Hi Friends, the co would be having its AGM on 31st, would appreciate queries for the same.

Thanks,

Ayush

Hi Friends, the co would be having its AGM on 31st, would appreciate queries for the same.

Thanks,

Ayush

Hi Ayush,

The web site do not have link for Annual Report 2013-14. I have written couple of times to their investor contact but no response.

http://www.mayuruniquoters.com/announcement-detail.php?id=132

Do you have the report ?

Regards,

Amit

Hi Amit,

AR 2013-14

Regards

Adiga

Few queries from my side

Whats the scene on family front incl health of SKP?Is Manav Poddar present during AGM?

When is action on Mayur Brand and advertisement going to start?

Whats the status response and target of B2C foray in furnishings? whats the status of appointment of distributors for regions other then Delhi?

When are we expecting approval of PU Plant stuck for long?

How is exports to OEM n general exports faring?

What are the breakthrough and opp size in Indian SUV mkt?Are we getting much better rates now in Indian mkt specially luxury SUV mkt then rates in OEM exports mkt?

How is the footwear mkt performing?Why are we languishing when all footwear cos are performing well?How big is opp size?

Hi Ayush,

Few queries from my side:

What are the new markets, avenues and segments that company is exploring with an aim to increase it’s global presence leading to the increase in the margins ?

What is change in revenue break up as compared to 2013-14. This year Footwear segment: 50% and Automotive segment: 35%. Is there any client loss specially in the footwear segment ?

When is the capacity addition of 6,00,000 linear meters per month is expected from the PU plant ? Are there any future capex plans ?

Thanks,

Amit

If one heard the concall, mgt does explain the footwear slowdown vis a vis relaxo et al. Mayur sells material for premium footwear while relaxo sells cheap chappals. So the slowdown depends on the product mix the company has. I believe Mayur supplies 80% of Bata’s raw material demand and their sales havent gone anywhere for a while so that explains it. Mgt has earlier stated they have not lost a single customer …like ever !

SKP sounded very confident of getting the PU approval by June/July stating it was inevitable and now the bone of contention was more like they wanted to sign a 50 year agreement for water.

SKP also stated that they would decide on the seventh line by July ie if they even start a regular shift on the sixth line, they would order the 7th one in anticipation. Would certainly like to get updates on above two topics from AGM please.

Vivek, Not sure where SKP’s health concerns came up from but maybe you know ! Mayur now has more indian oems on it’s rolls besides M&M - volkswagen , fiat, GM etc have stopped importing from China. The margins are good here but sales are few since these are for premium cars. Maruti is what gives the volumes but squeezes badly on margins so SKP doesn’t really want to give to them.

In fact SKP gave the realization per meter figures for each of the segment in last concall.

Ayush, if you could bring this up, SKP should have someone pay attention to basic things like making the annual reports available. Cant find on bse or mayur’s website. The results it faxed to the exchanges were barely legible. Often the ARs have basic grammatical mistakes etc

PU, once approved will take 1.5 years - they will start off with two lines adding up to 6 lakh meters. This will be a greenfield expansion for which land is already acquired. The present facility has space for only the 7th line and then they shall be maxed out.

I am glad you highlighted this point. I have written few times to investor contact to upload the AR’s on Mayur’s website but no response. The AR 2014-15 have basic grammatical and spelling mistakes which does not look professional.

Ayush, if you could bring this up, SKP should have someone pay attention to basic things like making the annual reports available. Cant find on bse or mayur’s website. The results it faxed to the exchanges were barely legible. Often the ARs have basic grammatical mistakes etc

Is there any information on the breakdown for revenues in the footwear segment?

What proportion of revenues come from Bata, Liberty, Paragon, Relaxo, etc.

I once received some anecdotal information that their largest footwear customer is Paragon. However, Paragon is low-range / mid-range type of footwear, with limited premium footwear presence. So, I wonder if the anecdotal information I received is true - because Mayur is mostly into premium segment…?

Hi Ayush,

Any update from the AGM?

