Piramal Enterprises Ltd

Highlights Of Q1 FY 19 results

Financials

- Revenue grew by 29 % to 2902 Cr from and during the quarter company sold the emerging business to alliance medical group upon on sale of this business

- There was a non-recurring and non-accounting charge of Rs 452 Cr towards emerging assets and hence company reported a net loss of 70 Cr excluding this quarter company had net profit of 382 Cr an increase of 27 % as compare with 302 Cr in same quarter last year.

- Cash profit for the quarter grew even higher by 54 % to Rs 540 Cr . During this quarter all our business has demonstrated a strong performance

Segment wise Highlights - Financial Services

o Loan book grew by 64 % to Rs 46,995 Cr . Loans worth Rs 22,400 Cr are approved but yet to get disbursed. So in all Loans worth Rs 69,000 Cr are either disbursed or about to get disbursed soon.

o All segment of Finance show strong finance- Real estate , Developer Financing , Corporate finance lending , emerging corporate lending and housing finance business.

o Real Estate loan book grew by 40 % to Rs 34,800 Cr ,Corporate finance loan book grew by 163 % to 9400 Cr.

o New vertical which were launched in last year are also witnessing strong performance. Sector agnostic emerging corporate lending business grew to Rs 1163 Cr and the housing finance vertical grew to Rs 1604 Cr additionally the business loan approved but yet to be disbursed of 1087 Cr as on 30th June 2018

o Gross NPA stands at below 1 % since the last 10 quarters. GNPA based on a 90 day remains healthy at 0.3 % being more conservative company continue to provide much more with the regulatory requirement and maintain provisioning at around 1.8 %.

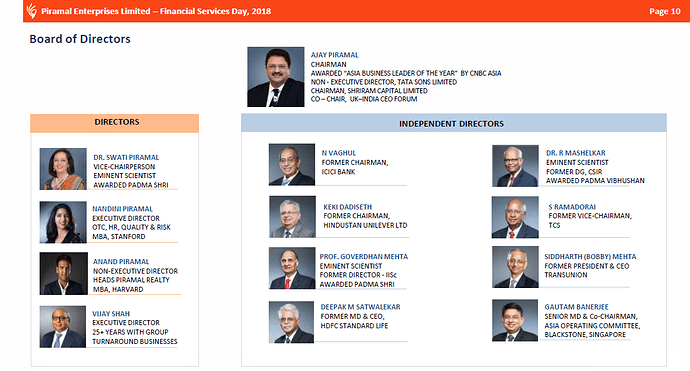

o Now have a risk management committee of financial services with people who have huge experience like Mr. Deepak satvalegal , Mr. Babul ,Mr. Bobby Mehta and an external advisor Mr Deven Sharma who the formal president of Standard and Poor USA

o Loan assets of Piramal enterprises and financial were rated AA+ CARE Stable upgrade from AA stable

o Company has recorded ROE of 25 % plus over the last 10 consecutive quarter prior to the fund raise through the QIP issue and right issue.

o Company had raised nearly 7000 Cr to the QIP and rights issue and during this quarter the business generated ROE of 19 %. ROE is low compare to last quarter only because of 5000 Cr equity which was raised for financial services. Company will deliver 20 % plus ROE going forward - Pharma

o Global Pharma revenues grew at 16 % to 979 Cr as compare to 845 Cr last year

o Strong growth was there in API development and vitamins.

o Company has cleared 5 regulatory inspection including USFDA in this quarter and Since 2011 company had 1300 regulatory inspection and 877 customer audits. - Consumer product business

o Saw a stong recovery in the segment as revenue increase by 55 % to 64 Cr . This led due to scaling of digital assets and scaling up of E-commerce - Healthcare and products business

o Revue increase by 10.5 % to Rs 278 Cr primarily driven by company continue focus on Data and analytic and out of it 4 % are of depreciation due to Indian rupee. - Financial Services

o Loan book grew by 64 % to 46995 Cr. This growth comes from

After merging of corporate finance business(CFB) company was saying that CFB will gre very fast and actually CFG has grown faster

