Posted excellent results profit ups

Finally we see YoY growth

https://www.bseindia.com/xml-data/corpfiling/AttachLive/1b0527b1-44af-439d-8798-b1d6a9e83dab.pdf

Good set of results leading to a breakout in the Stock. Hopefully some of their filed ANDAs start to get approved soon. I understand it takes a lot lesser time (10 months in many cases) for ANDA approval now, so does anyone know when these 36 ANDAs were filed from Shilpa/partners?

Shilpa Medicare Ltd FY18 Annual Report Notes

Company gave a very detailed Annual Report this time. Product wise filing details in every regulated market and the expansion plans are all give in great details. Going forward main focus of the company seems to be on US market and Biosimilar segment. Following are the highlights from the AR.

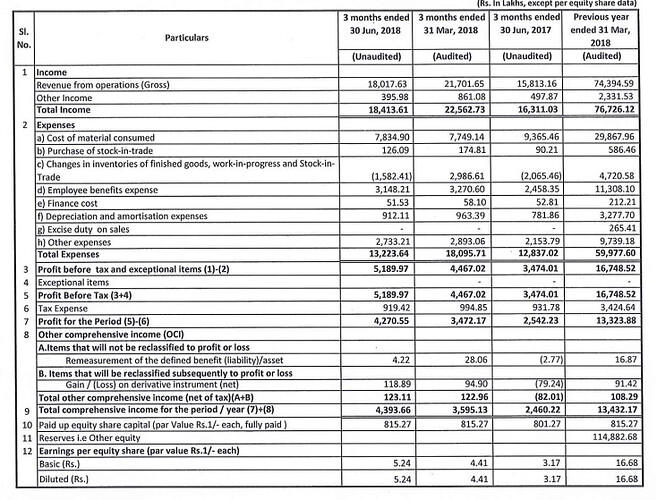

- On standalone basis the Company reported operating revenues of Rs. 74394.60 lakcs as against Rs. 73789.90 lacs and a Net Profit of Rs. 13432.19 lacs as against Rs. 12562.30 lacs in the previous year

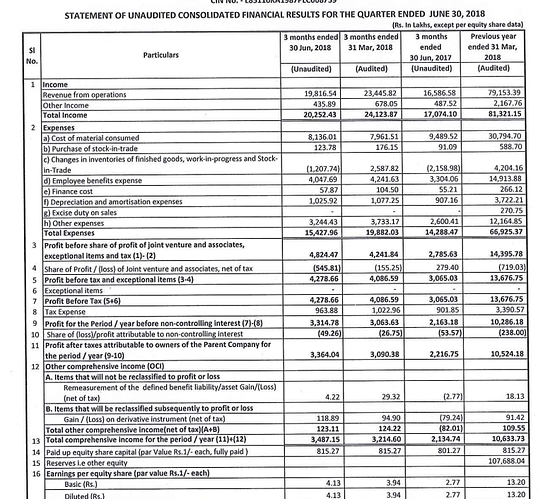

- On consolidated basis the Company reported operating revenues of Rs. 791.53. cr as against Rs. 783.81 cr and a Net Profit of Rs. 102.86 cr as against Rs. 104.45 cr in the previous year

- Sales from

Bulk Drugs / Intermediates = Rs. 621.69 cr (Rs. 649.80 cr)

Formulation = Rs. 90.04 cr (Rs. 48.46 cr)

FPS/ MEIS Licences = Rs. 18.67 cr (Rs. 17.53 cr)

Power = Rs. 5.32 cr (Rs. 4.82 cr)

Trading= Rs. 9.55 cr (Rs. 9.24 cr)

Product Development = Rs. 39.46 cr (Rs. 49.08 cr). - Shilpa Medicare has two API plants with world class state of art facilities at Raichur. The units are cGMP compliant and are approved by national & international regulatory bodies like USFDA, EU, Korean FDA, Cofepris-Mexico, TPD-Canada, PMDA-Japan and TGA-Australia.

