Overall I guess the company might report similar performance in FY18, if the soda ash prices remain stable. The company believes that Textile may turn EBITDA postive in FY19.

Disc: Invested

Overall I guess the company might report similar performance in FY18, if the soda ash prices remain stable. The company believes that Textile may turn EBITDA postive in FY19.

Disc: Invested

https://www.bseindia.com/xml-data/corpfiling/AttachLive/364e6be1-0408-46fa-8713-5f423d639e46.pdf.

Link to latest presentation after declaring Q1 numbers. Textile division is performing good and sequentially sales and EBDITA increased by 21% and 43 % respectively. Overall satisfactory numbers…

Important Commentary:

(1) PAT for the current quarter is Rs. 62 crore compared to Rs. 76 crore of Q1FY18 (excluding one time tax credit of Rs. 82 crore accounted in Q1FY18). This is mainly due to impact of Headwinds in Home Textile, however now looking stable and growing. In Soda Ash, despite Annual Shutdown and M2M Forex Impact profitability maintained at Q1FY18 levels due to operational efficiencies. Compared to Q4FY18 PAT of Rs. 82 crore, the profit is lower mainly due to Annual Shut Down, seasonality in soda ash (4 th Quarter being the best) and M2M Forex fluctuations. On Sequential basis, textile segment is showing signs of improvement compared to Q4FY18 which is likely to continue in the coming quarters. We are Confident of achieving our vision of +20% Profit growth on a long term horizon creating value for our stakeholders.

Inorganic Chemical Division:

Maintained EBITDA at Q1FY18 levels despite Impact of Annual shut down (taken during the current quarter) impact of Rs. 15 crore and Forex M2M of Rs. 7 crore due to efficiency improvement and increase in selling price over cost.

Home Textile Division:

Revenue increased by 21% as compared to Q4FY18, however lower compared to Q1FY18 is primarily due to reorganisation of customer mix. EBITDA Margins – In line with our previous guidance sequentially increased by 100BPS due to operational efficiencies. Yarn demand remained buoyant during the major part of the quarter mainly due to strong exports. Overall positive outlook with gradual growth is expected in both revenue and improvement in Margins

Latest credit rating report of GHCL by Ind-Ra. Report highlights upcoming expansion details and also positive view on Soda Ash industry. Following are the key points.

Soda Ash Segment

Textile Division

Regards

Harshit

New Capex Plans details of GHCL.

Source: http://www.careratings.com/upload/CompanyFiles/PR/GHCL%20Limited-10-08-2018.pdf

Regards

Harshit

Good results from GHCL - https://www.bseindia.com/xml-data/corpfiling/AttachLive/ffb425d4-5575-481a-a952-c6a917b4116f.pdf

Investor Presentation - https://www.bseindia.com/xml-data/corpfiling/AttachLive/f0cf4366-f55d-4496-8b86-760f87a4595c.pdf

I was going through the recent concall of the company and it was interesting to see that the anti-dumping duty is over on imports from US & China (it still remains on Turkey & Russia) and yet the prices of the product have remained stable and the company continues to do well. Infact the company has taken price increase in last few months. Expiry of anti-dumping used to be a major concern here.

I do wonder as to why this stock has been trading at 7-8 PE multiple despite very good margins consistent over last few years + lots of steps my management to improve their perception in the investing community + dividend and buybacks. Would be good to know the negatives.

Regards,

Ayush

It is the textile division that is dragging this company in past…soda ash division is performing well due to oligopolistic nature of business in India…Market is giving low PE due to its commodity business as well as previous history of promoters…I wonder why the promoter do not go for demerger of business to rerate the company…love to know more about its consumer division…

Good results:

Regards

SJ

Soda Ash Price 2019 outlook :

https://www.icis.com/explore/resources/news/2019/01/09/10304121/outlook-19-asia-s-soda-ash-prices-to-stay-supported-despite-turkish-supply/

Once again very good set of results from GHCL - https://www.bseindia.com/xml-data/corpfiling/AttachLive/65c02238-271d-4bb3-b045-1da8428c8bda.pdf

Its surprising to see so many of the companies trading at very low PE multiples just because some of these names are labelled as commodity!

I think textile division is still not performing for Ghcl.Revenue in textile division falls on qoq basis. Textile division is constantly underperforming for almost 1.5 yeara…Invested from 252 prices levels for almost 2.5 years. Let’s see when Mr. Market sees its cheap valuation and rerate it.Will hold for another 1 year…

Exactly sir, I don’t know how does market justify such PE for GHCL that too with consistent dividend

This type of business never commands high PE as it’s a commodity business. Check historic PE it’s trading above that.

Hi

Please check ultratech cement commodity company

GHCL came up with good results by achieving 44% growth in profit and revenue growth of 26%. Inorganic as well as textile segment mainly benefited from higher volumes. The company efficiency can be judged from preponement of brownfield leading to volume growth of 16000 MT in the quarter. The brownfield expansion is done from internal accrual.

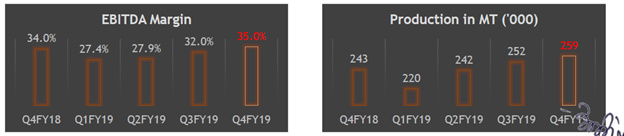

The EBITDA margin dropped in q1fy19 and q2fy19 due to impact of headwinds arising under home textile segment and annual soda ash plant shutdown and forex impact.

The company generates 500+ crore of cash and have been reinvesting cash for expansion at healthy return on capital of 20+% for last many years. The current capex is progress is 178 cr. Almost all the capex planned is from the cash generated from business., This indicates Company sees stable growth and healthy margin to flow in future as well. Company management expecting business to grow by 30-40%.

Key financial ratios ( Source Screener.in)

Now with the higher volume of soda ash coming online from new brownfield plant, major benefit to ensue in FY20, and the price of soda ash seems to be firm, GHCL is at interesting point.

Technically also GHCL is at long term support:

The spoilsport can be played by oversupply of soda ash so need to keep watch on international soda ash price and Idled soda ash plants in China coming back online.

Disclosure: Invested

Last 5 year mcap become 7 times then why promoter holding is low? Recently started tracking!

Important highlights from Annual Report FY19

Sir I think GHCL trades at such low PE because of their every increasing capital allocation to textile business. I don’t see any economic sense to stay invested in that business and I think that is the biggest hurdle in getting the right valuation and the company should sell that off to generate shareholder value. In many conference calls, investors have asked the same question and management never had a clear answer to why they don’t dispose off their textile biz.

Don’t you think then it will become pure commodity company?

FMCG is hardly doing anything for GHCL.

If they want to create some brand in textile , it’s for company moat and investors only right?