There is a growth in Real estate wholesale segment of financing and the main growth is coming from construction finance and also the hospitality sector which company enters

o In terms of diversification and granularity . Last year wholesale was 87 % of the book today it is down to 74 % of the book and as an percentage of overall book it will continue to come down

o Continue to have Gross NPA of 0.3 % and it has been below 1 % for the last ten consecutive quarters.

o Company disbursed 8800 Cr and out of which repayment and prepayment were 4200 Cr which was actually 48 % of the disbursal . More than 50 % of repayment and prepayment comes from cash flow of the projects and others were refinancing . It shows that the company thesis is going right.

o Detail of sanctions which are yet to be disbursed

Majority of it are construction finance which was sanction in the last one year or so also this includes various other deals like Housing finance , ECL , Etc

o Debt equity stand at 3.9x and by FY 2020 company will go back to 4-4.5x

o Upgrading of credit rating has bought down Interest expense by 25-30 basis points impact of which will actually play out in next quarter. - Real estate financing on wholesale part

o Consolidation is on and getting more and more consolidated and it will go on. Company portfolio has perform better due to regulatory changes on the back of deep relationship with developers .

o In cities where company are there are around 10500 developers and 21000 projects and company portfolio comprises only 1.3 % of the market. So company loan book in real estate of 36,700 Cr is actually serving a very small group of developers and these developers has moved on from the traditional method and getting into new method that is finance closure from Day 1 after RERA. Company portfolio of 1.3 % contributing sale of 6.7 % across India.

o In the two large market which is MMR and NCR , In MMR company is only at 1.6 % of the total projects ongoing which contributes to more than 9 % of the sales . In NCR company has funded only 1.7 % of the total projects contributing to 17 % of overall sales. In Noida has funded 3.4 % of the total projects contributing to 39 % of overall sales. So this show that company selecting the right developer and it is actually playing out .

o No of Month supply over hang

In MMR the inventory overhang is at 58 months and company project is 40 month

In NCR Gurgaon Inventory overhang is 65 month and company project is only 45 months

In Noida inventory overhang period is 80 month and company project is at 42 months - Loan Book Detail

o In 40 % loan book growth

Company main business is construction finance and company is moving toward LRD and construction finance for commercial . Company LRD which was 35 % to overall loan book has actually come down to 25 % and construction finance increase to 62 % which was 60 % in Q1FY18 and 41 % in Q1FY17.

Commercial real estate book has increase to 22 % in Q1 from 12 % last year and in absolute terms crossed to 7000 Cr from 3000 Cr . Again the LRD book from 1250 Cr to 4300 Cr again a jump of 250 %.

In Hospitality sector , mainly in form of LRD company have disbursed more than 340 Cr and have a very healthy pipeline their.

Corporate finance book loan book grew to 163 % to 9414 Cr

Measuring funding has down to 51 % of the corporate finance book and balance is senior debt and Loan against shares.

Also moved into cement , logistics and warehousing sector etc.

Emerging corporate lending the rate of growth was 8 times where the books is now 1163 Cr from 140 Cr last year. Company is now actually ramping up the team. - Housing finance Vertical

o Housing finance loan book has grown to 1604 Cr and disbursed 384 Cr in the last year. The bulk deal is from Mumbai region. Customer mix was 54 % salaried and 46 % self employed. 87 % of whole loan are below 1 Cr. Going forward there will be diversification in terms of regions . - Underwriting Criteria

o Whether the developers are continuously executing on the site

o Ability to sell

o Minimum Key man Risks

o Developed a proprietary model of early warning signal in housing finance which is unique to housing finance. - Asset Liability Match on the borrowing mix

o In June it was well matched 45 % of floating assets are against floating of liabilities and also the balance linked portion is balance to company PLR . So company is well hedged

o Company have adequate cash balance and unutilised capability. - Company see a very good opportunity in financing the wholesale side in Real estate. In coming month there will be deal of equity in IVANO platform also.

