http://www.bcg.com/documents/file80247.pdf

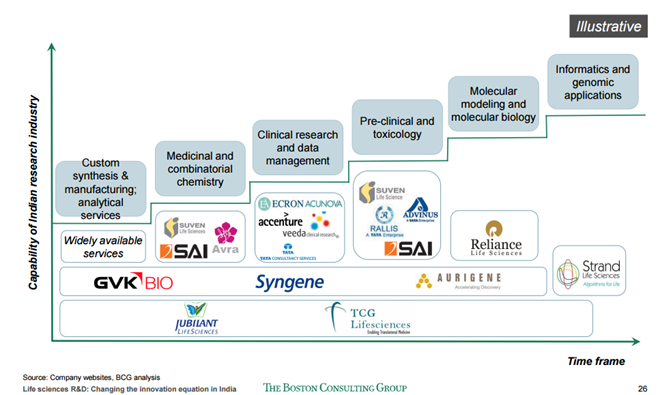

Below chart is from 2011 paper.

2011

2013

> Either not part of assessment or lost ground to competitors.

2015 report yet to be published.

Sales and Marketing

Does not pertain to the Pharmacovigilance segment which deals with Adverse events

Sales and Marketing - ITO

https://www.imshealth.com/files/web/Global/Tech%20&%20Apps/Nexxus%20Commercial%20Application%20Suite/IMSH_IDC_ITO_excerpt_2015.pdf

Sales and Marketing - Strategic Consultant

http://idcdocserv.com/HI258970e_Accenture

Below segments are being de-focussed by management.

Manufacturing and SCM assessments

2013

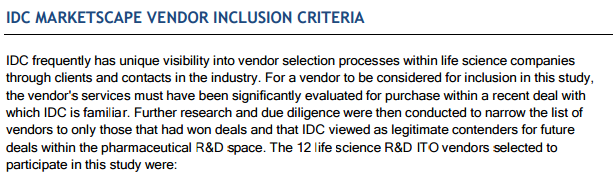

ITO Vendor Assessment

https://www.wipro.com/documents/IDC-MarketScape-worldwide-life-science-manufacturing-and-supply-chain-ITO-2013-vendor-assessment.pdf

Strategic Consultant Vendor Assessment

BPO Vendor Assessment

http://idcdocserv.com/HI259302e_Accenture

Strategic Consultant Vendor Assessment

http://idcdocserv.com/HI259357e__Accenture

Top Preferred Life Science Technology Vendors for 2015

http://idcdocserv.com/HI255788-_2

Was about to post the IDC results ![]()

I think this explains the reason why we don’t find mention of take in some IDC results like 2013

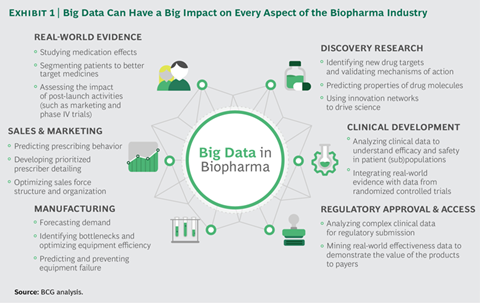

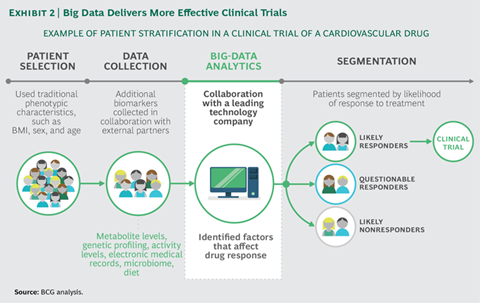

The section “Delivering More Effective Clinical Trials” is very good and particularly related to the kind of work Take does. Take’s management had explained the same thing in an interview (probably the youtube link that I shared above). Now after hearing the rationale from a second source I could relate to it better.

