Could you due to further sell-off by Shell as their original plan is to reduce stake upto 12.5% & sofar they have sold only 8.5%, not sure though…

One reason could be the oil price bullishness because of which natural gas prices could increase too. CGD companies have the potential to pass on gas cost increases to customers. But to what extent would be the question. If not 100%, then margins could erode. But still even if NG prices are in an upcycle, it doesn’t make sense that MGL should trade at such a low multiple.

Came across this interesting piece.

Many highlights:

- US exports of LNG moving higher since 2015. Expected to be 20% of production by 2019 end. Major source of global LNG supply. This will potentially cause domestic US gas prices to increase. But globally prices should dip or stay where they are.

- China is going to be a major buyer of LNG, perhaps causing shortage of supplies.

- New investments in LNG production are falling.

- Demand is going to outstrip supply over the next 1.5 decades. Unless major new investments are announced.

Screenshot_20180417-193928|281x500

Weekly Natural Gas Recap - When Do Natural Gas Producers Become A Buy? https://seekingalpha.com/article/4163023?source=ansh $AR, $CHK, $COG, $EQT, $LNG, $RRC, $SWN

Is it because of the free float available now

I checked the price of Natural Gas on Bloomberg.com and it trading at USD 2.739 USD / MMBTU whereas MGL is purchasing gas under the APM at USD 3.06 USD / MMBTU.

Is this because it is more expensive to liquify and transport and that there is a supply-demand mismatch for gas produced locally or is there some other reason?

I do realise that what I’ll be sharing now has no relevance to assessment of MGL as an investment opportunity. But, I’ll share it anyway.

Almost a decade back my family switched from gas cylinders to MGL pipelines. And, we haven’t regretted it one day.

Our bill went down by at least 40%.

It saved us the hassle of requesting cylinders in advance at the local gas agency.

Often there’d be a long waiting list which worsened our troubles and caused distress. MGL saved us money and time.

Now, in my limited understanding, urbanisation will lead to a massive rise in adoption of natural gas for cooking at residences.

And, this is precisely what happened in China where natural gas connections increased by more than 900% as cities grew.

India’s population, slowly but steadily, will migrate to cities which augurs well for natural gas.

So, there’s tremendous potential for growth.

But, the only problem could be geographical restriction. There’s only so much a company can grow by operating in few regions.

Expanding into other cities could be very difficult, if not impossible.

Hence, my humble submission is that the expansion to more regions could be key.

I may be totally wrong.

If so, please guide.

Govt decides APM gas price as the average of prices at Henry Hub (US) and similar NG producing wells in Canada, Russia and one another country (I am forgetting) for the last 6 months. Prices from Dec - Jan - Feb are usually high in US because it’s cold and people heat up their homes using NG. In India, there are some places from where extraction of NG is difficult and costs more. So to incentivise producers like ONGC, Reliance to invest in difficult terrains they keep the prices at around $6/mmbtu.

If you read about US natural gas, states there are preventing more NG plants from opening and preferring renewable energy production. This means US is going to be a very big exporter of NG in the coming years. There is trillions of cubic feet of NG reserves waiting to be extracted. Price of NG is not going to move up anytime soon. At least this is the general opinion.

I will post some links to back up my claims above soon.

As to why MGL is showing such weakness I am clueless for now.

Today MD came on news channel and discussed some of the issues . Will try to search link n post

Thanks for the explanation. Fourth country is the UK. I was keen to know why MGL or GAIL can’t just import RLNG from abroad specially since prices there seem to be lower. MGL is paying more than 5 USD per MMBTU for gas from the PMT fields.

Link to the news https://twitter.com/CNBCTV18News/status/986837088254418945?ref_src=twcamp^copy|twsrc^android|twgr^copy|twcon^7090|twterm^3

Thanks for sharing.

Though he didn’t share anything new that wasn’t in the public domain.

Everybody knows MGL has good financials and tailwinds. What everyone wants to know is what’s causing the weakness in stock.

HDFC came out with its prediction for MGL Operating profit in Q4 at 7.4/SCM. It was 8/SCM in Q3. Mgmt has clarified it’s focused on volumes. IMO it’s a good strategy even if some margins are sacrificed.

My opinion is MGL is being overlooked by investors because of continuous fall in share price, although there is no significant drop in performance.In fact, as liquid petroleum price increasing, demand for cng would increase

How much threat does Maharashtra Natural Gas Limited (MNGL) pose to Mahanagar Gas? I see more and more MNGL stations coming up in and around Pune and Mumbai which is traditional Mahanagar turf?

MGNL and MGL are in different regions.while MGL is in mumbai and around ,Mgnl is in a different geography.

See the attached link -

http://www.pngrb.gov.in/CGD-network-govt_authorization.html

As you can see, MGL can not come in Pune and MNGL can not go in Mumbai. When any new region/area comes up for bidding, these city gas distribution companies have to bid (bidding is going on for many cities right now)and once they get awarded, nobody else can “get in”. So it is monopoly business for that city.

