Agree

I think; these analysts should be banned completely unless they can pledge that they dont make any trades on their own. By making these statement, they fool the gullible retail investors.

Investor needs to tie the companys growth story to a certain level of PE. Say Page at 70/80.

As long as this rate of growth is intact, paying this PE or less is fine.

Growth story is all that matters. Stock price, PE etc will only follow suit.

If growth reduces, PE should also reduce and V.V.

Hence, the investor needs to become good at tracking the growth story.

Case in point, Infy at the peak of dotcom bubble in 2000, was trading at a PE of 200.

Investor made only 8% in Infy in last 18 years. The price one pays for not being able to tie a company’s growth to a correct level of PE.

Growth was there, albeit reducing with size. The hype also reduced in the coming years. The ones who remained invested since PE 200, wishing and hoping, payed a dear price. Index grew 12%, Infy 8%.

Alert investors would realize that the PE needs to get derated, would get out, and reenter at proper PE levels. Or buy more at discount, to average.

Does it include dividend. I guess with dividend it would be around 10%.

So even if I was damn unlucky to have bought at life time peak valuation of a high quality company I make around 10%.

That is beauty of investing in high quality companies. Time hides my stupidity of buying at extreme valuation.

I would be more than happy with a 10% tax-free return for 2 decades.

Thus far, I have only always thought of buying equity at a rate which warrants it’s earning power. If TCS appeared to give me a return of 25% in the next two years, and Bank Of Baroda did the same… Then they were no different to me. Idea was to track a set of reliable companies and buy at reasonable PEs, and wait to sell. Sometimes cheap would get cheaper, And sometimes, a stock would grow it’s EPS for the some years giving great returns.

Overall returns would comfortably beat FD, and even the Index. You call this PE-trading.

In your opinion, Real Investing is buying growth stocks. High PE no matter… All that matters is EPS growth and management quality. There is no room for Yes bank, or even TCS. Small to Mid Caps in an industry where sizeable growth is possible, across all barriers, across nations, cultures, ages. A large Market size needs to be identified and the managements ability to capture it. And the result would be a Page Industries which has flourished from 350 to 35000, 100 times in 10 years… This is Investing in truest sense ![]()

In the long run the above two are the most important factors which matters most, to sustain or keep hold of the wealth the business created.

Other wise once market sense that earnings are not sustainable or management is not trust worthy or both, we have lot of examples in our recent memory and history (last 24 months) where businesses lost their marketcap values like pack of cards.

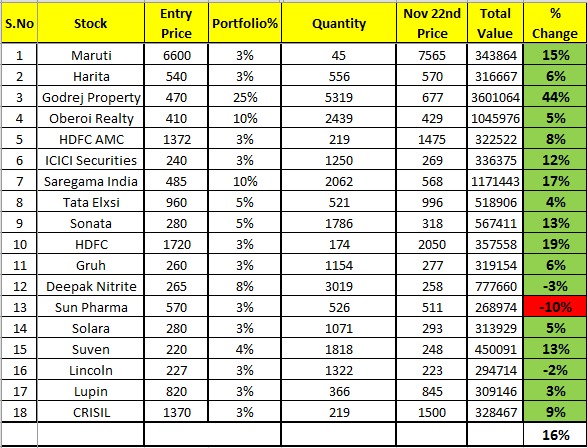

Well, I find you well informed and quite knowledgeable on investing. Thus I assume you have taken necessary caution to ensure that the funds you deploy in this protfolio will not be required until 2025 - unless for a very extreme event (beyond contingency fund). I liked the thought process of your fund however I am not convinced on the fund allocation given your objective of preserving capital and to enjoy life -

- Why 25% allocation to Godrej - While its a respected name due to its pedegree, its not the best in the industry and I do not find its financials very robust. Such a high allocation is a sign of very strong conviction - is there something you know that you´d like to share?

- Saregama - This an interesting story of company reviving itself using the medium of its age - the famous radio! However I am not clear how far it can grow. I would not bet 10% of my long term fund on a single product which has a strong competition to scale beyond its current market.