- Shilpa Medicare Limited – Finished Dosage Formulation Facility is a World Class GMP compliant Facility engaged in manufacturing of potent drugs- which includes liquid and lyophilized injectables in vials, sterile dry powder injectables in vials, oral solid dosage form (Tablets and hard gelatine capsules). The facility is approved by various regulatory agencies including USFDA, EUGMP, ANVISA & COFEPRIS. This facility consists of Oral Solid Block with two commercial scale tablet manufacturing and one commercial scale capsule manufacturing line approved by USFDA. Three separate Injectable blocks consists of two liquid-lyophilisation commercial scale manufacturing lines approved by USFDA and 3rd Injectable combi-line for handling of liquid, lyophilized and Dry Powder Injectable under qualification. Fully automatic packing area is under installation and commissioning.

- Domestic Sales = Rs. 321 cr (40.58%), Exports = Rs. 470.11 cr (59.42%).

- Sales from USA increased from Rs. 62.14 cr to Rs. 112.27 cr, increase of 80% yoy.

- Sales from Europe decreased from Rs. 414.65 cr to Rs. 284.38 cr, decrease of 31% yoy.

- Domestic Sales increased from Rs. 226.85 cr to Rs. 321.42 cr, increase of 41% yoy.

- Capex of Rs. 118 cr in FY18 in Tangible assets and Rs. 31 cr Capex in Intangible assets.

- Cash and Mutual Funds of Rs. 193 cr.

- Debt reduced from Rs. 240 cr in FY17 to Rs. 191 cr.in FY18.

- EBITDA margins declined from 21.9% to 20.44% yoy.

- Finance cost of Rs. 2.66 cr on average loan of Rs. 215 cr is a bit low, interest cost is being capitalised.

- Total R&D exp during the year is Rs. 67.77 cr, 8.5% of sales.

- The Company has invested in containment technologies for manufacture of oncology drug substances and made our manufacturing process sustainable. The Company has invested in latest available technologies like Bipolar system from Japan, first in India to manufacture one of our products there by reduced the water consumption by about 10 fold in that product.

- In FY 17-18, the Company has filed two ANDAs with paragraph IV certification as First to File (FTF).

- In FY 17-18, Shilpa and its group companies have filed 34 patent applications taking the cumulative total to 247 patent applications in India and other countries. Shilpa received grants for 9 patents.

- In FY 2018-19 Shilpa has plans

for filing 5 ANDAs with paragraph IV certification with US FDA, out of which two could be first-to-file ANDAs.

Shilpa & it’s Partners has plans for filing of two 505(b)2 NDAs.

Shilpa plans to file at least one NDA for its differentiated product. - Regulatory Filings (API)

Cumulative USDMF Filings: 30 products

Cumulative EDQM CEPs: 11 products

Cumulative EUDMF Filings: 15 products - Regulatory Inspections and approvals.

During the year under review, the Company has received EIR from USFDA, for the inspection conducted during the period of November, 2017 for FDF manufacturing site, Jadcherla.

During the year under review, two API facilities located at Raichur and FDF facility at Jadcherla inspected & approved by European authority from Austria (AGES) for GMP compliance.

During the year under review, two API facilities located at Raichur, Karnataka, i.e. Unit-1: Deosugur Industrial Area, Deosugur, Raichur, Karnataka, India and Unit-2: Raichur Industrial Growth Centre, Chicksugur, Raichur, Karnataka, India, inspected by USFDA for PAI. EIR received. - REGULATORY FILINGS (UNIT-IV Jadcherla)

US ANDA’s filed: 7 Products.

EU Dossiers filed: 7 Products

Cumulative ANDA’s filings: 15 Products.

Cumulative clients ANDA’s filings: 9 Products.

Cumulative EU dossier filings: 14 Products - Looking to the market potential, we have planned to build a state of art manufacturing facility of Transdermal Patch and Oral Films at Dobaspet, Bangalore. The plant construction work is already initiated and expected to be completed by end of year 2018.The High Quality critical equipment’s required for the above formulations manufacturing are already ordered from known European vendors and are expected to be received at site between Jan to June’19. Capacities are planned looking to all markets in first phase. A space for future expansion is allocated for capacity increment. Site will be ready for qualification by September 2019.

