I have been using Jockey for long. Recently I tried Van Huesen . I find them better than Jockey. Is the moat of Jockey impenetrable as is being made out?

Here is how I went about evaluating Page as an investment:

My desired rate of return from a compounder is 18% per annum for over a decade. I estimated what business scale Page would have to achieve to deliver that for me.

Justification for 2 key assumptions:

Derating of PE to 30 over 20 years: As Page starts saturating the innerwear market, growth rates and therefore PE are bound to moderate

Innerwear market growth of 7.5% pa: Inflation (4%) + Population growth (1.3%) + Per capita volume growth (2.2%)

By my estimates, Page would have to acquire 70-100% market share of the inner wear segment in India for me to achieve my 18% return - too hopeful for me.

However, for someone desiring a 12% return, Page merely has to acquire 35% market share - much more realistic.Page Macro Projections.xlsx (18.5 KB)

Buying page, a grossly overvalued stock, you think bet is on Brand Jockey.

— Shyam Sekhar (@shyamsek) November 9, 2018

But all you're doing is fueling the Jockey operating Page. Exotic research reports will reinforce your false beliefs.

Losing money in a good Biz is just as painful as getting conned in duds. #Nifty

I have used Jockey undergarments since the last sixteen years. During these period, I have personally felt that the quality of their undergarments has nosedived. That is why I tried Van Huesen undergarments-purchased from Amazon. And I feel the change was worth the trial. So as more players come in with comparable or better product, Page may fail to repeat their past performance. Hence in my view, the performance of Page Industries may be near to peaking out.

I second that. The quality difference is closing fast while Page keeps raising its prices which is reducing the value derived by the consumer. However, the brand is strong enough to pull it forward for longer than we think and may be they get the right feedback in the interim.

In companies where the valuation is termed as a ‘puzzle’, most things are given. Everyone has an idea about the growth, returns and reinvestments. So, in my opinion, the ‘puzzling’ part is how long the Competitive Advantage will be sustainable. Michael Mauboussin wrote a paper on it, which may come in handy:

http://people.stern.nyu.edu/adamodar/pdfiles/eqnotes/cap.pdf

In my personal view, both D-Mart and Page are overvalued. Do note that they necessarily may not be, if they turn out to be Competitive monsters like Coca-Cola or Disney. But that’s really the biggest question here: While approaching a company for valuation, even a good one, would you rather treat it as the good one it is or assume that it will turn out to be a jaw-dropper in the far future?

You may very well may assume the latter, and I do not have problems with that. Again, in my opinion, it is far better to choose the former and risk being conservative, than choose the latter and risk overpaying.

When it comes to an Either/Or decision, the question I ask myself is if it is a reversible decision or an irreversible one and what’s the penalty for being wrong. Reversible decisions make things easier. You lay down a thesis. Lay down an exit and take the punt with an appropriate position size. Anything doesn’t go according to the thesis, don’t re-justify, just exit and keep things simple. Posting about the position on an online forum induces one to defend it and that defence induces a commitment bias. So to answer your question - I don’t have an answer because I choose not to answer, as answering will make me married to the position.

I have understood the company in a certain way which I have listed out and I see certain transformations which I would like to participate in. If they don’t turn out the way I want it to in terms of certain quantifiable metrics (most listed in my initial post), I will be out. I have done this in the past in krbl and avanti and a few others where I have exited when my thesis did not hold and I hope I will continue to have the better sense. Lets see.

Quite insightful. As you researched on Page, did you come across reports which talk about things like with rising income people now aspire for more popular brands like Jockey, rising market share of Jockey at the expense of competitors etc. What I am trying to understand here is how likely Page is to continue growing their sales at 20-25% in the next 5-10 years.

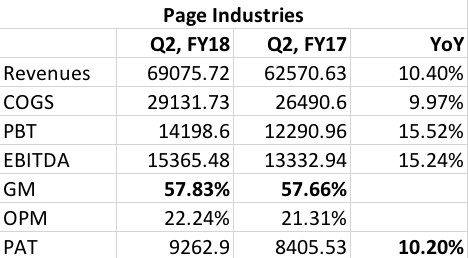

Below expectation result from Page. Sales up 11% YoY. PAT up 10%.

Special dividend of 110 declared along with usual quarterly dividend of 41.

Very tepid results for current valuations. I think a healthy correction should follow.

Dividend as per expectations but got to hear why the growth was so mediocre by Page standards.

Disc: Invested but not adding at current levels.

Page was hammered today, close to 5% fall. But what is important is the correction that will follow. High PE and tepid quarter can be a bad combo. Having said that, it can also throw up good opportunity to enter fresh or average down. Anyone tracking page closely, can throw some light on specifics of tepid results.

