Why Kernex Microsystems could very well be a potential 5-10 bagger: A low risk - high reward bet. (M-cap: ~ 50 crores)

Part 1) What is TCAS (Train anti-collision device)?

-

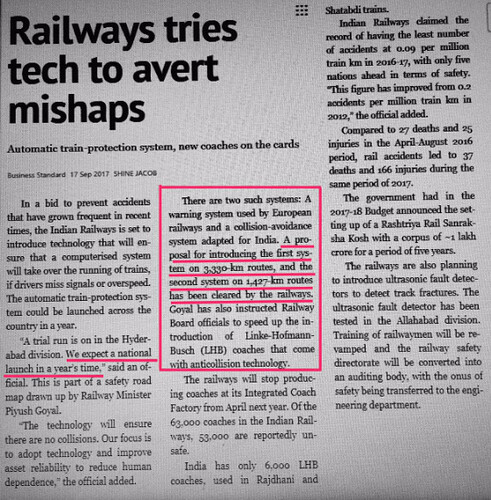

The railway is conducting trials on an indigenous and cost-effective anti-collision technology, which can help avert accidents that take place due to the driver’s error.

-

Indian Railway currently employs Automatic Train Protection System called Train Protection Warning System (TPWS), which is based on European technology. As of now it is available in just 100 trains because of the high cost factor

-

The indigenously-developed technology will cost one-third of the European system and can be

installed on much larger number of trains -

The new system is called Train Collision Avoidance System (TCAS)

-

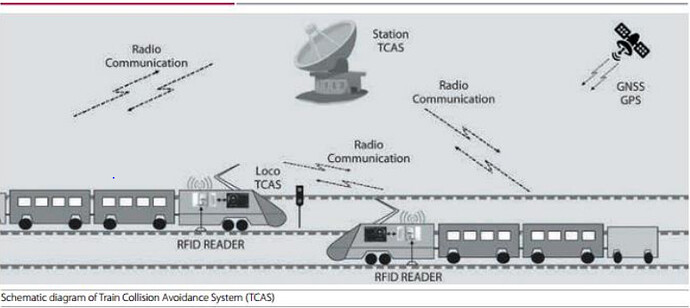

It will mainly deploy Radio Frequency Identification (RFID) tags every kilometre on a railway track and a TCAS system at railway station, which will gather data from RFIDs.

-

A radio tower will transmit this data to the engine of a train and a TCAS computer onboard it will display the data.

-

TCAS will have two main functions. If an engine exceeds its speed on a certain section then there will be warnings generated for the driver. If the driver fails to respond, the brakes will apply automatically.

-

Secondly, a train can send an SOS message to another or to a railway station and viceversa in order to prevent an accident

-

The new technology will undergo extensive and rigorous trials before its introduction. [Final set of trials expected to end in Sep 2017, Source: Annual Report’17 HBL Power]

Source1: http://www.financialexpress.com/india-news/trials-on-indigenous-anti-collision-technologyto-avert-rail-mishaps/370516/

Source2: http://www.thehindu.com/news/cities/Hyderabad/extended-trial-runs-for-train-collisionavoidance-system/article18620043.ece

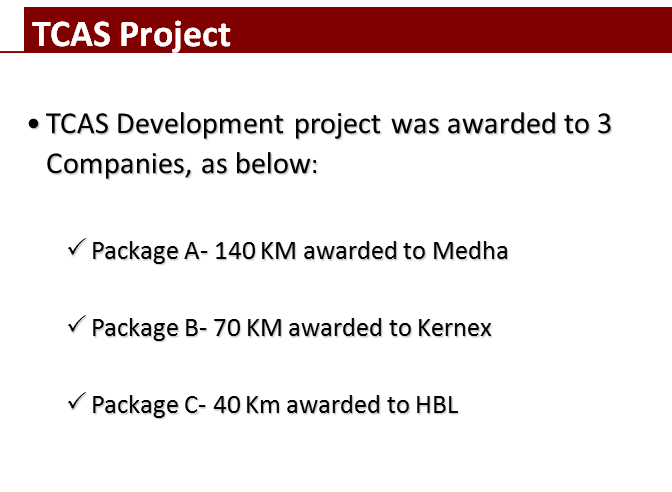

Part 2) Who will manufacture and deploy these TCAS (Train anti-collision device)?

