr

Profit and loss details:

- FY 17 revenue of Rs 529 cr and PAT Rs 55 Cr

- 63% COGS

- 5 % employee expense

- 5% Depreciation

- 12 % other expense

- 1% Interest

- 14% PBT Margin and to % PAT

- Higher single to lower double digit revenue and PAT grown

- Cotton is main raw material on Rs 529 or, 117 Cr of cotton which is 23% of revenue

- Out of Rs 515 Cr of core revenue in FY 17, cotton yarn, knitted product and waste

- Cotton shared Rs 45g Cr, Rs 18 Cr. and Rs 41 co with Yoy growth rate of 6 %, 9% and 9% respectively

- Power and fuel, asset maintenance, freight inward and outward and insurance are key component of other expenses

- Geographical distribution of revenue includes 50% domestic, 46% APJ and 4% Europe where in 2016-17 Europe showed 40% Yoy growth, high single digit growth in domestic and 5% de-growth in API business

- FY 16 and 17 raw material were in Rs 305 cr and 336 Cr where share of imported raw material went up from 66% to 77%

Cashflow Management:

- Cash flow is approx 1.5 times of of PAT around 68 Cr

- Rs 20-30 Cr is annual maintenance and growth (approx leaving 30-40 Cr of the cash flow

Others :

- 20-25 % working capital to sales

- 11% ROA, 15-16 % ROE, -19% ROCE

- 10 % CFO to EV with 2-3% dividend yield at Rs 1100-1300 price

- Assuming no growth, its almost to % yield on investment

Questions:

-

It took Rs 10 cr to do 8000 Kg per day knitting facility which * means at 100% utilization (assuming 12 hours a day and 300 days a month as 100% utilization), it can do 24 Lakh kg in a year. For FY 17, sales for knitting in Lakh kg was 9.25 Lakh kg. Does this mean that the capacity utilization for this 8kt kg facility was ~ 40%?

-

If yes for above case, then, at 40% utilization, this generated a revenue if 18 crore which means at 10% PAT 1.8 a profit at Io Cr CAPEX which turns out 18% return on investment?

-

At peak utilization, Revenue will be Rs 45 or and PAT Rs 4. cr which means 45% return on initial capital. Assuming to 1cr maintenance capex annually. Is the interpretation correct?

-

Any further clarity on proposed expansion (30,000 spindles with integrated facility including knitting at Rs 130 Cr)

-

what is direct and indirect market since opportunity?

-

For proposed expansion, capex (spindle at 130 Cr Rs 43000 per spindle. Earlier Rs 534 Cr capital deployed for 108288 spindle = Rs 49K per spindle but some of the asset is also for wind power so it must be lees than that. Current Revenue per spindle is Rs 459 / I 08288 = Rs 42,386, at 10 % margin, Rs 4.2k profit so, on Rs 49k capital, Rs 4.2k profit which is a 10%. Is it good enough?

Disc : 5% of portfolio . Holding and accumulating from more than 2 years

I have read your summary for this company.Regarding the questions,your analysis is spot on,only thing i would add is the fixed costs will get spread more as the company increases utilization.If the company starts expansion,there will additional depreciation charges,which will impact the bottomline.

Big question is valuations:At 12 p/e the stock is not gonna be a multibagger.Only if there is an expansion can you expect even a good return in few years.The last share buyback was at 1100 rs per share,however the company has again switched to paying dividends.

Valuations and investment decisions depend on risk reward expectation. A 15% return may not be attractive for someone but very attractive for someone else depending on his own philosophy , expectation and understanding of risk reward n personal biases

interesting article in Bloomberg;

https://www.bloomberg.com/graphics/2018-death-of-clothing/

This is international trend now, we have already seen the death of Neck tie during our life times. Such trends can impact demand of premium shirting, hence -ve impact on Ambika

Disc. Holding 25% of portfolio for last 2 years.

Some good points mentioned about Ambika Cotton in latest credit rating report -

hi ayush,

most of points are same as in earlier credit rating. key positive is mention about expansion in next 2 years and cash accural to 82 crore. expansion remains a key as there has been no update on mgmt on the same .

resutsl for q1 are out

decent results

After 3 long years, company finally received capex clearance.

At an overall basis results look decent but if one considers the following:

- Revenue and PAT performance of core business

- Exclude non core power business performance

- Take cognizance of yoy increase in interest cost whoch I am hopeful company will get rid soon as they generate strong cash flows

- Consider notable increase in raw material prices

- Consider notably high other expenses part of which might be attributed to front end expenses on coming expansion (guessing) and above all

- The kind of poor business environment on textile sector where most of the players have performed poorly.

This kooks very good result. The historical strength of business quality uniformity with relatively minimal standard deviation reflected in its operating model continues to impress. Disc : Invested

Current spindle capacity is ~1,08,000 and additional 30,000 spindles will increase the capacity by ~30%. Given that company was running at full capacity since last 2-3 years and was waiting for approvals, it will be easy for them to come up to 80%+ utilization of this new capacity very fast.

It might take 6-12 months to come up with new capacity. For every spindle it generates ~150 Kg yarn per year, with sales price assumption of ~325 and EBIDTA margin of ~20%, it translates to ~30 cr incremental EBIDTA at full capacity.

Considering project cost of 100-120 Cr. and depreciation of 10 years, the PAT for incremental capacity can come around 17-18 Cr.

This capex will give growth visibility of ~30-40% in next 2-3 years. I believe the stock should get re-rated to 15x fwd 2020 PE.

Disclosure: Invested and added after results.

hi Vivek,

Ambika PAT margins have been stable around 10.5% for past few years. So, on that basis that should we consider additional PAT as ~15 cr ( 30,000 * 150 * 325 * 10.5%) at 100% utilisation. Fy 18 PAT was 61 cr and on current knitting expansion PAT could go up by 10% to ~67 cr. so this additional 15 cr would mean around ~22% growth visibility. did you take any other assumption also to arrive to 30%-40% growth?

It is considering increase in realisation over 2 years (based on past trend)+ slightly more estimate of EBIT from new capacity due to operating leverage.

Agree with your thoughts. Also as Mr. Chandran kept his patience on this particular land for expansion, there would also be some operational benefits. However, from a longer term perspective, the growth rate might be lower than what many would want and considering the age of Mr. Chandran, one would want clarity on long term growth potential before the stock can get high valuations

Is the land issue resolved in Company’s favour?

Yes, seems so. Otherwise co couldn’t have gone for expansion

Hi Ayush, If I remember reading somewhere, both daughters of Mr Chandran are actively helping in running the business though not sure if this is succession plan (to be valid irrespective of marriage etc considering Indian context). Also, even if they are part of succession plan, yet, yea, they may have to prove their mettle. I just hope they will be able to preserve what Mr. Chandran has created. Any more info available on this subject ?

I think Mr. Chandran is exceptional and sort of gifted…not easy to fill his shoes. Lets hope he continues with healthy life and in the meanwhile we see next level of leadership prove their mettle