10% topline and bottomline growth when you are trading at 85 P/E is inexcusable.

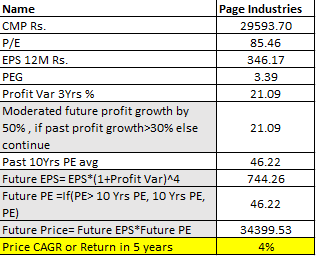

Today’s correction got the post-earnings P/E down to 79. My gut feel says price should drop down another 10% to 25000 (which is strong technical support) which will bring the P/E down to 70. I would ideally like to pay 60 P/E for further additions, so will look for 22000 levels or closer if it gets there before next quarter.

Disc: Invested

What is the reason for the slowing growth in top and bottom line of Page Industries? Is it that more players with comparable products have entered the fray? Quality of their products have come down over the years as I have first hand experience being a user since 2005. I recently switched to Van Huesen and found them to be better. Complacency may have set in the company with their scorching growth during the past years. Many like me may have opted to try the products of other branded players seeing the deterioration in the quality. My personal hunch only. No on ground scuttle butt.

Q1 and Q2 of FY18 is not comparable to FY19 since there was a lot of de-stocking in Q1 and re-stocking in Q2 at channel distributors due to GST implementation.

H1 FY19 vs H1 FY18 still looks decent PAT growth of ~25%+

From valuation point of view, assuming an exit multiple of 40 in 10 years, page would have to grow earnings at a CAGR of 20% to deliver 12% CAGR shareholder returns in 10 years. (Excluding dividends).

I think to justify an investment at CMP with those numbers, either people have to buy a lot of underwears like never before or Page has to diversify into another successful product category to provide long term returns to shareholders > 15%.

Disc- not invested.

Last few days, I tried making a price forecast calculator. I shared excel in a separate thread, but yet to receive feedback on accuracy & improvement. Nevertheless, this is what my calculation says

Doesn’t look good with only 4% return.

Disclosure: Tracking, Interested

I would just like to put forth some very valid points.

- Moat in such a business.

-

In an industry like this, distribution, ASP and free cash are of utmost importance. This in turn means a high roce is needed so that one can spend on the other two heavily and with more ease to generate growth. That is to Page has to spend far lesser capital to generate a high return on its capital deployed, enabling it to do more with its free cash. This gives a moat to the incumbent.

-

Quality of product.

A sub standard product for jockey will still do better in the minds of a consumer than a quality product from dollar, rupa simply due to brand positioning and the moat that comes from the business’s ability to throw out cash and hence invest in newer products and fresh branding. They can pull akshay kumar overnight from a rupa (he endorses rupa right?). So high quality does not necessarily mean higher sales and hence a better brand. Apple’ products are not of the same quality of aleinware in terms of laptops and well oneplus in terms of phones. Still people will buy apple. Patanjali chemically, have a cleaner product than colgate and are cheaper. But people still buy colgate more as far as what ive seen. -

If an incumbent loses market share due to poor quality, the incumbent due to the moat of its balance sheet, brand recall and distribution is able to regain its position and rebrand itself much more efficeintly. Take the example of maruti going from what it was as a brand to what it is today. It is no longer “below” an executive to arrive in a swift.( if you want take that soceital thingy into account). The cars do provide value for money and great quality. But its not like maruti always offered this. Prior to the swift they made junk literally compared to the rest. So for page to reinvent, they can do it very quickly and if page drop their quality substantially jockey will intervene since it is their brand afterall!

-

Roce.

Regardless of PE multiple if page can deploy Rs100 at a 60% roce every year and deploy 80% back as incremental capital, the excel junkies here can calculate the hypothetical earnings along with the incremental capital employed. Starting at 100. There is no way a van heusen can compete with a page simply due to the balance sheet and roce. And of course multiple focus areas. Let us not forget page’s state of the art manufacturing and the fact they have been in innerwear as a business since inception (if im not wrong)

- Overestimating the simplicity to start a business…

-

Over the last many years we have seen incumbents go out of business. Be it, kodak through the digital camera or blockbuster through usb’s and streaming services or nokia. We tend to think that this is easy to do. Get an idea, hire a few people, raise funding and thats it the incumbents just sit down and let you take their share. It is very very difficult to set up a business let alone a consumer franchise. Tell me one consumer franchise that has been disrupted? They just end up aquiring simple as. It is very very hard to set up an fmcg business let alone any other business. We cannot blame ourselves for this because we are what we read and we are fed only the success stories. That being said, these days small start ups in fmcg and consumer are rasining capital and doing well. But can they leverage that one product to such an extent to become a page like operation? Or will page just up the ante increase product quality, take short term margin compression and scale up distribution or whatever? Nobody is going to fund an innerwear brand simply due to this. The product has be unique without hitting competition head on. Like a paper boat. Clothing is not commoditised. Electrical appliances to small extent have been commoditised, where someone offering good quality at a good price is able to make a small dent. But the dent is sort of insignificant when seen on a large scale. Look at Boat in the speaker space. You need a berger like operation to compete even slightly with an asian paints (there are unlisted paint cos like nippon paints too)… Who is the berger to Page?