Three Indian companies shave been selected to bid for TCAS:

- HBL Power systems (listed)

- Kernex-Micro systems (listed)

- Medha Servo (unlisted)

Source 1: http://corporates.bseindia.com/xml-data/corpfiling/AttachHis/1e2fd937-b230-4dd9-8eac-4e109061124d.pdf

Source 2: SCR tests low-cost anti-collision system

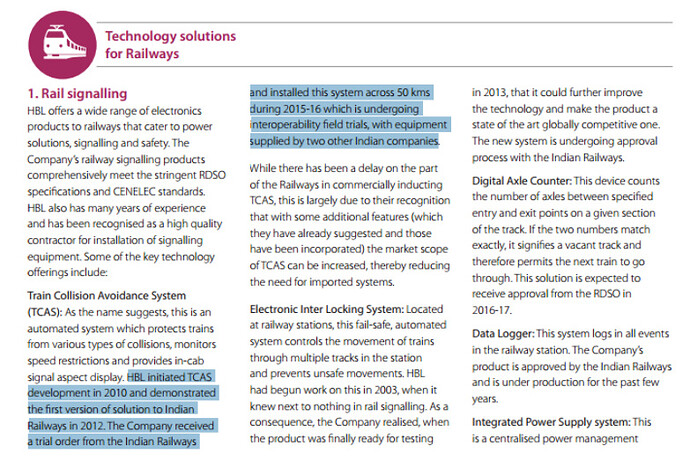

Below is an excerpt from HBL Power Systems annual report (2016) that explains TCAS and mentions ‘two other Indian suppliers’ (page 18)

Source: http://www.bseindia.com/bseplus/AnnualReport/517271/5172710316.pdf

Part 3) How big can the market be for TCAS?

-

The Indian railway network in the fourth largest railway network in the world comprising

119,630 km. Theoretically TCAS can be implemented on the entire length -

Rolling stock has ~11,100 engines/locomotives while TPWS (the costlier version of TCAS) is

implemented in only 100 trains. -

Cost is approximately 10 lacs per km

-

(Source: https://indianrlynews.wordpress.com/tag/traincollision-avoidance-system-tcas/)

-

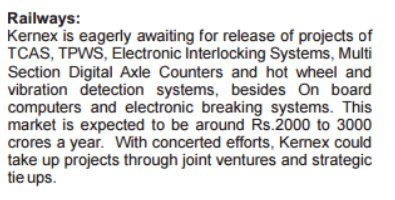

Annual market for TCAS could be around 2,000- 3,000 crore per year.

