Liquidity tighneting currently is a global phenomenon happening around the world in every country and not happening just in India and less related to demonitization or GST. This is more to do with QT which central banks have been doing . Look how much liquidity RBI has pushed into the system in last 6 months to cushion against QT through open market operations. This would go on until central banks decide to stop QT and start dropping interest rates.

This makes me wonder, I was expecting eradication of the truckloads of black money which the politicians and industrialists had amassed. Instead, the axe came down upon the aam aadmi, again.

It will continue to be so.

This makes me wonder, I was expecting eradication of the truckloads of black money which the politicians and industrialists had amassed. Instead, the axe came down upon the aam aadmi, again.

Aam aadmis by and large don’t contribute to political funding of parties. So, what is the basis for your expectation? Most political parties are working for their paymasters.

Demo and digital wallet and other parameters are to regularize the movement of money. Parallel economy benefited only powerful few, this is an economy of equals. Fewer option to hide money in the black pits like property and gold brings the money in formal economy which in turn will help the economy grow in developing earning potential which will help the economy in longer run. It is little pain for now but essentially the money has to show up in the economy and will bolster the economy. The venture capital is brewing R&D as well as innovation in the industry…The economy is showing green shoots. Right nudging, government policies to reward risk in business instead of sitting on files, projects and payment will lead to bolstering the economy. Look at the economic models of countries like Singapore, Hong Kong Taiwan and even China. Country is in right motion.

I strongly feel that the benefits of this governments policies will be reaped by the next government! This government had done all the capex, the impact on bottom line will be reflected in the next few years.

Yes. It is like 2004 scenario. Economy may just take off from here.

Wonder if anyone has had the chance to read Seth Klarman’s latest annual Baupost letter to investors.

If I can draw 2 or 3 key points from it:

-

Next recession is likely going to be caused by a sovereign debt crisis. Govt debt of major economies around the world are close to or have crossed post WWII levels as a % of GDP. Private non financial debt in developed as well as developing countries is also highly elevated - debt coverage ratios are under pressure despite low interest rates. As interest rates go up (akin to tide going out leading to determination of who is swimming naked) many of these assets might turn bad.

-

This should cause Govt’s around the world to start taking remedial policy actions however large economies are engaging in more populist policies and irresponsible spending than ever before (eg. Trump with his tax cuts causing fiscal deficit to cross 6.5% of GDP!)

-

As an investor however, one must balance between chasing the last cent of return and too much caution. Portfolio construct at a time like this needs to be geared towards event based stocks (demergers, mergers, restructurings, etc.) as opposed to terminal value based long holding period stocks to minimise risk.

This is now the 4th investor with an unparalleled track record (Howard Marks, Ray Dalio and Stanley Druckenmiller being the others) who has been advising caution that I have read about. Even the eternal bull Warren Buffet is sitting on $60B cash on an equity portfolio of $200B (if someone can confirm this number). People are talking about the next crash being very different to the previous ones where traditional tools like tax cuts and interest rate cuts not being available to central banks resulting is a long painful period to revive consumption.

