What do most of PMEs charge in terms of management and performance fee or any other fee?

October has also turned bad for most of PMS firms

Motilal Oswal : - 2.51%

Basant : - 6.08%

Porinju : - 3.63%

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doPmr=yes

It varies from a PMS to PMS, generally most PMS have fixed fees and variable fees.

Thanks for your reply. Can you please let me know approximate average or range if these fees?

good primer on PMS:

Average 2% of AUM per year

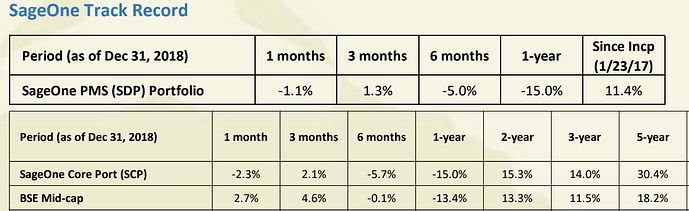

While others (majority) have also improved… BM is back with big bang … more than 10% returns in Nov’18, The confidence was visible in his recent interviews

Any one has subscribed PMS of SageOne. I would like to get his feedback. Kindly share

SageOne is managed by one of the BEST in industry. Have heard very positive about him

Can you provide some basis pl since pms is recently incorporated

CA Rishabh R Adukia

09819861049

Does anyone have any feed-back about 2Point2 Capital PMS managed by Amit Mantri and Savi Jain.

They are a relatively new entrant (2016) but their performance seems good. Also they are one of the few PMS who have finished 2018 in the green .

Good fund. Around 50% exposure to financial sector. They only invest in businesses which they truly understand. And put a lot of on ground efforts to verify the finance and revenues. That being said the fund is quite conservative (compared to SageOne). Joined in August, account is around 2% in red.

I joined their PMS around June/July …they have invested around 90 percent and 10-12 still on cash.

As on date it’s has not delivered any positive or negative returns and it’s more or less is at same value ( went down 8/10 percent and now recovered ).

I would wait for another couple of years before judging it.

As I feel they doing the right things and are well grounded and are not getting carried away by looking others performance etc.

whats their minimum capital requirement ? i checked their website, it seems missing this info

Hi Sunny…It’s 25 lakhs for 2point2

Joined in Nov 2018… in 5-7% positive… but it could be because of timing of my joining of fund… Need to watch for a yr or two to judge…

One of the major concern I have is, that portfolio is significantly biased towards financial… any sectoral headwinds may become issue in future… yet to speak to Savi on this…

Good thing is that they are approachable…

any opinions on ASK pms funds ?

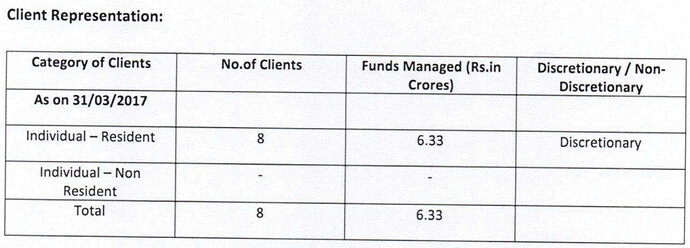

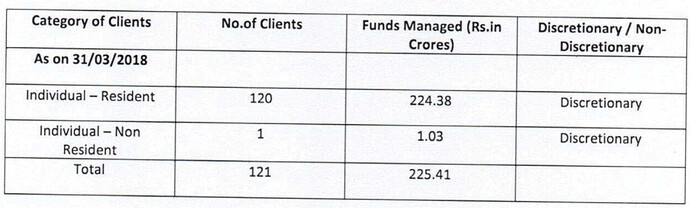

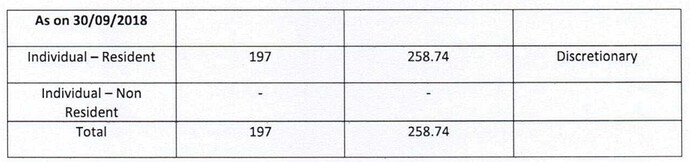

Scan-Sageones-Disclosure-Documents12.pdf

Time period under observation 1 Apr 2018 - 30 Sep 2018

Net client addition - 77

Net increase in fund - 45.58Cr ( 224.38* 0.05 ( portfolio loss) + (258.74 - 224.38 = ~34) = 45.58Cr )

6 Month performance ~ -5%

When they accept 2Cr+ from new investors, why average fund from new investors is quite less then 1 Cr ?

(45.58) / 77 = 0.59 Cr

25 lacs. A friend is investing on my reco. They are planning to increase it to 50. NRI acc is already 50 lacs.

What is the view on Alchemy Capital Management Pvt Ltd?

They are one of the largest PMS players in the country with Assets under Management of over Rs.5500 crores. Profess to be long term investors. But see SEBI Portfolio monthly reports.

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doPmr=yes

In January 2018, they have made total purchases of Rs.8571 crores and sales of Rs. 8512 crores. Portfolio churning 180 % !!!

For July, on a AUM of Rs.5400 crores approx, total sales and purchases are Rs.12179 crores and Rs. 11759 crores respectively. Portfolio churning 218 %.

The situation is the same for every month from January to July 2018.

For a PMS supposed to be taking a long term investment horizon, every month portfolio churning of 180 % ? Is it a PMS or Day Trading investment ?

Is there anything amiss? Or Is there any error with SEBI data?