- Deepak Nitrite - 8% on china / Fx theme is very tricky - if we are focusing on long term , this is just a temporary tailwind.

- Pharma theme - I would focus on innovation , particularly on development in biosimilars and complex drugs. You may also want to look at Biocon, Dr Reddy´s, Cadila, Natco

Given that you porfolio is skewed towards upcoming/ongoing themes and that the market itself is expenisve - its going to be a rollercoaster ride. I wish you good luck and hope acheive your financial and personal objectives. Please do post your porfolio progress every 1 yr / 6 months so that we can be part of your journey

Thanks for sparing your time for giving inputs. Here are my logics:Godrej Property : 1.Asset light model :they normally don;t buy land on their own and usually develop a project in collaboration with land owner.So unlike other struggling builders who’re struggling with huge debt ,they may not face that issue in coming days 2.Godrej brand name :over the years they have developed a reputation of a reliable builder.Timely delivery has been one of their hallmark.As of now they are number one in Delhi NCR,number 2 in Mumbai,Pune and number 3 in Bangalore 3 Due to their presence in key markets,they have spread their bets evenly .If one market does not do good ,they have other places to depend upon 4. Their sales strategy is one of the unique ,They offer initial discount so 25-30% project is sold in very first week. 5.Have found their leadership very inspiring. Have listened few of the con-calls,got very much convinced with their vision ,though process and enthusiasm. Leadership is young so has the capability to go many miles.

Saregama: Yes you’re right .We can’t depend upon one product. Carvan may peak in FY 19-20and then it may start going down.But i have looked at other bizs very carefully. Now because of internet penetration,and music industry getting organised (apps like gaana,apple music and alexa from Amazon) it is easier to encash their music library which was otherwise dominated by pirated CDs and downloads. The numbers growth in last 2 years give a sense of conviction. Apart from that their presence in entertainment content gives relief and they are really doing well on Netflix and Amazon Prime ,this is the future of entertainment .Also from their con-calls ,it is evident that they’re working on replacement of Carvaan with a better product in future. Once you build a brand franchise,distribution channel, it is easier to scale up your next offering.

Deepak Nitrite : Apart from China factor, major focus is on their new plant. India as well as China are dependent on import from USA.Hope with new plant, they would be able to garner a major share. This may help them to double their top line in near future.

I respect your insights as I read your thread…just offering my thoughts… I find real estate as not a great sector to be in equities…Godrej properties is indeed a best choice one could have made but a 40% allocation is too high. (I am invested in small percentage in max ventures which has exposure to real estate via max estates).

My second thought on your next big allocation on Pharma is that apart from Lupin, all others are smaller companies. I am sure you must have specific reasons to chose them verses any bigger names. Please do share.

Similary in IT, Harita and Sonata are relatively very small companies. I would not call Tata Elxi as IT. It would be a Technology company in its own niche/league. Thanks

Interesting. On what factors is this algorithm based on? If no rumor default of DHFL had occured, what would have happened? What exactly does the algorithm reflect?

Please elaborate, thank you.

The reason why Joint Development agreements are popular is because banks cannot lend to developers for land acquisition. It is a long pending demand of the developer community to remove this restriction. Developers have found ways to circumvent this through private equity participation but Private Equity is also a type of quasi debt. The net impact is that JDAs have margins that are much less than a fully owned project and often need more working capital. So a JD may not be as attractive as it may appear on paper. Just my two cents

Best

Bheeshma

Quarterly Portfolio Update.

Stocks in watch-list : Multibase ,Accelya Kale,AIA Engineering, Kolte Patil,Garware Technical Fibres,L & T Finance Holding, L & T Infotech …waiting for few panic days,would add if get at the right price.