-

The speed of disruption is not exactly as we think. Apart from kodak and blockbuster (who had multiple chances to partner with netlfix when netlix was bleeding but turned it down). Disruption has been slow and has been pulled off by players already in the space. Like apple. Amazon with ecommerce let us say retail, but they still have gone the omnichannel route. By investing huge capital. Funding by, you guessed it free cash from AWS. In the consumer space disruption is even slower. Again we cannot blame ourselves because what we read are these stories of a guy doing not much and scaling his company to a multi billion dollar enterprise. Valuations maybe multibillion dollar but we still go to a dmart etc: And again we see an incumbent in walmart overnight throw 10s of billions to aquire a flipkart. From where the float i.e roce matters! Dont worry about disruption happening overnight it takes a long long time. Coal will supply power for the next 2 decades plus Im telling you. May not grow but wont degrow significantly for a long long time.

- Growth hit this quarter…

-

Firstly we do not know why this happened so let us wait for clarity.

-

If you were to see the results of march 2016 vs march 2017 we see a similar pattern before growth jumps up again.

-

So this is not the first time and definately wont be the last.

-

Also if one were to compare H1 of each of years then the performance looks “okay” by the high expectations set by company.

- Page closing thoughts

-

The company has big untapped markets in sri lanka, nepal bangladesh and the UAE. Let alone India.

-

Just drive around and see the number of people assume 30% wear jockey and look at the opportunity here itself.

-

If you look at PE alone it does not make sense. Keeping things constant page with its roce and dmart with its roce, page will generate more cash for shareholders and thats what matters right? not PE. So valuations will hold as long as roce and some tepid growth is present along with the moat staying fairly intact.

Im not saying page is perfect or anything. And Im by no way comparing page to asian paints, that is a mere analogy and I believe that it is a good one. Is it expensive yes. Will you get it at 30x maybe not today.

Views?

Hi everyone,

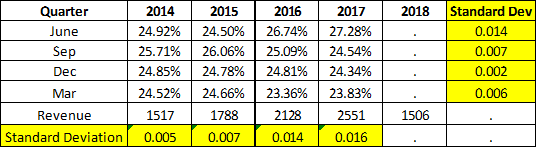

Since some time now, there appears to be a growing trend of revenues accruing in Q1. While being a very stable company still, the revenues appear to have become more seasonal than they were.

Earlier ( 2014 & 2015) September quarter used to be the best of the lot followed by June but now the trend has reversed ( 2016, 2017) , with June being the best quarter of the lot. H2 is far more stable compared to H1. I think this trend is continuing in 2018. One should dig deeper to see why this is so, but i think there is an underlying shift in the product mix.

The seasonality is reflected in the increasing standard deviation of the revenue stream across time esp in June and September. My best guess, given the current trend is that Page should close 2019 with a growth rate of 15% in top-line, which is not bad at all given the high base.

Promoters stake has decreased -Says screener

@dumboinvestor Please check the balance sheet of page industries, 2018 it generated cash from operations 4545 million, did it put 80% back in the company, the answer is big no, 2190 million went into mutual funds and dividend paid 1684 million that comes to total of 3874 i.e 85% of cash. The net block of the company has increased from 217 in 2015 to 290 in 2018, while it generated close to 950crore from operations. Company is not deploying back its money into the company to generate 65% return as u said.

I have read a lot of your replies and it seems that you are trying to force your views on others and as per you everyone should only buy 3 companies namely Page, Nestle and Asian paints. Please put in your thoughts but be open to counter views as well. You have written a lot many times that people are ignorant,please note that ignorance is bliss and being ignorant and open to learn takes you miles ahead.

As per analyst reports, the company had taken price increase of 10% in Q1 so lots of preemptive buying happened in Q1 itself and the company was rewarded disproportionately. Volume growth in Q2 was slightly negative yoy partly due to shift in festive season. One needs to see H1 growth which was 25%+ as days of 30-40% growth are truly over. It is poised to grow 20-25% over the medium term. I would not pay more than 50-55x trailing in that scenario.

Disc: No holding