Delhi High Court has struck down the central notification restricting definition of Basmati rice to the northern states.

It seems now even Madhya Pradesh will be able to grow Basmati rice.

It’s a good decision

We cannot stop Pakistan or China from calling it’s rice, basmati so why stop our states

Basmati Prices Fall 5% as India Awaits Clarity on Iran Export Payment Mode

Madhvi.Sally@timesgroup.com

New Delhi:

Basmati paddy is being sold at 4,700 per 100 kg –– which is around 5% lower compared to a fortnight

ago –– as traders and companies await government clarity on the export payment mechanism to Iran.

The industry has requested the government to issue guidelines to ensure that payments against rice exports

to Iran will be guaranteed in view of the US doing away with waivers for import of crude oil from Iran by

India.

Iran has remained the largest importer of basmati rice from India in recent years, by buying over 30% of

the total basmati rice exported from India. Traders said there was volatility in the market as things were

unclear.

“Market has shown a fall of 5% since April 22 till date, although exporters have stock. Prices can further

fall in the coming days if we don’t get clarity on Iran demand,” said Rajesh Paharia, a Delhi-based grain

trader.

Prices of different varieties of basmati paddy have seen a fall in Haryana mandi, he said.

“The 1121 steamed basmati paddy prices fell by 2.4% to 8,100 per 100 kg while the traditional basmati

paddy has fallen 7.8% to 4,700 per 100 kg in the past 15-18 days,” said Paharia.

Companies said that if Iran is unable to import Indian basmati rice because of the nonexistence of an

export payment mechanism, then rice prices would go down in India in the coming paddy season. This

could impact basmati planting in Haryana, Punjab, Uttar Pradesh, Himachal Pradesh and Jammu and

Kashmir. Paharia said Indian companies have started talks with Saudi Arabia and traders in the UAE to

offload the huge stocks they are holding now.

“Now that the US has abolished the waiver for import of crude oil from Iran by India, there is uncertainty

among exporters whether or not to accept fresh orders since they are worried about receipt of payments

against such supplies,” said Vinod Kumar Kaul, executive director, All India Rice Exporters Association.

Basmati rice is a major commodity in the agricultural export basket of India fetching close to 30,000

crore in foreign exchange, said Kaul. An agreement had been signed by the Indian and Iranian government

on November 2, 2018, that India will import crude oil from Iran using a rupee-based payment mechanism

through UCO Bank. Under this bilateral mechanism, UCO Bank remits payment to Indian exporters

against exports to Iran.

In 2011-12, basmati rice exports from India to Iran was only 6.18 lakh tonnes. After setting up this

bilateral payment mechanism through UCO Bank, exports from India to Iran grew substantially to 14.80

lakh tonne in 2018

While the margins for the year were a tad lower, the volumes growth made up for it. The overall PAT growth is ~9% yoy. Overall a decent end to the year. My sense is that a growth of higher single digit in PAT is a more likely scenario from 2-3 year perspective, anything higher than that will be a positive surprise. Link to presentation.

SJ

The balance sheet indicates a company going downhill. P&L doesn’t mean much if inventory, debt and receivables pile up with reducing cash balance.

Typical recipe for disaster

It is a tough business but I also think that is what gives them a moat operationally.

They have to buy a whole year’s inventory in a short period spanning a few months. In order to do this there will inventory build up and they will have to borrow for the same. So alot of money is tied up in inventory. That is the challenge. On top of this challenge KRBL are able to continue to build the brand and launch new products.

Without cash flow, a moat doesn’t serve any purpose.

It’s a risk to load up inventory while letting debtors pile up. Collections happen months after supplier payments. Thus liabilities become commitments even before sale has hpnd. Inventory turnaround time is long which forces them to rely on borrowings.

Such mid caps that allow balance sheet deterioration seldom come back

I think the inventory buildup is a necessary evil for rice suppliers as rice needs to age before being sale worthy

It’s like whisky where you have no choice but to let it mature

It is the nature of the business. Please refer to the latest Investor presentation. FY end you will see a lot of debt due to procurement needs. Half year end meaning December quarter end they will almost be debt free. That has been the case for the past few years (is what they presented in the IP). High inventory is the nature of the business where they procure the rice and let it age for about a min of 12-18 months. So that much amount of inventory will always be there. I think the right way to look at it is the relative increase or decrease in % (as a % of current assets) for the last few years. Also compare with companies in the same industry.