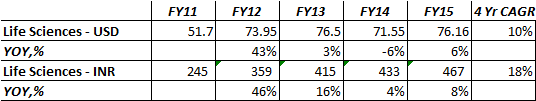

In the last conference call management gave this overview of their business. Ambit research has put that matrix nicely here.

Out of the above 3,

Consulting : 20% contribution to revenue and has highest margins. Competitors in this space is Deloitte…

Technology - 30% contribution and medium margins. I think this is implementation activity for products from Oracle like Argus Competitors in this space are TCS/Infyetc ? Business is not that sticky.

Functional Services - 50% revenue contribution. Medium margins. Competitors are Octagon research , ISI, Medidata

If my understanding is correct, these reports show TAKE at bottom rung of the ladder and they have a small pie of the whole market ( Contender) and where a minus sign for TAKE indicates it is not growing. Two things we need to track 1) How they increase their market share in LS and 2) How do they reduce business in SCM ( finally get out) or improve margins there.

Have just started spending some time on this company. Few questions that I am looking out for answers are below:

Few more questions :

I think the metrics to track in Take, like in MPS are

What’s the data point for saying the WCI acquisition hasn’t worked well ?

I was thinking it’s probably one of their better acquisitions. They got the consulting and industry networks from this acquisition. Both of those have high value for what TAKE is doing currently. Consulting is high margin and sticky business. Industry networks is what gives them a standing in the market and among the thought leaders. Jim Tizzard from WCI is now heading NAVITAS and considered to be the brain behind increased focus on sales and marketing and lot of leadership activities.

Raj, if you hear the con-call at the time of WCI Consulting acquisition a large part of the thesis was cross-selling TakeSol’s offering in Europe and increasing the share of Europe’s revenue. This hasn’t been successful yet. WCI at the time of acquisition was 70-75 Crores in revenues, This has grown to ~ 140-145 Crores so abotu 18-20% growth which is not bad. But their primary premise was to increase revenue share from Europe which hasn’t happened.

Here are few questions from my side.

Questions to Management:

Will look up and get back on this.

I always wondered how come the company is paying taxes at so low rates.

In q2 fy 16 it paid taxes at 10% whereas for first half of fy 16, its less than 10%.

And I dont think it has carry forward losses of earlier years?

One logic is acquired companies could have carry forward losses and might help in lower taxes but couldnt find any answer on the above tax query.

disc: no position.

Taxation

Tax expense for the current year FY 2015 stands at 54 Mn from 10 Mn last year, resulting in an increase in the effective rate of

taxation from 2% to over 6%. This is due to increase in the deferred

tax expense for the year offset by drop in current tax component as

well downward revisions to tax pertaining to prior years. Deferred

tax expense is a function of the difference in carrying amount of

assets considered for tax reporting purposes and for GAAP reporting

according to laid out Accounting Standards.

This is from Take solutions 2014-15AR. Can somebody explain in simple terms what the highlighted line means?

Indirect Competition for Take Solutions

Navitas has Qlik listed among its Analytics partners.

http://www.pharmatechoutlook.com/magazines/December/January2016/

Found below additional links from Qlik site:

http://www.qlik.com/search?q=life%20sciences&p=2 (Search link listing multiple PPT’s)

http://www.qlik.com/~/media/files/resource-library/global-us/direct/datasheets/ds-life-sciences-top-ten-solutions-en.pdf

Qlik being mainly a BI Platform with focus on visualization through dashboards and reports, with respect to Navitas has focused solutions for Pharmacovigilance and Clinical Trials Management.

Europe was the second largest market in 2014. This is attributed to the tax benefits offered to the large and small-scale companies to promote more CRO activities. The large companies can claim 30% deducible from the income of their R&D expenditure. In case of small and medium sized enterprises, it is 225% for the R&D expenditure.

Asia Pacific is the fastest growing industry due to the reduced cost it offers in comparison to the U.S and other developed economies. Increasing incidence rate of chronic and lifestyle diseases such as heart disease and diabetes coupled with ease in patient recruitment and available expertise for the clinical trials are few drivers propelling growth of the Asian healthcare CRO market.

