Kennametal india:

Kennametal India is a 75% subsidiary of the US company Kennametal Inc.

Kennametal india is a part of cutting tool industry where it manufacturers machines and tools used for metal cutting. Metal cutting tools is used in wide variety of industries including automobile manufacturing, infrastructure mining etc.

Industry:

As per india machine tool manufacturing association machine tools is roughly around 3000cr industry.

As per reports, it is dominated by Sandvik, Kennametal and Iscar. With sandvik and Kennametal having higher share. There has been recent entry of some Korean/Japanese players which is putting some pricing pressure.

One can go through the IMMTA site to understand the industry size and structure information.

http://ictma.co.in/wp-content/uploads/2016/04/17_WCTM2-2.pdf

The main raw material used in cutting tools is Tungsten carbide which is not available in india. Hence the industry is dependent on imports of cutting tools and raw materials.

Company:

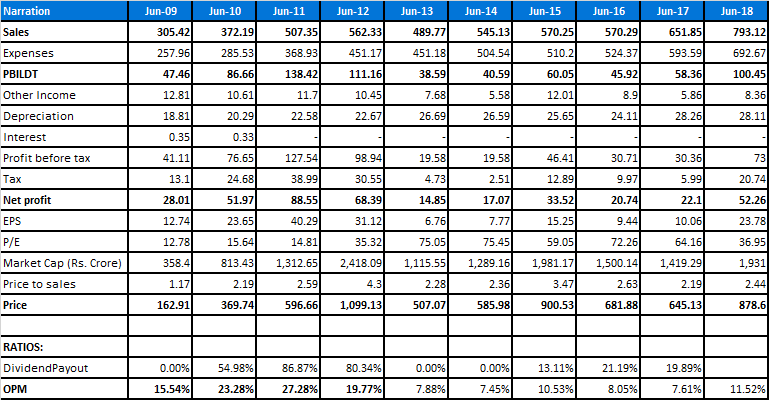

| FY15 | FY16 | FY17 | FY18 | |

|---|---|---|---|---|

| Sales | 570 | 580 | 695 | 793 |

| Operating profit | 60 | 46 | 58 | 101 |

| OPM | 11% | 8% | 9% | 13% |

| PAT | 34 | 21 | 24 | 52 |

| EPS | 15 | 9 | 11 | 23 |

The sales consist of both machines and machine cutting tools made of tungsten carbide.

Dual brand strategy:

Most of the players include Sandvik, Kennametal and Iscar are going to market with Multibrand strategy. Most of the end-customers go for multiple brands in their shop floor and each brand finds some space. Similarly, Kennametal is going to indian market with two brands Kennametal and widia. Kennametal brand provides more customized solutions where as widia is more a B2C play with own distribution distribution.

Kennametal india has been introducing newer products continuously in indian markets.

Widia strategy:

To continue focus for widia in india, company is forming a new subsidiary. It can apply seperately from kennametal brand in many of the tendors floated by govt or by MNCs.

Widia is a old brand in india and had a leadership in position in india in the past. Widia is historically a german brand. After acquistion by kennametal in 2003, this brand got bit sidelined. Now again, there are efforts to revive the brand. Widia is the fast growing segment under kennametal india.

Widia has strong solutions for aerospace. The manufacturing for widia was underinvested in previous years. This is being corrected now. The company is also planning to increase sales and distribution for widia and increase the reach. There is lot of focus on channel partner development and availability of products through increasing distribution reach.

Kennametal Inc the parent company has total widia sales of 200m$ globally. This is manufactured in multiple facilities around the world. In future, Kennametal Inc wants to make Kennametal india a manufacturing hub for widia worldwide sales . This is evident in the world wide head of Widia Mr Alexandar sitting on the board of Kennametal india.

As per Kennmetal Inc presentation widia india sales have grown at north of 30% in last two quarters.

Kennametal Inc strategy:

Kennametal inc is cost rationalization mode and is projected margins to go from 16-18% ebidta to 22-24% ebdita in next two three years.

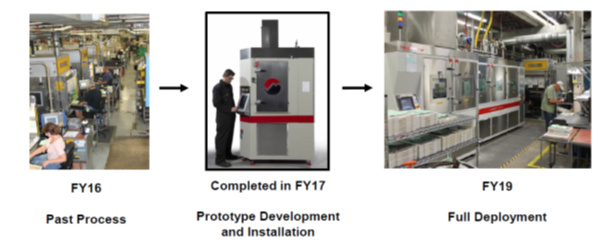

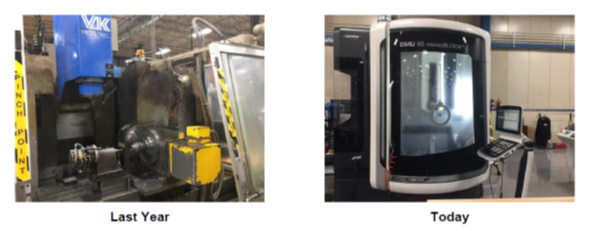

The strategy includes strategic sourcing, modernization of plants and factory rationalization. Some of these benefits will flow to indian subisidiary.

https://kennametal.gcs-web.com/static-files/50ce8424-0b19-4a86-8392-e27186148964

Capex:

Kennametal india india has been in capex mode last 3 years and investing a lot in plant automation and increasing manufacturing capability/capacity. Lot of investment has been done in EHS.

| FY16 | FY17 | FY18 | |

|---|---|---|---|

| Fixed assets purchased | 44 | 50 | 60 |

This capex mode may continue in next few years as per the management in the AGM.

Exports:

The exports are growing at a fast pace though it is still a small part of the sales.

| FY15 | FY16 | FY17 | FY18 | |

|---|---|---|---|---|

| Exports | 46 | 56 | 86 | 130 |

Kennametal india being a net importer. The currency risk is getting less due to exports growing at a fast pace.

Margins:

Kennametal india had peak operating margins of 20+% in the previous cycle.

Last quarter Kennametal reported 18% OPM but there may be some one offs in the machines division leading to higher margins.

There may be scope for improvement of margins although company has started seeing increased competition from some Korean players.

Working capital:

There is very little debt on balance sheet of Kennametal india.

Debtor days are continuously reducing.

| FY16 | FY17 | FY18 | |

|---|---|---|---|

| Receivable days | 76 | 61 | 57 |

| inventory days | 72 | 60 | 71 |

| Payables days | 45 | 46 | 48 |

Risks

- Higher valuations

- Tungsten carbide cutting tools are imported.– risk of raw material price fluctuation as well as currency fluctuation

- Any change in royalty policy

- Significant part of sales come to auto industry which can be highly cyclical in nature.

Links:

AGM presentations:

https://www.bseindia.com/corporates/anndet_new.aspx?newsid=46f59048-b665-4275-b28d-298ebba401c4

Tungsten carbide

https://www.kennametal.com/en/about-us/news/kennametal-buys-emura.html

https://www.kennametal.com/en/about-us/news/global-carbide-recycling-facility.html

Disclosure: invested. No transaction in last 30 days.