Hi Vilas, have you been tracking KRBL for long? I’m asking because if so, you may have noticed that that the company’s Net Debt goes to ZERO (or very close to zero) in it’s September balance sheet. At least that has been the trend for the last 2-3 years.

I understand your point of view of the balancesheet bloating and yes one needs to be extremely weary of it but I’m not sure that it applies in this case as Basmati Rice (very much like cotton) is a cyclical business - 70% of procurement happens in 3 months and like others have also pointed out, ability to invest in this procurement is a key source of competitive advantage. Another point that may interest you is that the company’s cost of borrowing is much lower than it’s competitors (I don’t have the exact figures handy). This would not be possible unless the bankers did not have a lot of comfort on the business.

Rebuttal welcome

Sachit

Dear Sachit,

Yes I’ve seen that and it’s a unique situation.

I call it high risk becoz:

-

Receivables, payables and cash is counterbalanced by inventory.

-

Heavy dependence on borrowings to fund working capital albeit the borrowings reducing by ~50pc during Sept and then picking up by Mar to fund inventory for the next sales cycle.

-

Low margin of error. If something goes wrong with Receivables or inventory, there’ll be a big balance sheet issue.

-

Company is well managed for sure and is a leading basmati rice player, but as an investor I’m not comfortable with frontloading of liabilities.

-

There were some corporate governance issues if I remember…Augusta and auditors having reputation issues-plz correct me if I’m wrong on these.

I believe most of us would agree that having large inventory (aging of rice) is part of the KRBL’s business model. KRBL is where it is because of its ability and strength to age rice at such magnitude. There is no other player in the world - which procures and ages basmati rice to KRBL’s level. In a separate post I will share why aging helps KRBL to maintain its margin especially when industry is struggling to break-even in a bad cyclical year. Currently there has been consolidation going on in the industry, where many weaker players have been wiped out because of financial constraints which has reduced competitive intensity.

Bloating of inventory and debt during paddy procurement period may give an impression that this business doesn’t generate any FCF. This is true if someone views just end of the year financial statements. But the reality is quite different if looked at using proper lens, IMHO. As Buffett has said - a company should be viewed as an unfolding movie, not as a still photograph.

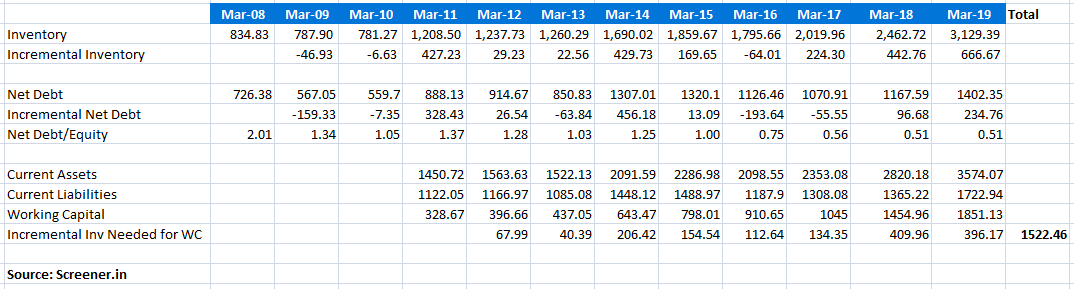

I’m making an humble attempt to share my lens with the readers. Let’s zoom out and look at few key metrics for last 9+ years and see how business has evolved and how the cash has been utilized by the business:

Inventory: has increased 2.6 times from 1208.5cr in FY2011 to 3129.39cr in FY2019. Last three years inventory has increased significantly from 1796cr in FY2016 to 3129cr in FY2019. My guess for sudden increase in inventory is increasing domestic demand and decreasing domestic competitive intensity, as company is attempting to increase its domestic market share.

Net Debt: has increased 1.58 times from 888cr in FY2011 to 1402cr in FY2019. Net debt has not increased at the same rate as inventory. In fact it has remained quite stable since FY2014 with downward trend. Net D/E was as high as 2.01 in FY2008, which has been brought down to 0.51 recently. I’m not too much worried about Debt levels as it becomes almost zero by month of September when sales converted to cash is used to payoff temporary higher debt levels.