- We have also planned to have a state of art Research and Development centre at Bangalore along with a pilot plant facility for potent and non-potent formulation. Layouts are under approval process and construction shall be initiated soon. This facility also will be ready by September 2019. Initial discussion initiated with Vendors for equipment finalization.

- During the past year Shilpa received two product approvals in US for Azacitidine and Capecitabine. Those products are being commercialized by partners in the US.

- In order to address the consolidated and diverse group of customers in US. Shilpa hired in January 2018 a seasoned Executive Mr. Adam Levitt as CEO (US Market). He has a diverse background in the generic pharmaceutical business. He is an experienced leader having worked for global and International generic companies. During his career, he has developed strategies, built multiple organizations while creating sustainable value in both retail and Institutional markets.

Biosimilar Segment

- The amalgamation of Navya Biologicals Pvt Ltd with your company was completed in late November 2017 and now is your company’s Biologics Division, based out of Hubli-Dharwad in Karnataka. This transaction has enabled your company to save about 5-7 years in development timelines for biosimilars. The company now has 13 biosimilars in its pipeline and is dominated by drugs catering to the autoimmune disorders and oncology segments, with 7 of the top 10 biologics in its pipeline. The remaining are niche, high margin opportunities catering to high unmet clinical needs. The company has also filed 3 platform patents and is pursuing these in global markets.

- The first biosimilar is poised to enter human clinical studies later this year. The innovator has a global market of $8 billion pa for this molecule, while the biosimilar opportunity is at $3-3.2 billion per annum. Three other molecules are ready to complete preclinical studies this year. Your company expects to commercialize its first biosimilar in 2019 in India, with the others following suit in 2020-21. We expect to be in a position of strength to penetrate the global window of opportunity for global biosimilars through strategic partnerships in the global markets, while opportunistically continuing to build our marketing channels in a few strategically important markets.

- Your company has taken steps to become a vertically integrated biopharmaceutical player, by acquiring 11 acres of industrial land in Belur industrial area, Dharwad and initiating set up a world class biologics manufacturing unit (including fill & finish), employing best in class manufacturing technologies, that reduce the footprint of the facility by about 40%, thereby reducing the capital and operational costs significantly. Phase 1 of the facility is expected to be commissioned in the first half of 2019 and will cater to global biologics markets. The biologics unit is expected to emerge as the next growth driver for your company in the coming decade and look forward to an exciting future in biopharmaceuticals.

- The global prescription pharmaceutical market is estimated at $811 Billion in 2018 and expected to grow at 6.5% for the next 5 years. Of this, the generics market is estimated at $90 billion and expected to grow at a similar rate. The above figures hide the new shifting reality – Biologics now constitute about 27% of prescription pharma sales, while biologics share within the top 100 drugs is ~50% – showcasing the effectiveness of these drugs, whose target markets are – oncology, Autoimmune disorders, hematology and diabetes.

- Genericized biologics (biosimilars) growth in the generics market is expected to parallel the growth of innovator biologics above, thus presenting the largest opportunity for growth over the next decade, with sales of biosimilars expected to hit $20-23 billion by 2023-24 globally.

Subsidiaries and JVs

- After completion of 3 years of establishment i.e., by 2018 January, INM Technologies has received DSIR certification. For FY18 Sales = Rs. 4.31 cr, PAT = (Rs. 9.52 cr), Holding 75%.

- As a result of continued efforts in the research and product development, STPL had developed the most sought after novel drug delivery dosage form– orally disintegrating strip/film and obtained the manufacturing and marketing licenses for this dosage form in India and abroad. For FY18 Sales = Rs. 3.11 cr, PAT = (Rs. 1.84 cr), Holding 100%.

ODS products of Shilpa Therapeutics have already been launched in India by prominent pharma companies viz., Mankind, Delvin, Alkem, Leads Pharma and Rx Drugs.

Shilpa Therapeutics has also extended its business to the external markets with its ODS products launched in Kenya, Yemen, Honduras and many other countries to follow.

Registration process like dossier submission is under process in many countries like Francophone countries, Malaysia, Thailand, Myanmar and Cambodia.