I think you are doing great when i believe all MF’s and PMS and individual portfolios are in Red

1Cr PF is simply outstanding…how do you buy that large qty at a time or you spread in days…ex godrej property…? do you plan to add more to existing portfolios names or buy in your watch list? as you said it is for 2015…you plan to hold everything what have invested or will you churn depending on qtr results etc…

Thanks for the compliments . Here are my views on your comments:

1.Can’t compare an individual performance with PMS & MFs as they’ve a compulsion to invest clients money .Unlike them an individual can sit on huge % of cash (in my case I became lucky as I exited the market in Dec 2017 and re-entered in Aug/September). Other difference is churning of portfolio, think an individual has more flexibility in churning of he gets a better valued stock.

2.If you look at any stock, quantity is not that big ,it is minuscule if you compare it with number of shares traded in this scripts.

- Yes ,I plan to reduce/add stocks in 3 scenarios

a) If 2 consecutive quarters go above or below the expectations along-with structural issues or any new negative/positive factors come to the light .Like I plan to add more of Saregama if price goes down by 10% from CMP as I still believe that the stock is underpriced given the growth potential and log runaway in front of the company.

b) If price goes below 10% than my purchase price and I still find the valuation attractive wrt results , I keep adding some at every 10% fall.

c) Watchlist stocks are the ones which are under study ,waiting for few more quarters results, waiting for fall in price due to some irrational ,short term incident. May not buy all ,but would definitely buy few of these .

One can indeed learn from your clarity of approach! A novice question - how do you determine the expected performance of a company? Is it a repeat of past performance over a period of time or something else?

How do you see the price of a company, do you have a valuation model and arrive at a price to buy or do you simply understand the depth and growth of the business as you are a businessman and do not pay too much attention to the price?

Thank you Radhey Shyam ji.

2Q analysis and averaging down at 10% fall is a practical approach. Wanted to know do you average up. I mean if one of your holding has gone up by 20-40 %, you hold only or you also look at averaging up. Paper profit will come down as avg buying cost increases, but you allocate more capital to better performers.

Please share your views and experience.

Its always better not to trade in core portfolio holdings, i had started active investing in Oct 2013, i am markets from 2006, saw great euphoria and crash in 2008, however i used to trade in futures and luckily made profits as well as took out capital in Nov 2007 due to family obligation. My initial capital in Jan 2014 was close to 5 lakh rupees, attained a pick of 1.18 cr in Jan 2018 with investment of 20 lakhs time to time. Started liquidating holdings from Nov 2017 to Jan 2018, took out 38 lakhs out and closed home loans and other liablities. From 75 lakh portfolio, am sitting on a notional loss of 30 lakhs now. Learnings , nothing is permanent in stock market, sell your holdings if you see euphoria building up, below are some sectors for very long terms

- Niche FMCG

- Basmati rice

- Aqua culture

- Luxrury auto makers

5 export themes

6 private banks and niche NBFC

7 Chemical

Stay away from domestic housing and ancillary, we will see recesion going forward.

Very important is you can never create a portfolio for 2025 or 7 year duration, events keep happening and you need to take decisions if fundamentals are changed. Below are some examples from my journey

- Madhucon bought 20000 shares at 12 rupees in 2014, sold at average of 52 in 2016, decision to sell was no long term PPA for powerplant, goverment policy changes, current rate is 7 rupees

- Bought gayatri project at average 125, 2500 shares in 2014, sold at average 525, most profitable bet in my last 4 years. Stock still ruling at 825 pre split:pensive:

- Bought suven life at 85, sold average of 255, still ruling below 255, good stock, once SUVN 502 clears phase II, rates might go to 500-600.

- Meghmani organics bought 10000 at average of 45, sold at 95 in august 18, promotor moves questionable.

Sold DHFL at 570 in Mar 18, reason was interest rates were about to start rise. DHFL crashed below 200.

Misses, IDFC bank bought at 65, made good loss

LEEL electrical, lost good profits, bought at 90, sold at 180, came down from 300, current 62, reason, promotor siphoning off money recieved from havells.

There are different style of investing, you need to keep a hawk’s eye.