China and India are projected to witness tremendous growth in the CRO market owing to their treatment naïve patient pool coupled with disease prevalence rate. Furthermore, genetically diverse population, highly qualified English-speaking investigators, well equipped hospitals are other opportunities offered by India for global clinical trials.

CROs are in a process of continuously improving their portfolio by integrating services with technology. This enables them to save more on time and deliver efficient and desired results to the clients. In October 2015, PPD joined hand with Oracle to use its cloud technology named Oracle Siebel CTMS.

In addition to offering improved services, CROs are in the process of collaborating to promote their services at a global level. For instance, in May 2014, ClinDatrix, Inc. collaborated with six other CRO’s to offer services to multinational clinical trials. The collaboration will strengthen its presence globally apart from the U.S. and Canada.

Major contributors are Quintiles, Covance, Pharmaceutical Product Development, LLC (PPD), Parexel, Charles River Laboratories (CRL), ICON plc, inVentiv Health, Medidata Solutions, and Theorem Clinical Research. According to the US database of trials, Parexel, Quintiles and PPD are involved in large number of collaboration with the sponsors pertaining to clinical trials.

This post is an attempt to understand the implications of the acquisition of Ecron Acunova.

Views are invited.

Prior to the acquisition of Ecron Acunova, Navitas had the tech capabilities to handle clinical trial management through the following services:

Highlights of the acquisition which has been commented on by mgmt. is:

Most of Navitas competitors other than Medidata are mostly CRO’s who later diversified into CTMS, CDM tech solution space (eg: Quintiles, Covance). This investment in IT was more out of compulsion due to the amount of data generated from clinical trials (and nature of complexity) which had reached a point that their in-house data management systems could not handle.

Couple of links which attest to the above point.

Increasing data volume, trial complexity and changes in sponsor and regulator demands are driving investments in IT systems among contract research organisations (CROs).

During a panel discussion Christian Tucat, Senior Vice President Business Development at INC Research, said CROs “are awash with data” adding that “there are more and more data points, biometrics and capturing tools, but the biggest challenge we have is how to read and interpret it all.”

“Our sense is that CROs are viewing IT capabilities as increasingly important competitive differentiators, more so than in the past.

CRO: Explaining the term

http://www.financialexpress.com/article/pharma/cphi-india/at-crossroads/172755/

The abbreviation CRO is used for both ‘Clinical Research Organisation’ and ‘Contract Research Organisation.’ The former includes only the clinical research companies which can be subdivided into two categories:

• Clinical research organisations offering phase I to phase IV clinical trials

• Bioequivalence centres offering BA/ BE studies

And Ecron Acunova having both of the above 2 capabilities makes the combined entity a fully integrated CRO tech company.

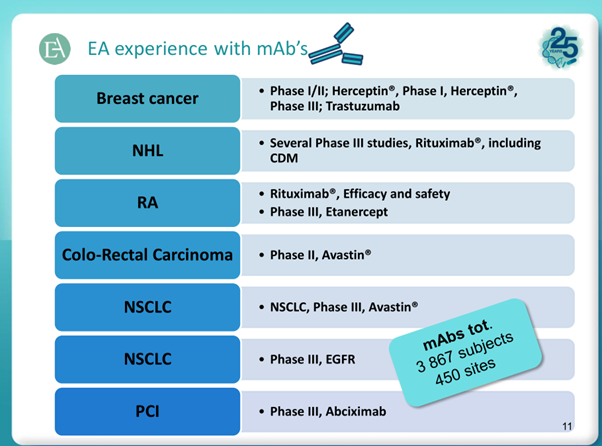

Now, unlike Syngene which is clearly into drug-discovery, Ecron Acunova core competency is Phase I-IV clinical trials with dedicated sites available across Eastern Europe, India, Germany and US as well.

