a presentation I had done for TIAA on capex. capex-understanding .pdf (650.8 KB)

And the video of the speech.

I wanted to share a scathing report on Raymond shares by IIAS, which carried out a detailed analysis on how a related party transaction will deprive minority shareholders of upto Rs 650 crores.

The report is attached; and IIAS says that if not for recent disclosures, this would have gone unnotices to unsuspecting shareholders.

Very instructive.

Iias on Raymond.pdf (804.4 KB)

This time on Reliance Communications. I have uploaded the declared financial results for FY 17. Now what is plain shocking (or for Reliance watchers, its usual habit) is that it has not said anywhere in its press release or exchange filings, about a material event, which is a delay in servicing of secured debt.

It was only by way of statutory disclosures in the attached do you come to know that it has delayed (or better still, defaulted, though that term is not used in form).

And I can bet 3 to 1 you will not be able to figure out, at first glance, where in this disclosure they say they have defaulted. It is sneaked in, in a harmless, by the way blah blah, manner.

Here is the attachment (and what serves as a useful training in reading results). 31052017 RCOM bad disclosure.pdf (1.6 MB)

Allied Digital Services (ADSL) on upper circuit for two days. Came to know a strange aspect about it on another group. It had debtors of 145cr on 30-09-2016, it did sales of 100cr in H2FY17. Even if the company did zero collection from debtors during the six month period (1-10-16 to 31-03-17), its debtors should be 245cr on 31-03-17. But as per balance sheet of 31-3-17, its debtors are 302cr!! I have been cracking my head over this but unable to comprehend. Request help in understanding this…

@chetanb Excellent observation.

I happened to quickly go through the filings made by the company with BSE. Now practically change in Trade Receivables over two periods cannot be higher than Revenue booked during the period. So it is really flummoxing. Here are my possible reasons why:

-

It is possible that during this period certain revenue of the earlier period was de-recognised because the contract terms were unfulfilled, and payment was returned / adjusted. Subsequently the revenue was recognised because terms were fulfilled but the now the payment is yet to come.

-

If there was an acquisition made or an associate became a controlling entity requiring consolidation, and if that entity had trade receivables, then upon consolidation the receivables will increase more than revenues during that period

-

Sometimes client may give an advance that may be adjusted against unbilled revenue subsequent to approval from the client. Subsequently the approval may have been withdrawn leading to increase in trade receivables more than revenue booked (other current liabilities moving in tandem). That does not seem to be the case here.

But my experience tells me that there is a very very high chance the books are not reflecting the true state of affairs of the company. You may see that the auditors in “Emphasis of matter” say that Trade Receivables are yet to be confirmed.

Further the auditors also talk about inability to comment on capitalization of Rs 37.7 crores

I also notice that between Sept 2016 and Mar 2017, they have capitalized entire Capital WIP of Rs 37.6 crores that surely resulted in increase in ‘Intangible Assets’ from Rs 39.8 crores to Rs 69.6 crores.

Seems like standard ways to cook books that was seen in Geodesic Ltd some years ago.

Some more details on how Geodesic promoters siphoned money raised by the firm via FCCB; an amount of $ 125 million - hat tip; alphaideas.in

http://alphaideas.in/2017/06/22/geodesic-promoters-125-million-fraud/

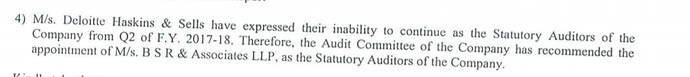

Pennar Engineered Building Systems Ltd. What can we conclude from this ?

http://www.bseindia.com/xml-data/corpfiling/AttachLive/9c693572-62d6-4fd1-9ef9-90d29ecab9fb.pdf

Disc: No investments

BSR is a member firm of KPMG. So for what its worth, it is from one Big 4 to another

hey do you still see these red flags in the company balance sheet

Yes. These and several more.

even now the market capital has reached 25k +cr

have you gone through the latest annul report

do u still see equal concerns as you found 2 years back i actually am invested from 2005 and un able to understand the kind of return the stock has given and you are mention that there are serious concerns its just timing when it burst like in amtek auto can u please give me your contact so that i can speak to you personally

Moneylife’s piece on the PwC forensics in Ricoh.

Moneylife got access to PwC Forensic report on the alleged wrongdoings at Ricoh. A forensic report is very enlightening on the heuristics used to suspect fraud and I have always wanted to lay my hands on one, sadly unsuccessfully.

This one doesn’t disappoint in outlining how fictitious sales were generated, the various parties - inside and outside involved, the transactions that give away fraud. It is also particularly damning on another listed company which has been touted as a multibagger in this veritable forum.

Here’s the link to the Moneylife report - The Fraud At Ricoh. Exclusive: PwC Forensic Report

After Screener query this is how i start, i think many do this already but no one did put this on paper in this thread. Hope it helps!

