At first glance, the company looks like a deep value buy based on quantitative parameters. A deep dive into the financial statements reveals a few red flags.

The company is currently at a Market Cap. 22 cr. at a price of Rs. 75. Company main business is to trade in agriculture products, equipment, minerals, metals, & paper.

A few salient features from the Financial Statement of FY16: Comments in ()

-

Trade payables of 1012 cr. and other current liabilities of 199 cr.

-

4 cr non-current investments in a related party and cash of 913 cr.

-

Short Term loans and advances of 102 cr, while the inventory of only 32 lac on sales of 1976 cr. (possible due to trading business)

-

Other income of 5.66 cr & interest received of 3.86 cr. (at first glance cash on books starts to look doubtful)

-

Most Cost Of Goods Sold is coming from the purchase of stock in trade of 1951 cr. (trading business)

-

Finance cost of 10.68 cr on a short term debt of 60 lacs. (Whom is this finance cost being paid to?)

-

Depreciation & Amortization of 33 lacs on Fixed Assets of 104 lacs. A major portion of depreciation (30 lacs) coming from a vehicle or vehicles of value 1.38 cr. (No infrastructure needed for a trading business of 1900+ cr.?)

-

Account receivables of 206 cr on an EBITDA of 24 cr, of which 6.59 cr are outstanding for more than 6 months. (Taking EBITDA because comparing to Sales in a commodity trading business would not be right)

-

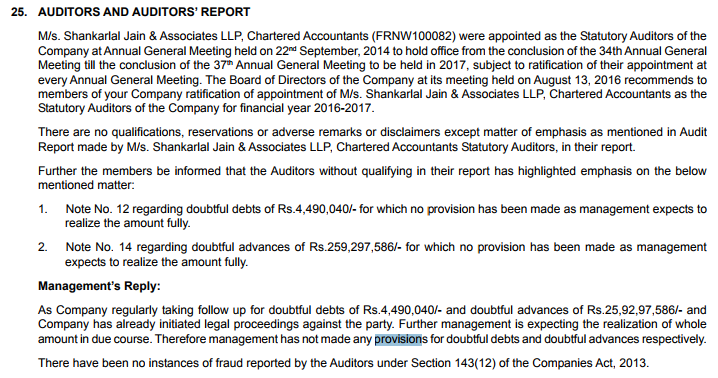

Doubtful receivables of 44.9 lacs for which legal proceedings initiated but no provision created. (Not sure if Indian Accounting laws deem that a provision is to be made for such doubtful receivable under legal proceedings.)

-

910 cr of cash in a term deposit with banks which are pledged against letters of credit. (For what?)

-

Short Term loans and advances of 41.85 cr to Related Party and 25.92 cr of which are separately doubtful. (More than the market capitalization of the company.)

-

Other current assets include interest accrued on term deposit of 15.23 cr which based on the value of term deposit is less than 2%. (More on this below)

-

Other operating income includes 66.34 cr of interest received for term deposit. These are the advances received by the customers and deployed in bank deposits. (Taking this interest received into account the interest rate on the cash deposited in the term deposits comes to 7.3%.)

-

Advances from customers in other current liabilities is at 198.8 cr. (Since a portion of the bank deposits are based on advances from customers, mentioned above, the notes to balance sheet does not disclose what portion of the current cash balance is comprised of company’s cash and other people’s money. If we take this value of advances in other current liabilities as the full extent of advances from customers then how does it explain 66.34 cr of other operating income mentioned in point 13. 66 cr of interest from 198 cr of advances is not plausible. So either the advances received from a bigger part of the cash balance or the other operating income is incorrect.)

-

Manufacturing expenses in FY16 are 0 against 2.11 cr in FY15. (Given that it is a trading business but such a sudden fall?)

-

Finance costs include bill discounting of 8.31 cr, interest paid to banks of 15 lacs on Short Term debt of 60 lacs and 2.22 cr to others. (Bills discounting means company is either in urgent need of cash or the receivables are not being paid. No further explanation is given by the company on 2.22 cr of interest paid to Others.)

-

Rent & Lease reduced from 1.67 cr. to 56 lacs in FY16. (How?)

-

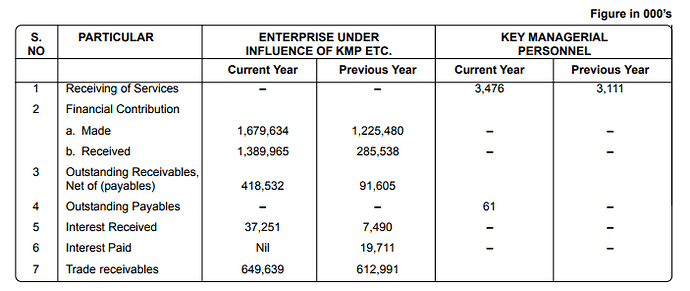

Related Party Transactions disclosure has been specifically made in 000’s figures while the rest of the AR is using the Rs.unit figure. (Done to hide the actual value of RPTs at first glance (pg. 46 of AR 15 - 16).)

19 Auditor’s observations:

Conclusion:

Even if we ignore the obvious corporate governance issues, one needs to ask of the ownership of the cash & cash equivalents disclosed on the company’s balance sheet. Does it belong to the company or the customer’s who have given it as an advance? Quality of disclosures can be improved immensely in this company. Perhaps these are the reason why the market is pricing it the way it is.

Disclosure: Not Invested