Oppurtunity size for CRO Market

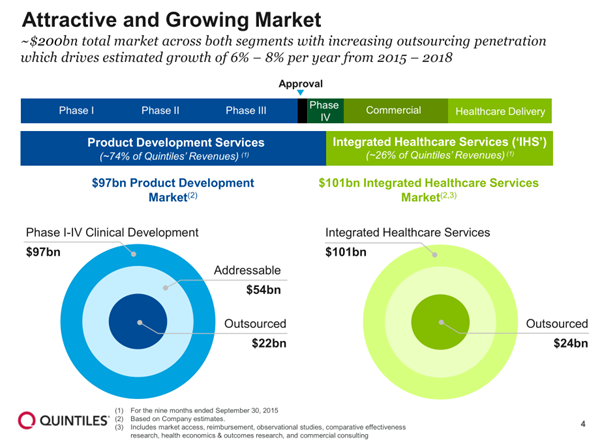

From Quintiles JPM16 slides - http://s1.q4cdn.com/151453148/files/doc_presentations/2016/JP-Morgan-2016-Healthcare-Conference-vFINAL.pdf

Below is a comparison matrix between EA and Quintiles which is a decent match up.

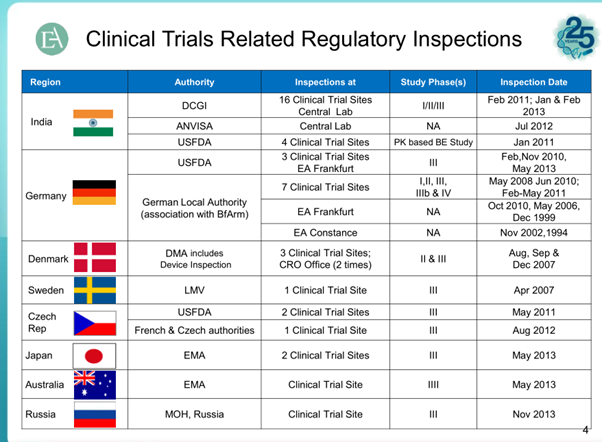

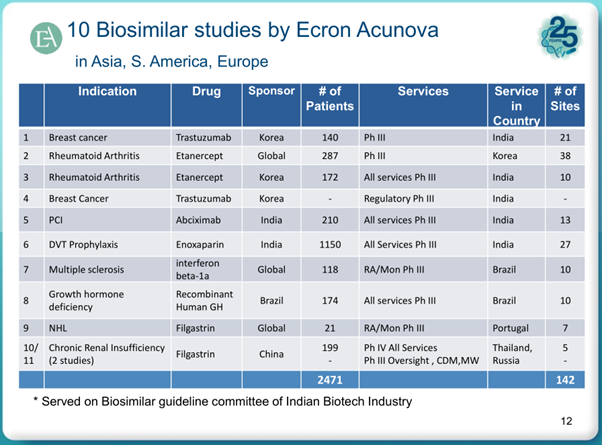

Below snapshots highlight the pedigree of EA’s capabilities and its potential in future.

Coming to the negative aspects:

http://www.iconplc.com/news-events/news/icon-and-ibm-to-revolutio/index.xml

Initially, ICON is applying Watson Clinical Trial Matching to its breast, lung, colon and rectal cancer trials. The solution enables ICON to advise sponsors how many patients match their trial criteria, where they are located and how they will recruit them

3.EA had a partnership agreement with Biotrial for handling clinical trials in Europe. Biotrial has been in news recently for the failed trial which led to death of 1 patient and hospitalization of 5 others.

http://www.fiercecro.com/story/french-cro-biotrial-tries-move-forward-after-disastrous-clinical-study/2016-01-21

4.Low taxation numbers as was highlighted by @hitesh2710 bhai in earlier posts.

All the above information is from public domain.

Ecron Acunova site is a treasure trove of information from which above slides have been taken.

I had bought shares of Take Solutions last week during the correction. I have bought it with a 3yr horizon. There is a degree of high uncertainty and hence please do your own due diligence.