STPL has obtained manufacturing and marketing license from the Drugs Control General (India), New Delhi for 7 products and 8 products are in pipeline. - Koanaa Healthcare GmbH will act as a regulatory hub in Austria and is currently focused on getting commercial cooperation’s with other pharmaceutical companies. First cooperation with Amring is already achieved and intensive discussions to expand the existing partnership are ongoing. For FY18 Sales = Rs. 1.41 cr, PAT = (Rs. 10.27 cr), Holding 100%.

- RAICHEM MEDICARE PRIVATE LIMITED The Company has entered into Share Purchase agreement with joint partner ICE SPA Italy to dispose off its entire stake in the Company to the joint partner ICE SPA Italy. According to the terms of agreements, the Company has so far disposed off 24% stake in the Company for which the Consideration has already been received. The Company is in the process of disposing the remaining 26% with prior approval of Reserve Bank of India. Loss attributable to Shilpa Medicare was Rs. 8.83 cr in FY18. Equity Investment = Rs. 14.02 cr, Preference Share Investment = Rs. 18.50 cr and Loans Given = Rs. 5.08 cr. Total Investment = Rs. 37.60 cr. Trade Receivables = Rs. 49.86 cr.

Regards

Harshit

Disclosure: Invested

Link to Annual Report 2018: http://kcpl.karvy.com/images/2018/7381_SML/SML_AR2017-18.pdf

Hi Harshit,

Thanks for putting up the notes. Its a pretty detailed report this time from Shilpa with some discussion and insights on several of their business segments and positive undertone. It will take time to digest and understand it well enough.

The company seems to be capitalizing some of the R&D expenses now…need to understand this.

I have been concerned with the announcement of the dis-investment of the JV (though its good for short term as it was making losses and the company will get money also). Is the business with ICE also at risk from longer term perspective?

Also, the pace of growth from new investments has been much lower than my expectations.

I also wonder that to be successful in bio-similar the company would have to make a lot of investment…how will that affect the company?

I hope some answers are there at the AGM .

Regards,

Ayush

Disc: Not invested

Hi Harshit & Ayush,

Thank you Harshit for summarising the AR. Ayush as far as I understand , ICE CRAMS has not been working well for Shilpa post their Raichem venture (some issues on uptake from ICE & margins pertaining to the uptake) . My understanding is that post divestment , they would continue to contribute around 150cr till 2019 or 2020 (not that clear) but none after that as ICE would be technically manufacturing in that unit purchased from Shilpa medicare-not sure what will fill that gap

Not happy with Capex investment , expected a substantial growth in capex post Tano placement.

European sales drop is something we need to check with CEO as they were quite bullish Euro area

Also the interest cost does not tally with debt exposure (like harshit mentioned -interest capitalised)

still positive on this scrip & hoping that ANDA approvals drive the next phase of growth.

Discl: Invested

As per recent interview of MD, they are looking for high growth from formulations…I think in the interview he mentioned scaling up US formulation business from 30-40 Cr to 200 Cr this year and then again a good growth. Perhaps this will replace the drop in ICE business.

The drop in EU business would be perhaps due to shifting of ICE business to the JV

But yes, I agree. Things haven’t been as expected. One needs more clarity

In March this year, a company called INM Nupaint was incorporated which is a step down subsidiary of Shilpa, with Inani and Bhutada as Directors. With a paid up capital of 1 lac rupees, this paint company has got a 10 crores loan from Shilpa at 9% Rate of interest. The purpose of granting loan is to “meet principle business objectives”. Typo apart, why would Shilpa start a paints subsidiary and then, loan out an amount 1000 times the paid up capital of Nupaint? I wonder if this came up in any con call, or AGM? Shilpa has given out 35 crores in 2017-18 as loans to its subsidiaries, with another 10 crores going to INM technologies and 5 crores to Raichem, again to enable both to meet principle business objectives (sic).

Looks to be very relevant new area of research for Shilpa Link

Dr. Phani is highly respected in his area of research Link

INM Nuvent Paints - Chairman - Sri. Vishnukant. C. Bhutada

His excellence Sri Vishnukant Bhutada is a Managing Director for Shilpa Medicare Limited has vast and diverse Business experience of API and Intermediates. Since 1987, Shilpa is among the leading suppliers of oncology APIs in the world with eight manufacturing plants and three R&D centres. With a turnover exceeding INR 800 crores. Subsequently, various state honours were conferred upon him -like -“Best Entrepreneur” from Karnataka State Govt. in 1996; “Excellence in Exports” from Vishweshwarayya Industrial Trade Centre, Bangalore 1996; and Export Excellence Award-2006” by FKCCI, Bangalore.