- Technology

o Company now have full fledge analytics service which work will housing finance , asset and liability match , and other aspects which bring advantage to company to see things much earlier.

o Continue to focus on ratings to get lower cost of funds. - Other Business

o Asset aggregation strategy in operating roads and also started tied up new people and started talking with SEBI for AIF and few solvency fund for that. In this FY19 company will announce the set up of that .

o Aggregate Re-platform by march 19 company will be ready to launch it.

o Focus on Fee base Income and started hiring more people into this indication spend and in Q1FY19 only company a small start of 9 Cr of Fee Income.

Q&A - In real estate , did the problem going on is a short term structural issue or a liquidity problem for overall Industry ?

o Customers are only going to developers who can execute and deliver . If one is a good brand with good productivity with right ticket size so demand is there . In Piramal realty sold 2500 Cr in 15 days that shows that demand is there for the right ticket size. Filtration process is going on where the distance developers are converting them into a landlord and company is playing a major role in that consolidation by getting the distance developers or selling their assets to company developers.

o In luxury market, more than 90 % of company loan are in mid market so company is not into luxury anyways and not affected. Developers has started flats for investors not for users with 200+ volume in single project so luxury cannot be with volume. - Last quarter yield on loans was 14.8 % which is now 13.9 % but your NIMS are actually increasing and ROA but company cost of borrowing is also stable so just reconcile those numbers ?

o Last time it was average yield of last financial year and this time it is average yield from April to June so it is not completely correctable. - How company will create domain specialty in the newly entered sectors ?

o Company study the sector for at least 6-9 month and there is a separate team for that and then company have experts on boards so each field is studied by internal and external experts. - On segmental basis the financial services segment number is 56000 Cr while the loan book is reported around 47,000 Cr so this 9000 Cr difference is related to shriram group ?

o Yes and it is at the market price - When would be the loan standing on the standalone balance sheet will get shift to piramal housing Ltd ?

o This year it will get moved and the process is already started and quantum is 7300 Cr and that will be transfer to the NBFC group. - What is the average ticket size in Housing Finance business?

o 80 lakh and it will coming down as the AUM coming from small cities increasing. - What is the average yield on the home loan side ?

o 9.1 % - Why me asinine funding is stable compare to last year?

o Developer need me asinine funding when he don’t have equity. In last 4 years company have move from tier-2 developers to teir-1 developers. Teir-1 developers need equity , construction finance , LRD and housing finance. So 3 years later people only borrow me asinine because they were not capable to raise equity so they were tier-2 and now company have moved to tier-1. So it is not something that Tier-1 developer take.

o There is already a churn not a structured debt continuous but if you are betting the right category of developers they will take equity may be for a short time they will convert into a structured debt and that really move on to construction finance. - What is the plan to enhance the shareholder value in Healthcare analytics business because this business occupies 20 % of capital employed and a low growth business?

o Company is in focus to increase the top line growth and profitability . Company provide data and insides to the whole healthcare industry and people has been change in requirement of customers , company was use to give data which has been done with lots of research to customers. Now it gone to real world data and that the transition company is taking and there is some earlier sign of post topline growth . Now company is focusing on improving the profitability. - Kindly give some idea on company cost to income ratio and is there any product launch plan for FY19 ?

o There was a one time cost of 25 Cr in the quarter which was a merger cost related to the demerger so it is going up and in next five month company is going to open 5 more branches so that cost will also be there because it is an investment and some more will come in this quarter. - In healthcare analytics will the margins will be 20 % going forward in next 3-4 years ?

o Yes it will be 20-22 % and company is working on that. - What are the macro risk that company still have after coming out of RERA and GST ? How company will grow consumer products business in India ?

o In Macro environment 2019 politics election is there and company has proactive started working with developers in guiding them how their borrowing and loan book look like so that no construction stop in their any projects. So company is the partners and solution providers. That is the macro environmental affect of things go wrong in the elections.

o Invested in setting up a sales and distribution network , now whole strategy is to add new product in it some of these will be organically developed and also some will be acquisition. If infra get setup then whatever product company put in that will straight give margin improvement. Company continuously looking for product to acquire.