Its all in the Name(s):

(GOOGLE SEARCH SECTION)

Auditors: I always check whom else do they audit for. Why is this important is because a dishonest promoter will always choose an auditor who is in favor of helping or hiding his wealth. (Red Flag for me here)

For Eg: Do a google search for P M u r a l i & C o. (I intentionally wrote it with spaces because this search result will not appear on GOOGLE)

The way to search in google is type " ‘the auditor name’ site:bseinidia.com ", you know the example i gave you. You get all companies which they audited for including Lycos Internet, Country Club Hospitality, GoldStone Technologies, Virinchi, Vivimed Labs and many other companies whose stock is delisted or move from 100’s to near 1 Re. So you know there is a probability.

Orange Flag : If the Auditor is only auditing for one group only. Eg: Amtek Auto, Ahmednagar Forgings.

Resignations: Chief of Finance resigning too soon and many prior CFO’s doing that. Lycos Internet, Dhunseri Petrochem, i think you can add many more examples. Infact their LinkedIn pages will also help you.

Court Cases, FIR, fraud, money laundering, insider trading, fine :

You can also check their track record on any of the above. You can check all of them in google. You find answers to many promoters, board of directors, key personnel.

Good Example would be Eldeco Housing, Aksh Optifibre

Registered Address of the company:

Cross check the Registered Address (like building name) with the court Cases, FIR and anything above this, you will find pages in google with fraud, insider trading and so on.

One Eg like this would be Arihant Capital Markets.(In this case the door number is different but rest is assured)

Subsidiaries(address) & similar named companies from the same address which are not mentioned in Annual Report. Kitex Garments and SKM Egg Products i suppose.

Some of the above information are like not full Reg Flags but they will make the river soupy for your investment to swim.

Every one wants a piece of the Action:

(CORPORATE ANNOUNCEMENTS MINING)

Investigators always use this statement: “Always follow the money trail”

Companies generate cash from selling Equity, subsidiary companies, real estate etc:

I always look for answers for “What are you going to do with this money?” in Concall, sometimes the answers will appear very vague and the promoter will answer things like a considerable part in operational expense(house cleaning), i look for this very much.

Eg: i am sure you must have read many. I read it in Vivimed labs and similar proposition in Manpasand Beverages

Share Pledging and whom did he pledge to ?:

It gives me many answers.

For Eg: Most of Mandhana Industries Promoters pledged their shares to IDBI. Big Flag for me.

(I don’t consider pledging to be a bad thing as such… every one has capital requirements)

( I could be judgemental but i will not risk it)

Share Price Movements:

Check Share price movements before an announcement comes. One event like this might not be an indicator, however if you find this multiple times, like in a row. Lower level of honesty i would say.

If you mine Corporate Announcements you get this kind of information and look it with share prices.

Profiles of the Board and key personnel:

A responsible company will always give the profiles of their Board of Directors. I am generally interested in knowing their track record.

After this point i will start looking into their Financials

Note: All of this is my personal view and i request everyone to take it with a pinch of salt.

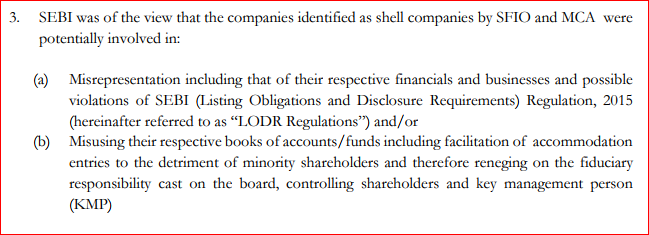

We know that 331 listed companies have been declared as shell companies and trading was restricted ( BSE Notice )

But what’s a shell company? While it brings about negative images, there is no clear and actionable definition. I used to think of it as an inactive company sporadically used for ‘canalising’ transactions for the real seller and real buyer. Nothing wrong with that if the rules of the land have been followed. So why should shell companies be banned?

I found some answers in a fantastic order drafted by Madhabi Puri Buch on Nu-Tek India which appealed against being declared as one.

She first defines a shell company for purpose of ascertaining if Nu-Tek was indeed one. Her definition was as follows:

I don’t think anyone would have thought of this definition of a shell company, would rather classify it as a fraudulent company. But that’s besides the point.

Her subsequent investigation to find out answers in the affirmative or otherwise to the above premises, the responses from the firm and her subsequent conclusions make for very instructive reading, reads like whodunit.

Her order is attached here - SEBI order on Nu-Tek

Excellent post, Valuable wealth of common sense.

SEBI bars PwC for two years on failing in its duty as an auditor in the Satyam fiasco.

The order can be found here

Interested members may study this 108 page document and make their notes here, I am yet to go through it. What is delightful is that a “reputed” auditor is held accountable against failing in the standards of an auditor’s report.