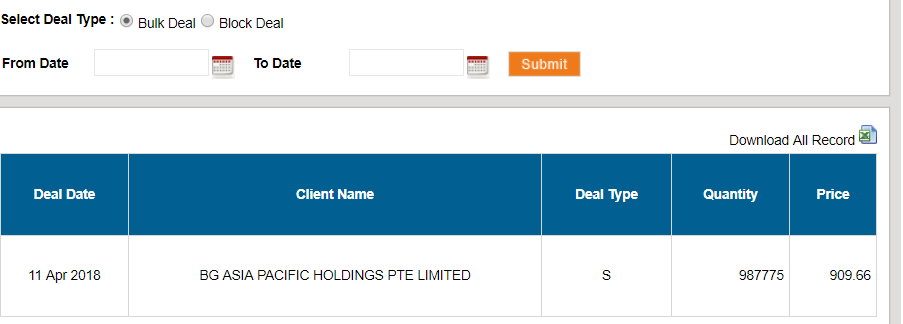

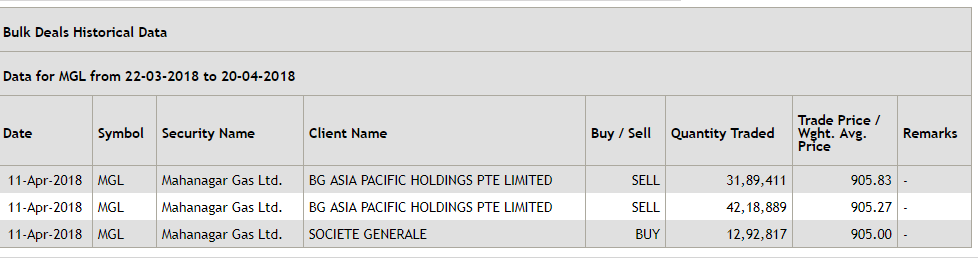

Just trying to understand more about bulk deals. I see BG Asia Pacific sold 8.5% stake on 11th April. Where as I see only part of that being bought by SOCIETE GENERALI.

What does that imply? Who has bought the remaining part?

If buyer and seller have done transactions in bulk deal matching qty, there won’t be any change in the stock’s liquidity. It happens that one mutual fund/FII is the seller and another is the buyer. In such cases, market price does not get impacted by a lot. But in case as shown above, the seller has sold around 74 Lakh shares in bulk but bulk buyer was for only around 13 Lakh shares. This means rest of the shares (around 61 Lakh) came in the market thereby increasing supply in the market and driving the prices down. This may be one of the reason for current share price weakness.

In my free time I performed some calculations on the potential for expansion possessed by Mahanagar Gas.

Mahanagar Gas intends to provide services in Mumbai, Thane, Navi Mumbai and other nearby regions.

The total population of the aforementioned regions is around 3 crores. Let’s assume all residents switch to piped gas, which is unlikely to happen anytime soon.

Assuming a liberal per capita gas expenditure of Rs. 60

Total= Rs. 2160 crores

The second important segment is the vehicle segment.

There are a total of 300000 auto-rickshaws in the Mumbai Metropolitan Region which encompasses Mumbai city and several regions. Let’s assume all Rickshaws are operational.

In a 2012 study the fuel expenses for an autorickshaw were around Rs.160.

Yet again, I’ll assume a liberal Rs.360 fuel expenses per autorickshaw.

Total = Rs 3888 crores

There must around 2 lakh taxis in Mumbai Metropolitan Region. Assuming 80% switch to gas, which is unrealistic, but for the sake of calculation.

As the previous two cases assuming a lavish Rs.20000 on gas expenses.

Total= Rs.3840 crores

Grand total: Rs. 9888 crores

This is, in my limited understanding, the maximum revenue generation potential from the Mumbai metropolitan region. And, it’ll take years to attain the market share I’ve assumed in my calculation.

I studied the piped gas supplier in top 30 cities of India. Most are well established companies and it’ll be hard to compete with them. Quite a few companies are GAIL investees.

Even if MGL is able to attain rights to supply in those cities it’ll have to bear the network tariff thus making it an undesirable proposition.

What then will drive growth?

Good thing somebody is looking at MGL sceptically. But I’d request you to back up numbers with links so that these are easily verifiable.

Secondly, this analysis misses the industrial PNG segment and Raigad region. Please include numbers for that as well.

Thirdly, new cities which are coming up for bidding, and which mgmt has made clear it intends to bid for, will be a crucial factor deciding MGL’s growth.

Then there are triggers like favourable natural gas supply scenario about which I have made a post above.

Finally, wherever MGL or any other company bids for will be its home ground. There is no competition at all. Development of these areas is being funded through internal accruals which is again a good thing. Even if it’s debt funded in future, it won’t make a lot of impact.

On top of it if MGL makes a fruitful acquisition like IGL did to expand areas of operation, it’ll be really positive.

Of course whatever I’ve written might not make sense to the market and the share price may languish still.

I have done a comparison of MGL and igl and fin that MGL outperforms on most of the operating parameters compared to igl.while IGl is more fancied , I feel MGL valuation will catch up with time.views invited

I feel that there is going to be a tremendous competition during the bidding of rights for city gas distribution. With the players like IOCL,BPCL, SHELL and torrent coming in MGL might find it difficult to win the rights.