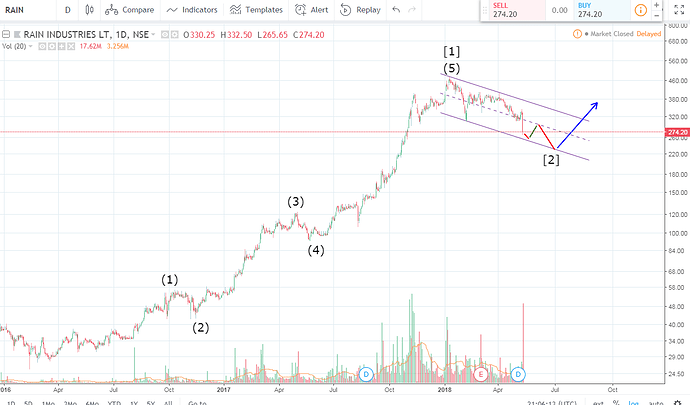

My view on RAIN using Elliott Wave principle:

I first thought it might correct up to 270, but looks like it may be even more.

Today I attended AGM of rain industries and this is my first AGM.

Gerald talked about this event of producing aluminium without carbon.

- He told that alcao is trying to work on this technology since last 50 years and nothing had been materialized till now.

- Aluminium production is a very big and Apple investment of 150 million is very less compared to industry. I am not sure about this.

- They will appreciate the work which also help in green environment.

- About cpc prices, he informed that if he can guess the prices, then he would have been a trader.

- They started advance materials and the revenue growth has been rised to 500% in last 2 or 3 years. They are very excited about it.

Jagan Mohan Reddy informed the below things:-

- Someone asked about selling of cement company. He told rain is first Cement company and then they grew into cpc company by mergers acquisitions.

- Debt:- 50% of debt can be reduced by advance payments and another 50%(bonds) can be paid only on due date.

- Instead of paying debt, their focus is on CapEx expenses for survival. They might look for acquisitions if they get it right.

- Crude oil price will not affect the company revenue. They will use the crude oil mainly in ships to ship the products from/to different countries.

- Someone asked a question about listing in US exchange. He replied by saying that rain is a very small 2 billion dollar company and can’t do it…

- Aluminium demand is growing at 3% in USA for the coming 2 to 3 years.

Please forgive me for any mistakes in the above summary

Regarding Alcoa and Apple doing carbon free smelting , he said technology is around for 50yrs and this particular investment is not big enough to feel threatened.

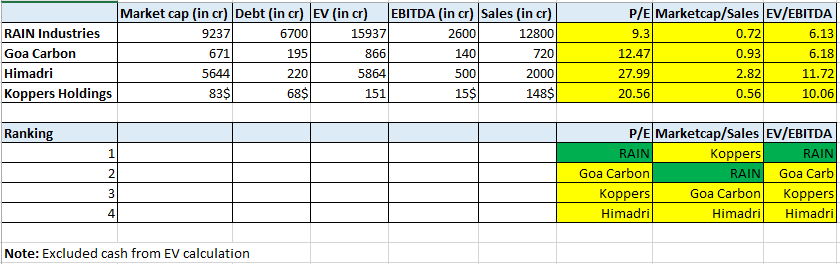

people are missing the tree for the woods. Simple arithmetic says Rain is trading at 6x ev/ebitda cy18e. Close to 6700 crores of net debt need to be taken into account. As of today’s closing price, 9300 crs market cap will not seem particularly cheap if you add in the net debt and arrive at an ev of 16000 crores for a bullish case 3000 cr ebitda.

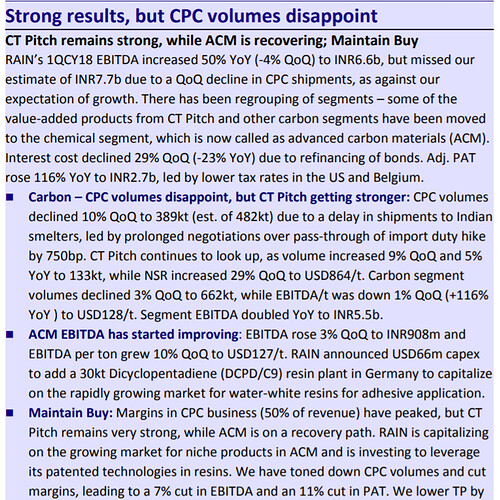

The finance costs were down this quarter. If this continues, next quarter results may be pretty good with normal tax rates and assuming no loss due to currency fluctuation.

