I have a case to project the worst case scenario if tdi prices crashes, overwhich a lot of us are losing sleep…

Gnfc tdi capacity- 67000mtpa

Current quarter capacity utilization 101%

For the sake of simplicity and to minimize speculation bias i will stick to 100% capacity utilization in the coming fiscals

So quarterly tdi capacity 16,750 mtpq

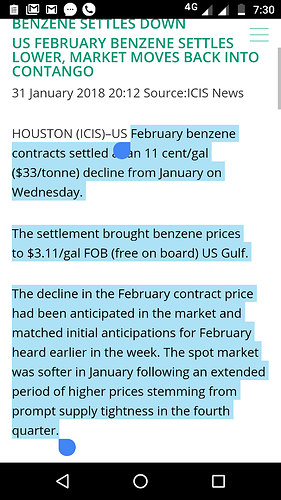

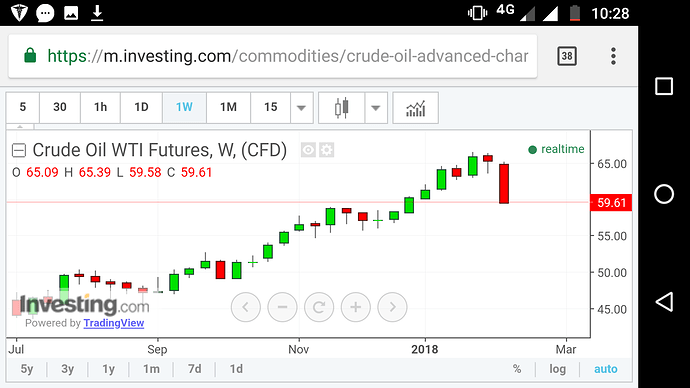

Now, q3 minimum price was 4300$ and maximum price was 4500$ internationally, domestic prices were higher, but we will take 4400 as a mean point price which is generating the current topline…

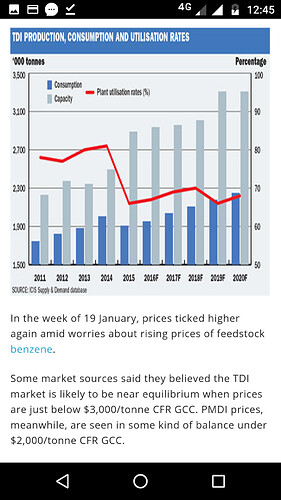

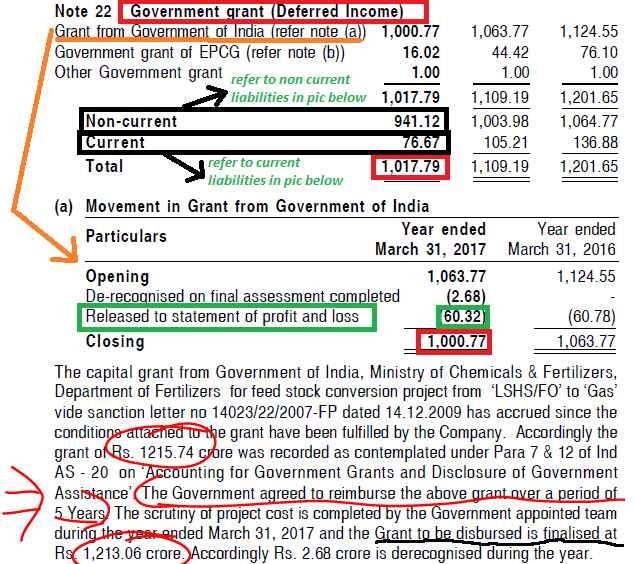

Read the following…

Fine…

So at present topline generated from tdi is

16750 mtpq x 4400 usd= 471.68cr rupee 1usd=64rs

At 3000usd equilibrium point,

16750mtpq x3000usd=321.6cr rupee 1$=Rs.64

Quarterly topline loss=150.08cr rupee

Considering ballpark pat margin of tdi is 30%…

(Overall current pat margin is 13.9%)

We will be losing 45cr PAT and Rs.2.7 each quarter , if tdi prices to tumble to 3000$ pmt from 4500$ pmt at present…the historic low was just below 3250$…