Success has never stopped coming his way- as he was awarded “First runner up” at the Emerging India Awards London 2008 by CNBC TV18. Recently, his efforts in the Shilpa Group for environment sustainability, has led to “Best National Energy Conservation Award in Drugs & Pharmaceutical Sector for the year 2012” by Hon’ble Ex-President of India, Dr. Pranab Mukherjee.

Many more awards from 2012 till date……… His passion, determination, will power and untiring efforts to bring new emerging technologies namely “Nanotechnology” is quite appreciable.

INM Nuvent paints

Dr. A.R. Phani

Founder, Managing Director of INM Technologies Pvt Ltd and INM Nuvent Paints, Dr. A.R. Phani, has made joint venture with Shilpa Medicare Limited (incorporation of INM Technologies: 23rd Jan 2015 and 2nd March 2018 INM Nuvent Paints Ltd) to establish world class Nanotechnology Laboratory and to cater the needs of nanomaterials for various industrial sectors. He is having a vision for long term strategies for a sustained technologies and growth of the company. He has vision in “Serving Humanity using Nanotechnology”.

Dr. A R Phani has obtained his Ph. D in Applied Chemical Technology, from highly reputed CSIR Laboratory “Indian Institute of Chemical Technology (IICT)”, Hyderabad in the year 1994 and has spent 16 years in abroad working as PDF, Associate Professor, Senior R&D Engineer, Project Manager in various prestigious institutions like University of L’Aquila (Italy), Texas Instruments (Italy), University of New Hampshire (USA), Wright Patternson Air Force (Ohio), Center for Swiss Electronic and Microtechnology (Neuchatel, Switzerland), CNR (Council of National Research- Italy).

For his credit he has published 252 international publications (h index: 45) in highly reputed international journals and reviewer for many international journals, and funding agencies and filed 12 Indian patents 3 International patents. He has bagged 18 national awards and 3 international awards namely Best Impact factor award from IICT, Best Researcher award from University of L’Aquila, Best Innovator award from 64th Indian Pharmaceutical Congress, Pavan Nagpal Award from ICS, Best Nanotechnologist award from ISRO, from Indian Science Congress for Best Performer in Nanotechnology, etc.,

Research areas :

- NanoChemical Technology

- NanoPharmaceutical

- Nao Bio-Med Technology

- NanoElectronics

- NanoBiotechnology

- NanoCoating Technology

INM Technologies can indeed be deemed to be connected to futuristic oncological research and treatment and hence I did not call it out, the other one, viz paints is what I am puzzled about. Lets spend a minute on INM Tech.

Its headed by a technocrat with technical credentials. The company’s mission shows the following:

In addition to biomed applications, there is also a whole host of industrial applications that the company considers as its business domain even if in future. That said, the current set of leadership seems focused on medical domain, and aerospace could come later ![]()

But what I am puzzled with is the INM Nuvent paints ; it is a paint company and no doubt about what it intends to do.

INM NUVENT PAINTS PRIVATE LIMITED

Inm Nuvent Paints Private Limited is an Indian Non-Government Company. It’s a private company and is classified as ‘company limited by shares’.

Company’s authorized capital stands at Rs 10.0 lakhs and has 10.0% paid-up capital which is Rs 1.0 lakhs.

Inm Nuvent Paints Private Limited is majorly in Manufacturing (Metals & Chemicals, and products thereof) business and currently, company operations are active.

Company is registered in Bangalore (Karnataka) Registrar Office. Inm Nuvent Paints Private Limited registered address is 4 , Tm Industrial Estate, 12th K M Mysore Road,bangalore,bangalore,karnataka-560059.

So, why is an Oncology/API company going after paints market? My speculation is that to get Dr. Phani to do nano-medical, Shilpa had to fund nano-paint as well as a package deal.

