Talking about mispriced opportunity, Bandhan Bank whose yearly profit equal to the quarterly profit for Yes Bank is quoting at Rs72,000cr as compared to rs58kcr for Yes Bank. On top of this, bandhan Bank is Microfinance which is fully unsecured. I am not saying yes Bank won’t go down further or it is not a risk. I am seeing a huge mispricing here. Whether Bandhan is over valued or yes bank undervalued is another story.

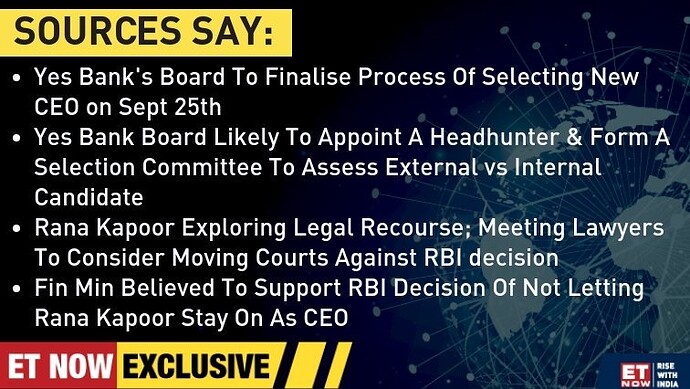

Rajat Monga seen as one of the front runners

finally we have some info on the reasons given by RBI in their letter to YES Bank,

weak governance ,

weak compliance and

wrong asset classifications

are the three reasons given by RBI to yes bank as per ET now sources.

these are very basic and core requirement for any Banking institutions.

while we don’t know the magnitude of the issues related to these three points given by RBI to Yes bank, but it seems it might be some serious ones.

I think price may further adjusts considering these 3 points.

specially w.r.t Asset classifications may impact the % NPA from current ~1% to higher level , to what level is any body’s guess at this stage.

Disc. Invested and added few today.

Source of the info? With all due respect, unless this info comes from the bank itself or from RBI, it could be news channel masala/speculation

Very much possible , but when RBI is taking such step in that case there must be something serious issue thats given and I can’t think of any other reasons for taking such measures.

So ,

What do you think can be issue for which RBI took such step and reasons for it being traded to heavy discounts to other private bank from past sometime ? If we connect all the dots that it seems very likely …isn’t it ?

Worth contemplating.

I have to strongly disagree with this. I have read several accounts of the functioning of the RBI, and even spoken to one of the recent ex-Governonrs one-on-one, and I do not believe this at all.

It is very likely, IMO, that the RBI is trying to save face from the PSB and related fiascos by strong arming the private banks. After all, how else to explain such harsh treatment for Rana Kapoor compared to Shikka Sharma and Chandana Kochher? The latter 2 have either destroyed wealth, or are accused of breaking laws.

It is sickening that the RBI has no concern for the stock price of an institution as important as a bank, since this drop can legitimately affect its basic functioning, hence why short selling of bank stocks is not allowed in some places. There are innumerable ways in which the RBI could have handled this better and they decided the worst possible way.

They have already stated the reasons - governance lapses (various fines imposed) , weak compliance culture and incorrect asset classification (divergences) … They have gone through the assets with a fine tooth comb and highlighted the divergences already… So pointless for us to speculate that there is something more than what the rbi has been able to discover and has stated

Even if it were true, mismanagement is apparent in a much larger scale in PSU Banks in comparison to private banks. But RBI does not have the will or power to sack a low ranked PSU bank clerk, leave alone a CEO… ![]()

I agree with you that it is over kill… A more equitable way would have been to approve the appointment for a period of one year with further extension subject to review based on adherence to the three parameter parameters cited… That would have been fair and sent a strong message as well IMHO

No one is questioning the authority of RBI regarding the management of banks. The basic question is its transparency in decision making and accountability of its decisions.

But, we are in a country where even after 70 years of British Raj, the raj mentality of Indian authorities are prominently visible in all aspects of life, not just RBI. Where even a railway booking clerk behaves like a prince, what can be expected of higher ups? ![]()

Speaking of questionable practices with the RBI, I don’t know how it is ok with Chanda Kochhar being elected to the board of ICICI Securities.

Anyway, however questionable, RBI has already acted. It is now for investors to take a call whether to remain invested and wait for a recovery (a large institution like Yes Bank certainly has the capacity and the bandwidth to come out of this situation), or cut their losses and take the money elsewhere.

I agree, all of this should be considered as a regulatory risk that adds to the risk premium of Yes Bank.

A much more pertinent debate is how well Yes Bank can run without Rana Kapoor at the helm. I can’t think of any way for an outside investor to evaluate the corporate structure or operational procedures at the top management level. At first thought, I find it hard to believe that an organisation like Yes Bank can grow so large or so rapidly without rock solid SOPs and competent people at every level.

Yes, no shortage of talent. The two gentlemen considered to be the prominent candidates to be the successor - Rajat Monga and Pralay Mondal - are both IIT+IIM material.

Remains to be seen, however, whether the board goes with internal or external candidates.

Yes Bank’s problems have just started. The leadership issue will take longer to resolve given his relationships with other promoter group. It is funny that he plans to take legal action against RBI. His smugness has no end if he really wanted to do this. Two major private banks ICICI and Yes have appointed ex-Fin min officials as Chairman. Sadly, YB’s chairman will himself chargesheeted in Aircel Maxis case. What kind of message he wanted to give? He could not find any banking veteran as Chairman? There were enough signals for the upcoming fiasco. I just hope RK himself doesn’t spend his retirement in litigations.

YB shares will not recover fully unless mr RK is removed from the board too as it will result in either remote control or twin power centres and RBI won’t sit idle in either scenario.

While yes banks leadership problems may have just started, the fall in stock price by 45 pct has been in anticipation of these problems. So a lot seems to be in the price. It’s a fair point whether or not incumbent ceo should continue to be on the board or not

Super , very few people can do that by overcoming their bias …both edelweiss and yes bank are my top 2 and top 3 holding and sooner we investigat and acknowledge our mistake better it is for us.

I am still holding both as of now but I don’t see anything wrong with edelweiss as far as long term fundamental goes but I am not too sure about Yes bank so analysing what to do .

Wish to remain free of biases just because I own it …

Kindly keep sharing your views