Also, the expansion in advanced carbon products doesn’t make rain a simple commodity company like an iron ore mining company. Margins should expand in next 1-2 years.

Both operating and financial leverage should play out in next 3-4 years.

To me the business appears to be too complicated with too many moving parts from the perspective that it is very difficult to estimate future earnings and, therefore, future stock price.

Disc: exited major part of holding since unable to understand the complexities of happenings around the world that are influencing its business.

Can anyone please share the Concall Transcripts or the link to the same

thanks

You can listen to the concall

Playback facility:

Available from May 12, 2018 to May 16, 2018

Dial-in: India +91-22-7194 5757 or +91-22-6181 3322

Playback Code: 18468

@vivekchoraria EV/EBITDA is a ratio that can’t be used alone to measure a company’s performance. This has to be compared with peers and see where it stands. The procedure is same for all performance ratios like P/E, P/B, Marketcap/cashflow etc. A stock may be trading at 40 p/e. It doesn’t necessarily mean it’s expensive. It may also be that it’s trading cheaper than the peers from the same industry, and the whole industry is given premium. I’ve made some comparison of RAIN with its major peers. This will give an idea where RAIN stands.

Also regd. debt, avg interest rate is 5.22% (dropped from 7.56% from last year because of debt refinancing).

And accordingly, finance costs dropped down to 117.9cr (this quarter) from 146.5cr (last quarter).

Only 400cr debt is scheduled to be repaid in the next five years until 2022.

Also flexible to accelerate repayments against Term Debt of 3700cr, depending on cash-flows.

So, it of course makes sense to go for capex with the cash on books instead of repaying debt because the avg. interest rate is much lesser when you compare with the Indian companies.

If this is the case, then Goa Carbon and Himadri stocks should have crashed as well, but they didn’t. So, to me it looks like yesterday’s selling was just panic selling. We need to keep an eye on the following stocks (Goa Carbon, Himadri, Koppers) to understand if the whole sector goes down or the fall is just stock specific. At the same time, these 3 stocks are technically weak as well, so even when those go down, we can’t really understand if the Apple-Alcoa development is the reason for the downfall.

This is the best explanation I’ve come across. Also worrying is the news of pet coke ban across India.

Stocks need not go down on the same day. If one looks at Goa Carbon or Himadri or Koppers, all the 3 stocks came below 200 DMA in the last few weeks. Stocks which are in a very good uptrend rarely comes below or close below 200 DMA.

Check Graphite or HEG on charts, irrespective of so much news flow (positive or negative), they didnt come below or closed below 200 DMA after their uptrend commenced.

Disc: Invested from lower levels.

Reference to “Also worrying is the news of pet coke ban across India.” I am trying to put down my understanding of pet coke and the role it may play/not play with regard to Rain Industries.

- Pet coke is a byproduct of oil refining. The term “green” used in connection to petcoke refers to the raw, unprocessed pet coke which comes out of the coker. It does not refer to environmental friendliness.

- The raw coke which comes out of the coker may be either FUEL grade (high in sulphur and metals) or ANODE grade (low in sulphur and metals).

- It is the FUEL grade coke which the Supreme court is thinking of banning because petcoke emits between 30 and 80 percent more CO2 than coal per unit of weight.This fuel grade coke is used by cement companies and others and harms the environment.

- If Rain industries is using FUEL grade coke for its CEMENT business then the ban on petcoke will affect its cement business - short or long term - till they find other substitutes for fuel.

- The ANODE grade coke (refer to point 2 above) is further processed by calcining to manufacture CALCINED petcoke which is used by the aluminium and batteries sector. THIS activity of Rain Industries - manufacturing of CALCINED PETCOKE ought not to be affected by the Supreme Court ban.

This is my understanding of petcoke and its role in Rain Industries. Please feel free to correct me.

Thank you. Clarity in assessment of the Carbon and Advanced Chemicals section is helpful.

Company has clarified in concall it uses imported coal for its cement plant, as such no impact of ban.

Motilal oswal expects 2000 cr debt reduction in next 21 months. Is this a correct assumption??

As per the concall with the management for Q1, this assumption is certainly wrong. The representative of Motilal was present in the concall when the management stated that that require funds for Capex etc.

Where did you get this info from?

Still looking to find the reasons of fall and in search of that i found this .Rain is testing my conviction in it …

https://www.quora.com/What-is-Gopal-Kavalireddis-view-on-the-rain-industry-Is-it-still-a-hold