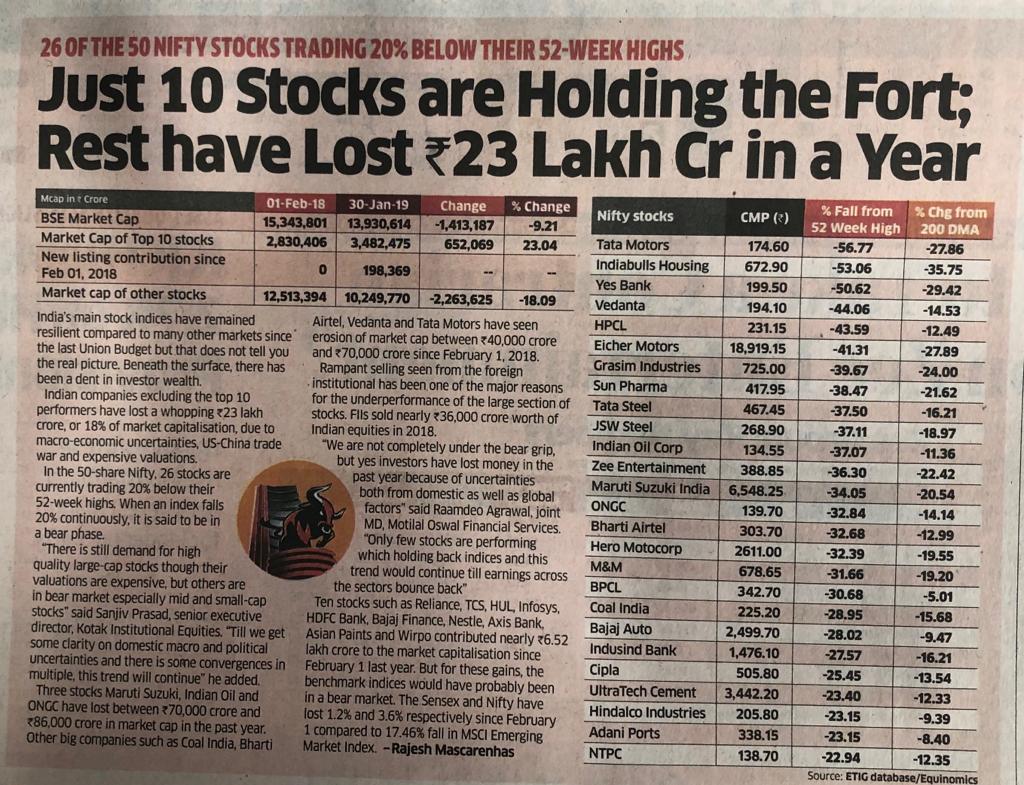

As an investor sitting on less than 10% equity allocation, I am extremely confused. On the one hand large cap stocks have barely corrected 10% (Nifty and Sensex) and trade at all time high trailing PE’s but on the other hand corporate earnings are at 15 year lows. Many largecaps seem to be making all time highs while a large number of broader market stocks seem to be making 52 week lows. While on P/B basis these stocks are on long term average on P/E basis many of these stocks are still expensive as compared to historical numbers. Despite small cap index crashing 35% retail participation and enthusiasm continues to remain unabated a phenomenon not seen very often.

Have been wondering for almost 4-5 months as to how to play this but havent been able to come up with a conclusive answer. Looking at mutual funds as opposed to direct equity. Options:

- Small cap heavy MF - P/B in line with long term average however, still not cheap on P/E basis. Even P/B is slightly above long term mean

- Portfolio of basic consumption compounders less likely to be affected blow ups - colgates and pages of the world have been bid up to prices which dont offer much MoS

- Continue to remain heavily in cash/gold - as Klarman said, at times like these, being too cautious is also not too good.

- Go for MF’s who have high cash exposure - as they are likely to be more conservative than the rest. Currently evaluating PPAS long term equity fund - they were at 30% cash levels in 2017 and 25% as of today - only issue is that 20% of their PF is banks.

If anyone has alternate strategies, views are invited.

I put a little thought into the fact that Large Caps are so popular. I mean, they are really popular compared to the lesser caps. They have amassed so much Market Capital partly because their businesses have the revenue, but once they are in the Index, they attract “popularity” buying from funds and retailers.

Since their introduction three decades ago, Index Funds are now a force to reckon with as they have blocked so much capital. Currently, RBI and FED both are increasing rates and receding the liquidity out of the economy, and into the government coffers. Liquidity is becoming scarce.

It is my belief that when pull comes to tug, Index Funds will be heavily sold, because way too much capital can be released from a large cap index fund, as opposed to selling a mid-cap, let alone a small-cap.

Nifty is more likely to hold these valuations and move upwards as exit polls start flashing NDA chances of returning to power.