Result out…Great numbers…

Consolidated Q3 FY16

Sales up 34% from 184.7cr to 247.8

Profit up 46% from 164cr to 240cr

EPS Rs. 2 vs Rs. 1.37

Yes…this is even after chennai floods…super results…

& its now on UC…

& its now on UC…

Some rough notes from today’s concall -

He talked about segmental break-up. Missed that part. EBITDA % was down mainly due to Chennai floods. Covered the segmental break-up below.

Chennai Floods impact:

In terms of revenue - $1.1 mn impact - got postponed. $160k will never be realised. $960k of revenues got transferred to current quarter. Revenue in rupee terms about 7 crores. —> "This will result in much stronger Q4.

One time cost of 2.5 crs. - Related to Employee benefit + Damage to assets + Temporary relocation cost (to bangalore) --> This wont recur

8 new customers added this quarter. Nefs(didnt get this word) membership grew to 110.

Our flagship Pharmaready has reached 100 customers now. This is a milestone for us.

I had talked about 2 major deals in pipeline as of last quarter - We did not win 1. On the other order, the order itself is broken down to three parts and we will get a substantial part. This announcement to be out this month/next. There are 3 other major deals in pipeline which we are pursuing. --> Likely to have a strong order book by 31st March 2016.

To sum up - We had a decent quarter. Augurs very well for 4th quarter due to spill over + very strong order book. 3 big orders coming in. We are very bullish on Q4 and thereafter. And add to that Ecron Acunova will get consolidated in q4.

Current orderbook at $80mn. Expected order book by March '16 - $92mn(due to amalgamation of Ecron Acunova). -> This does not factor in the possible wins.

Ecron Acunova - 120 cr, EBITDA margins at 11-12%.

Big data - We have a tie-up with a European major and we are going ahead with that. Intellent is the big data unit.

USFDA stringent regulations impact - This is going to impact us positively. We are looking at this as a significant opportunity to help our customers (pharma majors). We have a lot of process expertise to help our customers. Dont look at us as a technology company.

Tell us your EPS guidance - EPS guidance is complicated. Aiming at 25% cagr growth + 24% EBITDA level

Main competitors - Missed the names. line was bad  No one with 360 degree solutions like us. We dont compare ourselves with IT company as only 30% of our revenues are from technology. 70% of revenues are from Consulting & Functional expertise

No one with 360 degree solutions like us. We dont compare ourselves with IT company as only 30% of our revenues are from technology. 70% of revenues are from Consulting & Functional expertise

Are you able to cross-sell products to Ecron Acunova’s customers - It needs some more time. Cross selling will definitely happen. Margins improvement can happen quickly, but cross selling will take time.

Revenues from new deals(if we win) may start from May. We may not win all 3 deals. We should atleast 1 of them.

Revenues by verticals - Q3 Life Sciences - 71.5% SCM - 24.5%, Others - 4.5%. Next qtr Life sciences may contribute more due to EA acquisition.

What are the Margin levers in our hand - 1. How we apply technology is the critical margin lever. 2. How are we able to scale? alluding more towards mining the customer.

How are you looking at SCM going forward? - Life sciences is continously growing and thats why SCM looks small. We have some strategic ideas for SCM

Shriram has sold all its stake in Take Solutions - is it correct? They continue to remain a stakeholder. They have transferred to a different promoter entity.

Orderbook growth looks optically slow in Q4- It doesnt follow a sequential pattern. Dont go by that.

Good amount of cash available in your books. Plans for debt reduction - Cash is important for a company like us as there could be opportunities for expansion. Dollar denominated debt. so we are having this at fairly lower borrowing costs. We are comfortable with that.

Currently 7% of our revenues from Europe. We are looking at 20% going forward from Europe.

New acquisition(Ecron Acunova) effect will come only from Jan quarter.

Ecron Acunova sold off because the promoter wanted to call it a day. We looked at it as an opportunity.

Thanks,

Ravi S

Disc -Take forms more than 10% of my PF.