Working Capital: has increased from 329cr in FY2011 to 1851cr in FY2019. KRBL has invested almost 1522cr to its WC during this period while increasing Net Debt levels from ~888cr to 1402cr. So we can say that around 500cr of 1522cr investment in WC has been funded by external debt where as 1000cr has been funded by internal accruals. If KRBL had not shared dividends (which it has been paying consistently for last several years) it could have almost fully funded its WC requirement.

My conclusion: WC is growing because underlying business is growing. As long as its WC is mostly funded by internal accruals, investors should be fine. According to me this is the key item that investors should monitor very closely. It may seem like this is a low FCF business. But in fact it has low FCF because it invests a lot of internal accruals in WC. Low FCF but high “Owner Earnings” business per Buffett. It is safe to treat investment in incremental WC as ‘Owner Earnings’ as long as incremental investment is done to grow the business. Please read my post on ‘Owner Earnings’ in BRL thread here.

If KRBL decides to not grow and be happy with its current scale, it can easily fund all of its current requirement of WC from internal accruals. It can be debt free business for March balance-sheet and can throw a lot of cash back to owners since it does’t need a lot of capital for capex.

KRBL is generating 35% ROIC net of investment in energy. It’s a consumer staple business, IMHO, available at 3x book growing at decent pace with good longevity. I will let readers decide on the valuation.

Risks: 1) tax claim of 1268cr + interest by IT which is under protest by KRBL 2) long-term people reducing consumption of white rice and perceiving it as unhealthy which lacks proper nutrients 3) many other risks which are unknown to me right now

Disc: invested and hence biased.

Inventory this year has increased more than usual also due to steep rise in paddy prices - I think there has been a jump of about 15-20% since last year

Update: In November 2018, the US government-imposed trade sanctions on Iran. However, it granted waivers to eight countries including India, allowing these to continue to import crude oil from Iran. With effect from May 2, 2019, the US government has withdrawn this waiver, leading to uncertainty over India’s crude oil imports from the nation. This can in turn affect the exports of commodities, including Basmati rice, to Iran. The country has been a major export destination for Indian Basmati rice and the industry’s concentration on the same has only increased in FY2019. As a result, any moderation in exports to this market can have a depressing impact on the Basmati rice prices globally. This can impact the profitability of industry participants, especially considering the firming up of prices of the Basmati paddy in the recent times, resulting in industry participants carrying high cost inventory. While there is limited clarity at present on the policy stance on future trade with Iran, ICRA will continue to monitor the developments in this regard.

https://www.icra.in/Rationale/ShowRationaleReport/?Id=80556

Is this news positive for Rice exporters line LT Foods (Dawaat) and KRBL?

In recent SCO meet, China and Russia signed agreement for import of Indian Basmati Rice

In the recent conf call, Mr. Anoop Kumar Gupta clarified that the final hearing on pending tax issues was latest by June 7th. Can anyone please share any inputs on this ?

Thank you.

Ram

On May 17, I had pointed out corporate governance issues and that no FII will touch a stock with such question marks. The stock is tanking not surprising. Many go by financials plus play into narrative fallacy. They don’t understand the criticality of corporate governance.

A back ended balance sheet is an added risk to the margin of safety.

Some have bought at a high price copying pabrai and are now praying that people change their eating habits.

Sharing my presentation on KRBL that I made during 2019 VP Chintan Baithak meet in Goa.

I made an humble attempt to share my understanding of the business. My investment style, return expectation, time horizon, capacity to suffer/hold, position size, and conviction from investment in KRBL may be completely different from yours. I caution you to please use this presentation just to understand the business and do your own due diligence before putting your hard earned money in this stock.

You-tube links on Slide 11 are as follows:

I look forward to all queries and comments. Thanks

An Attempt to Better Understand KRBL Ltd._Amit Rupani.pdf (905.0 KB)

Hi Amit,

Being a market leader and largest player, business potential of KRBL is solid but what are your thoughts on the recent corporate governance issues (tax notice; ED attachment)?

Its difficult to build confidence in the business with corporate governance issues.

Disclosure: Holding KRBL since 2015. Has bought some in last 6 months