Now Jan collection of GST crossing 1 lakh crore is a big ammunition government has in its hands to increase expenses without damaging fiscal maths.

Also, Oil shock was short lived and likely be stable.

Looks like we are sitting on a nice base for accelerated growth going forward.

Interestingly (and surprisingly), Nifty surpasses 27 PE as on today, as per NSE site! And we are not even at 11k!

This in context of Nifty or S&P ?

I am looking to learn more on eventualities of Index funds. Any interesting analysis that you can suggest ?

This is a great way to look at overall market valuation.

I was wondering if it is possible to see this trend minus the top 50. I reckon the PE of this (bottom 450) portion of the Nifty 500 is a lot lower now and perhaps reasonably valued.

The Nifty 50 is an outlier compared to the broader marker in the current scenario.

It is surely possible on an excel. I don’t want to remove any data and simply use the full index. If I remove the top 50, then should I also remove the bottom 50 (loss leaders)?. So basically if I start slicing and dicing, I will end up with very fuzzy data. Just keeping it simple is easier for me. Best.

Thanks for your response @valuestudent

I feel slicing data in this case will do the exact opposite in my humble view. It will remove the fuzziness which an overvalued top is adding to the whole.

If we do careful like for like comparisons between similar data groups across periods we do not necessarily introduce bias, although statisticians would know better. Point being some portions of the market could be available at historically reasonable valuations (which I think is the contention of your original post).

I respect your view of keeping it simple and won’t bother you anymore but just think about this, any group whether its Nifty 50, 500, Midcap et. al. is just another slice anyway.

Dear @kkarimyusuf,

All views make a market ![]()

The whole point of nearly every post I have made in this thread is that: If you are a good investor who knows what he is doing one can invest anytime. Novices such as myself should invest when the indexes are cheap. Now whether some pockets are cheap, or some pockets are expensive, whether those expensive pockets when they correct will cause a further market correction, or not, these are things that we will know if and when they correct. I know, that on historical valuations, Indian stock market is expensive; it is expensive by Indian standards, it is expensive by US market standards (US because it is the most mature global market and that is cheaper than India) and it is expensive by the valuation standards of any market globally. So I would like to watch from the sidelines. I am not a pro ![]()

Dear @kkarimyusuf,

Apologies for the multiple answers but I thought it best to make a small visual graph how I think of risk. I look at risk before action in these buckets. This is my learning from last 2 years.

So, I have learnt that we carry different types of risk in the stock market when we buy a stock.

-

We carry earning growth risk.

-

We carry stock valuation risk.

-

We carry management quality risk.

-

We carry market valuation risk.

I feel, a novice like myself should invest when all the stars align. I feel if I am already going to carry the other risks which I mostly cannot avoid, the only risk I can avoid is carrying a market risk.

To avoid market risk, one needs a watchlist of stocks. Then one can keep following the businesses. Then when Mr. Market is very pessimistic, novices like me can deploy our hard earned money. At that moment we have taken out to a decent degree market risk.

The thing is; I feel people are unconsciously investing (speculating) in the hope of getting a high. The kind of high’s we used to get in 2017. The mind is seeking those high’s (it’s addicted). It wants a dopamine rush. So people invest again and again trying to get that rush. Only slowly will they accept the fact that that old rush is not available anymore. Then they will slide into fixed income. That is when I will slide out of fixed income into equities.

I don’t need a rush. I am calm and relaxed. I will wait.

Dear @valuestudent

I admire your persuasive writing style, Brilliant!

I don’t however concur to everything you say. I think you should stop calling yourself novice  Happy investing & all the very best.

Happy investing & all the very best.

Cheers!

While the nifty is at 27PE per the nse website, have checked few Nifty ETF funds, all of them are around 21PE. Any idea why is the difference ? Is NSE PE valid or ETF’s PE are valid.

This seems to be correct data. PE can not be 27 when so many stocks are at yearly low valuations.