Speculation could have been avoided had the company been more forthcoming in its communication, or if it has and I have missed it, my apologies and please point me to such information. The objectives of these two subsidiaries, their revenue generation timelines, and WHY paints in the first place! etc are all questions an investor would naturally have.

I am now really worried that my pharma company is going to take away market share from my paint company!![]()

No idea regarding applications that INM Nuvent Paints have in mind regarding nano-paints, but here’s a few that I could find:

Specialized nanopaints might perform an almost endless number of other functions, such as:

- Block cell phone signals in inappropriate environments, such as theaters, hospitals and funerals.

- Give glass the ability to become more or less opaque as desired.

- Give the surfaces of motor vehicles or industrial machines the ability to repair themselves when damaged.

- Allow the textures of surfaces to be altered at will.

- Discourage the growth of pathogens such as bacteria or viruses.

- Repel or neutralize toxic chemicals, acids or other corrosive agents.

On the face of it, seems like a perfect case of “Diworsification” as Peter Lynch calls it. Only time will tell if it makes any sense for Pharma company to diversify into paints!

I sincerely feel we are jumping the gun on Diworsification bit regarding a subsidiary and loans to it. Shilpa has been an innovation driven company and it needs to invest and venture into newer areas - ahead of the competition.

Investing in Shilpa is all about investing into the dreams and passion of Sri Vishnukant Bhutada. I would like to give him the benefit of doubt at this juncture nene believe all his efforts would be concentrated towards pharma sector only.

Question on a bit dated information, but any idea why there has been a creation of pledges by the promoters of Shilpa?

https://www.bseindia.com/corporates/SastPledge.aspx?srcripcode=530549&strdate=20180630

https://beta.bseindia.com/stock-share-price/disclosures/consolidated-pledge-data/530549/

Meeting purely personal short term expenses?

I felt this news item was quite relevant

PRWeb: Armas and Shilpa Enter into a Sales and Distribution Agreement to Bring High quality oncology products to U.S. Market.

Armas and Shilpa Enter into a Sales and Distribution Agreement to Bring High quality oncology products to U.S. Market.

Oct 8 2018 (PRWeb Newswire) – MANALAPAN, N.J. and KARNATAKA, India (PRWEB) October 08, 2018

Armas Pharmaceuticals Inc. (Armas), a NJ based pharmaceutical marketing & distribution corporation, and Shilpa Medicare Limited (Shilpa), an India based pharmaceutical company, have announced today, a distribution partnership agreement. This agreement will encompass various generic oncology injectables and orals within the U.S. market. The first product, an oncology injectable, to be introduced in late October 2018, has an approximate market size of $116 million annually. Armas expects to launch additional oncology products through the 1st quarter of 2019, with a market size totaling more than $430 million annually.

“We are extremely pleased to have an opportunity to partner with Shilpa Medicare Limited, to provide to the US market quality oncology products. Our highly skilled team also looks forward to identifying products for development, utilizing alternative dosage forms, and delivery methods to improve the patient experience.”, says John Niemi, President & CEO of Armas.

“We are very excited about this partnership. The combination of Armas’ deep customer experience and Shilpa’s vertical integration, high quality development and manufacturing capabilities are well suited to launch our portfolio of products approved and under FDA review while providing affordable medicines to patients.”, says Adam Levitt, CEO of Shilpa North America.

Armas Pharma has a website that is Under construction and one employee listed on Linkedin, the CEO who was hired 6 months back.

Thank you for the clarification. This announcement strangely did not come from Shilpa medicare via stock exchange. Anyway I filled up the 'contact us " page on their website

Apparently this pledge has been taken for purchasing a commercial property (I am given to understand combined property between Innani’s & Bhutada) in a certain city to earn rental income-in short personal expenses.

Discl: Invested

Not sure if anyone has clarified on this. Its not “Paints”, they are getting into a very specialized technology called “Transdermal Patches”. This falls under Novel Drug Delivery System or NDDS in short.

Many large companies such as Zydus, Sun, Glenmark are several US and Korean startups are dabbling with this technology. Remains to be seen how successful they are, but its a positive in my eyes.

ANDA approved by USFDA : Dimethyl Fumarate for Shilpa medicare