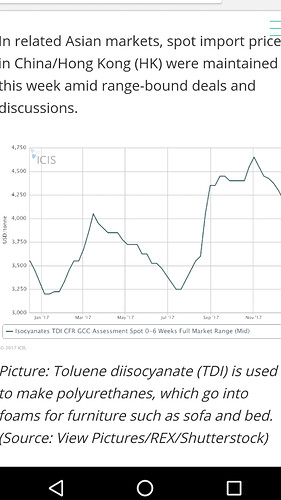

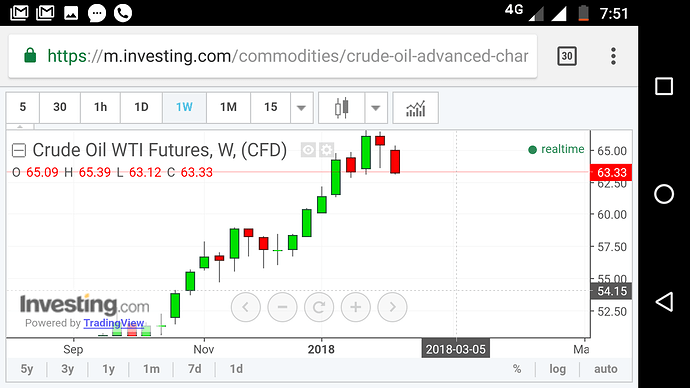

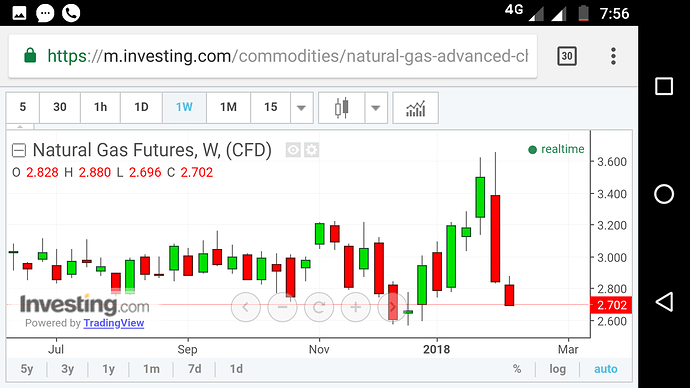

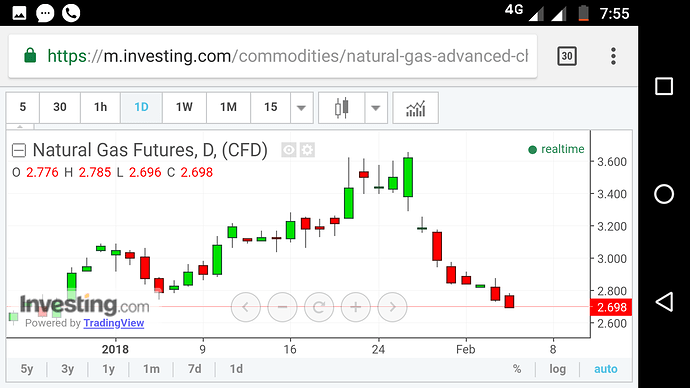

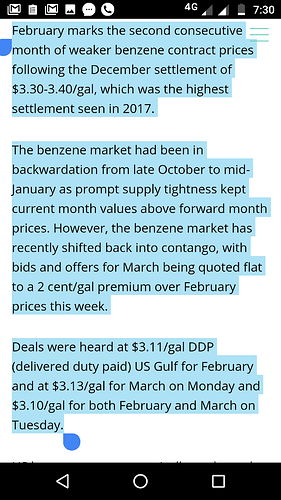

Here is the price trend in 2017…

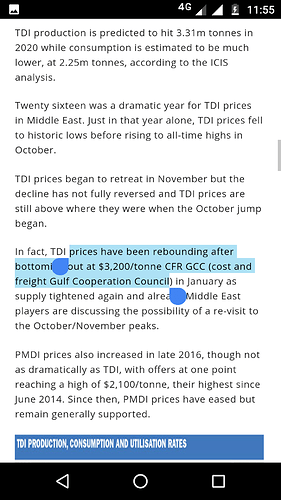

Remember from my previous posts i established, the is very high possibility of tdi prices to remain between 4300 to 4500 till july…

So to sum it up, considering every other parameters of q3 remains the same…

We will be posting, 14.7-2.7 =12rs eps every quarter, 48-50 annually…with ecophos in the fold, we will be generating extra 4rs eps (ref…

GNFC - The big becoming bigger! - #87 by Capsule91)

So in total in fy20, the net annular eps is 52-54rs…

Just taking into account only tdi worst case and adding ecophos…

If a mdi capacitu starts, we can still hope to maintain a 60rs eps even with tdi in the worst case condition…

@suhagpatel to your question…

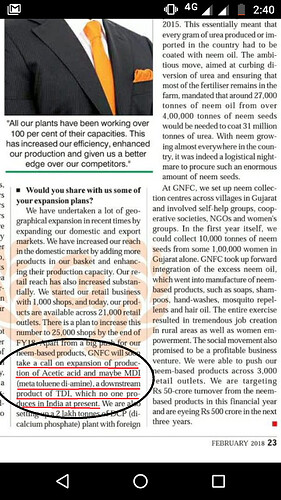

From q1 concall

@Mridul

For a general idea about worldwide capacity utilization of tdi plant and forward estimate, have a look…

So that is 70%…

Dow Sadara may top a 70%, releasing 1,40,000mtpa of tdi…

Upto next quarter we have a total of 4,60,000mtpa capacity shut down in europe…

Disclaimer… The volumes in tdi has been taken to be constant going forward…

Note… no antidumping duty is on sadara… And dow has targetted india in its marketting list…look prev posts for excerpts…

What can make the situation more grave, sadara also targets middle east and africa, same as gnfc… Hopefully gnfc captures enough indian volumes by july… But importing tdi from sadara is more costlier than gnfc, so that is a catch due to shipping

…