-

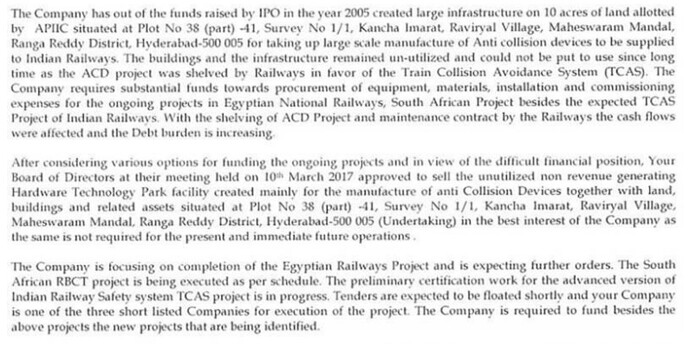

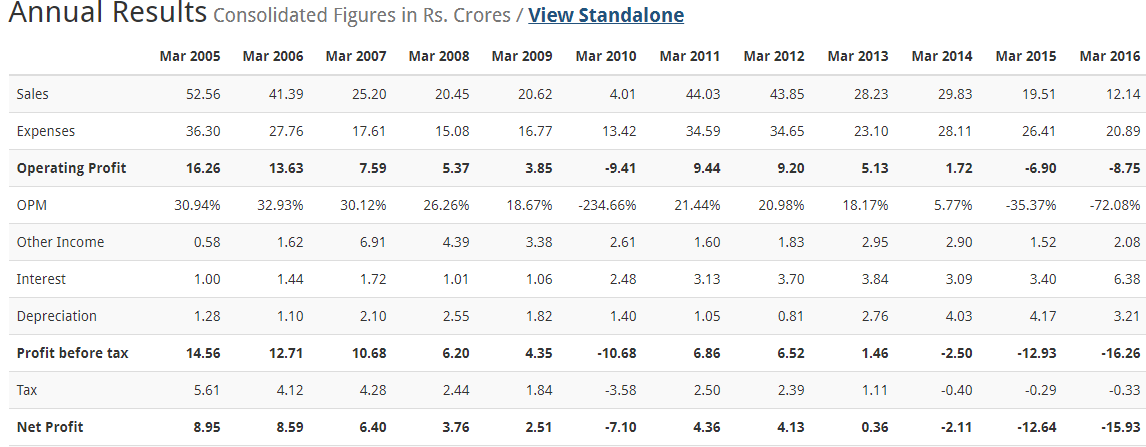

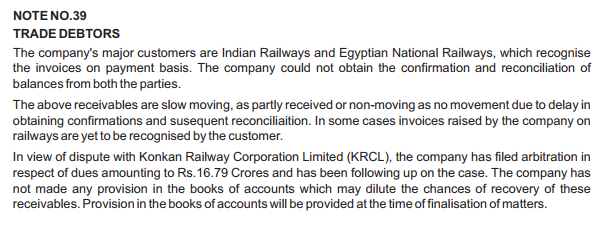

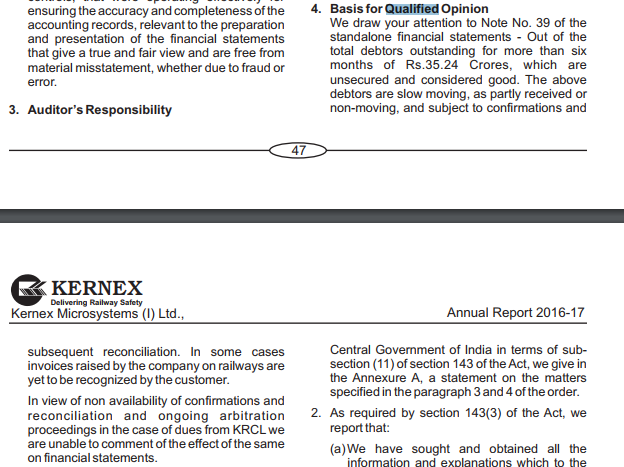

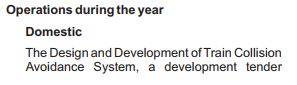

Excerpts from Kernex-micro annual report

(Source: http://www.bseindia.com/bseplus/AnnualReport/532686/5326860316.pdf)

Part 4) Order-book for FY2017-2018?

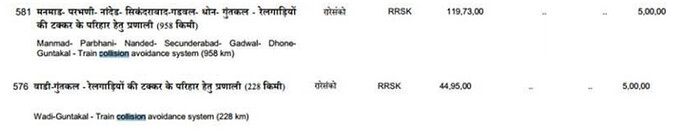

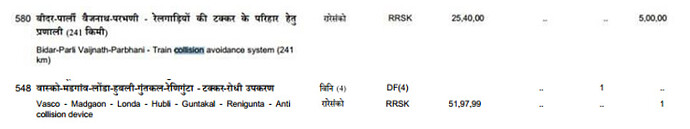

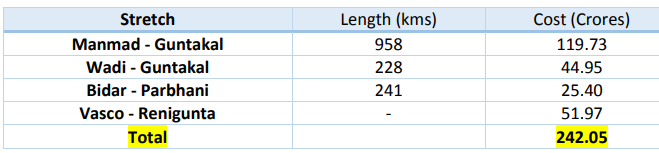

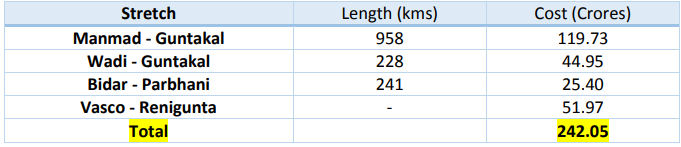

- The railways budgeted ~ 240 crores for TCAS in the pink book for south central railways in 2017-18