Thanks

Recent equity research report on Mayur Uniquoter. Provide good update about various issues on the company

http://www.moneycontrol.com/mccode/news/article/article_pdf.php?autono=2447301&num=0

Good results by Mayur Uniquoter. While top line remain static (probably due to lower crude price), net profit grown by around 30% over June 2014.

http://www.bseindia.com/corporates/ann.aspx?scrip=522249&dur=A&expandable=0

The EPS QoQ is mostly flat because preference shares were converted to normal equity shares.

June FY14 EPS: 3.25 (diluted)

June FY15 EPS: 3.49.

So it looks like an average quarter. I think they couldn’t take advantage because of lower raw material costs because of higher taxation.

I am not really amused by low raw material costs. That’s temporary.

I would treat it as a one-off benefit. The revenue is flat and that is a much more critical factor.

Disclosure: Exited all my Mayur holdings today before the results and I am glad I did.

Agreed @sushil86. Even with the tailwind of lower raw material costs, the profits are flat. That is a litlte concerning.

The improvement in Net profit and thereby margin has been mainly due to the raw materials cost coming down from 83 crores to 76 crores. Seems like the footwear is still struggling. Waiting for the concall to get more clarity

Any reason for CFO change?

Mayur uniquoters story seems to be intact. Brief Excerpts from concall;

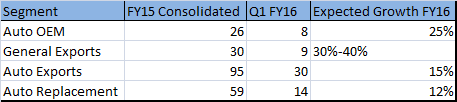

(Rs in crores)

Rest of the revenue for FY15 belongs to footwear which is approx - 300 crs.

The growth for Q1 FY16 compared to Q1 FY15.

general exports - 26%

oem exp - 15%

auto oem - 31.33%

auto replacement - 10.83%

footwear - -7%

Opened wholly owned subsidiary in US

Retail furnishing expansion going on.

Appointed dealers in Mumbai, Surat, Chandigarh and Kanpur. Target is to open in all capitals by FY16 end. Benefit of this will accrue from FY17.

OEM Exports

Got 25 crore new order from Chrysler.Exports to start from Sept-Oct.

Expecting another order in 2-3 months the work of which may start from early next year jan.

Currently working with Magna(vendor for seat manufacture) for GM’s new model. Magna has approved the product. Once GM gives the order to Magna, order will automatically come to Mayur,

Exports- General

Started exploring new countries which include South Africa and other African countries. Target is to increase exports to the incremental countries so added.

Decision to start the 7th line will be taken in the next 3 months based on demand . 6th line working on 1 shift.

7th line wont take more than 6-7 months for commercialising since only the machines to be added to the existing plant.

Expecting PU Plant approvals in another 2 months. From the date of approval, it will take 18-21 months for the 2 new lines.

As usual MR.S.K Poddar did not give aggressive targets and maintained 15-20% Growth. Footwear has improved from July & August which is a positive.

Thanks Krish for the update

AR 2015 highlights:

India’s shares of worldwide footwear market is only about

7% as compared to China which caters to 72% of total world footwear

market. There is scope for significant growth of this industry in India.

The scope of creating additional employment opportunity in

this industry is also greater than even the automotive industry. All

that is required is proper thrust in this direction by the government.

In India the population, particularly young middle class population, is large and growing. This is expected to drive

demand and ensure continued economic growth.

This augurs well for the long term prospectus of the synthetic leather industry, in which Mayur is the leader. There is potential of 20% annual growth in this economy, to achieve the one trillion dollar mark in just seven years.

in the current financial year 2014-15 and expected to continue with the growth of 20-25% in coming years.

Mayur proposes to establish a PU plant. The proposal has been made to the government of Rajasthan to use

the recycled waste water of Reengus. The Company is hopeful of getting the confirmation from the State Government very soon.

Recently Ford & GM in India stopped using synthetic leather imported from China and started buying from Mayur.

Mayur is expected to achieve at least 35% growth in revenue from domestic automotive market in the financial year 2015-16 and maintain this growth in the years to follow.

Your company is spending 10% to 15% of net profit on R&D activities.

The 40 bn domestic synthetic leather industry is currently dominated by unorganized players who account for more than 50% of the same. The balance comprises of organized players and Mayur is the largest of them with a capacity of 3.05 million linear meters per month

Mayur being a prominent player in leather industry capitalize the same and deriving 50% revenue from the footwear segment.

Automotive segment derives almost 35% of the

revenue of Mayur