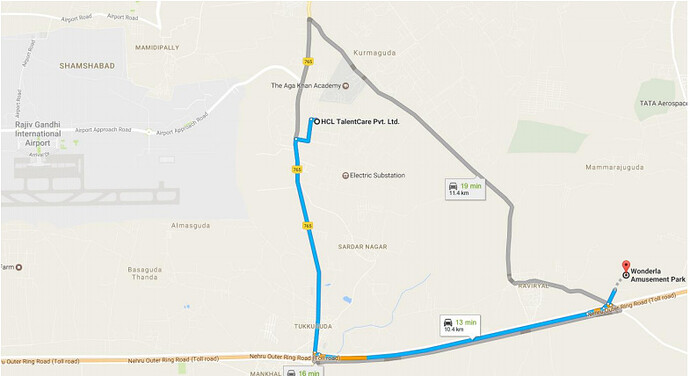

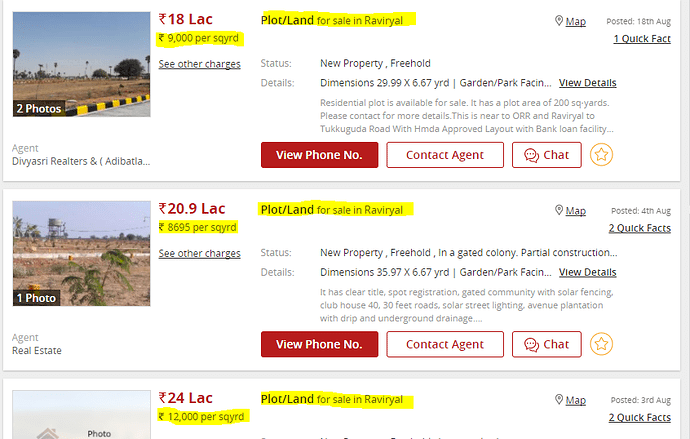

Part 5) Margin of Safety – Sale of 10 acres of land near Hyderabad airport (close to Wonderla)

- Kernex is trying to sell its 10 acres (48,400 square yards) of property and plant close to new Hyderabad airport

- This sale alone can fetch an amount close to ~50% of current market cap conservatively. (Assuming Rs 4,000 per square yard)

- Thus ensuring high margin of safety

-

Excerpt from corporate filings detailing sale of land & property and reason for sale.

-

Rough location for land at Plot no. 38, hardware tech park (Wonderla & Hyd airport can be seen

closeby)

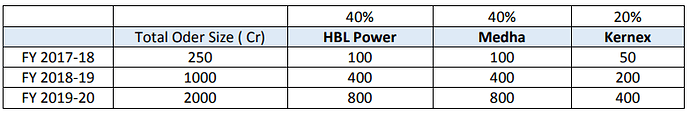

Part 6) What could be the TCAS orders that Kernex will get?

Given that it is an Indian railways order and all three vendors have spent significant resources to develop and run trials for this technology, all three should will get orders.

Assumptions:

i) Orders will be Split in the ratio of 40% || 40% || 20%

ii) EBITDA Margins of ~12-15%

Source:** Not verified; some scuttlebut

The order distribution for three years could look like this:

Important Note: This is a conservative order-book scenario for Kernex. Kernex might get the second biggest order going by the size of trials being executed by the three vendors)

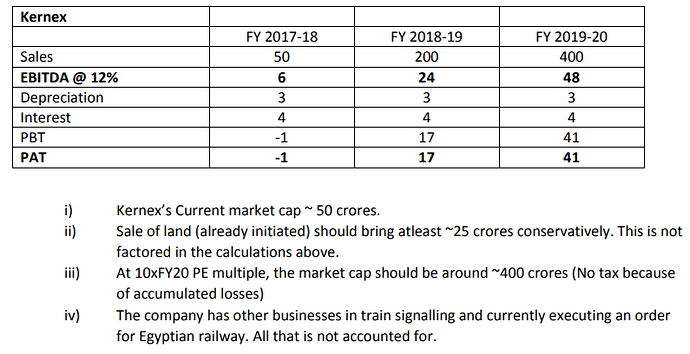

- Kernex’s P/L could look like this [conservative 20% market share and 12% EBITDA margin scenario]

Part 7: Risks to investment thesis

The key risks for the company is delay in receiving orders from Indian railways.

The second risk is that of execution.

Any new player trying to enter the market will have to undergo 3-5 years of extensive trails and inter-operability tests before being inducted as vendor. Hence, there is minimal risk of new competition entering the market.

Disclosure: Invested at current levels. Small portion of portfolio.