While I don’t want to add salt to injury, the Big 4 audit firms use Statutory Audit as an entry to get other lucrative deals, creating terrible conflicts. In many AGMs I have found analysts asking Promoters why don’t they have a Big 4 auditors, and sometimes firms succumb. But in my interactions I have always found smaller auditors more ethical (maybe selection bias) and more transparent. The Big 4 often try to minimise disclosure in the financial statements.

And as a historical fact, I should add that existence some of Indian auditors go back as late as the 18th Century (Haribhakti and Co, helped the Peshwas in Pune for funding their exploits). Varma and Varma*, a highly ethical audit firm, was established in 1935. The Big 4 carry a certain brand among foreign investors but I will put my money behind the Haribhaktis and the VarmaandVarmas.

Cheers,

*Discl: They do my firm’s audit.

The paragraph is opinionated by the particular gentleman, anyone can have an opinion. Hence to start with he is welcome to start. However the content is farthest from truth. Audit is old as hills, it’s the sibling of distrust and temptation. Auditor’s count the bricks in pyramid, walked the Britain railway tracks to ensure accuracy.

I am not sure when we say it’s the management prepares financials. I guess it’s the company as a whole we are referring. Two basic distinctions here:

- An accountant form part of management, belong to audit, so does to consulting. National and international accounting standards, practices and guidance’s are designed by accountants. So management can not prepare anything beyond generally accepted accounting procedures. Even estimates, judgments, contingent everything driven by us.

- Auditor do not start with what management produces them but with what is required by accounting and auditing standards. The number of uncomfortable questions asked has been always bone in contention. So let us not conclude that auditor are soft jelly, they are hard nuts.

They don’t raise certain issues, they have the power to qualify audit report including adverse opinion. There has been number of observations in past and will be going forward. One may look at Dunlop to Shaw Wallace.

The process of audit includes inquiry, examination to reperformance. Risk registers are built, mitigation plans are documented, opinions are consolidated for discussions. It’s like any other hard work, an audit report does not come out of air.

The power to audit is drawn from statute, in India it’s given by the parliament; it can not go any further. That itself a testimony of trusts and beliefs in the accountants by the highest regulating body. This is pretty much same globally. Everyone has the right to joke but focus will depend who is hearing? When it’s parliament and a class room we know where jurisprudence is leaning towards to!

Saying that let me reproduce words which I use quite a time.

My fraternity (Chartered Accountants) is single handed blamed for a lot of accounting mess. Some public perception goes to the extent we help clients in evading taxes, plunder money through business restructuring, puncture holes into accounting standards, conduct audit with a disclaimer, last but the not the least we ideate, write, advise and evade! It’s not me who is saying but the perception was reflected with Honourable Prime Minister of the country on CA day.

Am I saying all CA’s are out of falsehood and treachery? No, every profession has black sheep so we do have. Due to our watchdog nature every line comes out from our pen goes under scrutiny, we have been doing since 1949 officially. Sometime we failed, some of us did not behave the way they were supposed to but there is another side to us as well. We have transformed from rules based to control objective based, we moved away from transaction assurance to process assurance, error and omission to fraud. Of course, hegemonic institutions need time to put some of things into right track, but as a fraternity we equally feel frustrated for the black sheep and condemn their activities. But public should not deny us as the gravitational force behind financial regulations, tax system, governance transparency for years. We were the one who wrote COSO, we are the one who implement GST, we will be the one who will implement uniform direct tax laws in future. We are not trying to undermine other’s contribution but we have the rights to highlight our contribution.

Note: please do not conclude I am emotionally charged, it’s my right to defend against unsubstantiated statements. It’s to the gentleman’s statement not you personally.

Auditors perform a class of activities that involves preventing bad outcomes. In such class of activities* we do not notice and measure when things are fine, but vividly notice and measure when things are not fine. As a result, we often into a trap that leads to misjudgement.

For instance when firms prepare financial statements

-

We do not get to see what management has prepared before it reached the auditors; only after, thus we do not know what the auditors modified, and we do not measure that.

-

On the other hand since we get to see statements where auditors fail to assess the fair state of affairs, we measure that vividly.

As a result we fall into a bias that Daniel Kahneman calls WYSIATI - What You See Is All There Is and what you did not see does not exist.

We forget that auditors by and large get most firms to show true and fair state of affairs in their financial statements. Jim Chanos was certainly proven right in calling out Enron long before it was busted, but he is generalizing unfairly.

That brings us to the question - what about PwC in this case? Was is a victim or a perpetrator. In my view, after reading the facts presented in the SEBI order, PwC was wilfully negligent, and partners failed in their duty and I suspect given the levels of negligence (for instance, every year they ignored the daily bank statement in favor of the monthly bank statement from the Chairman’s Office, despite knowing (?) there are discrepancies), PwC was a perpetrator.

*any “prevention” of a bad outcome does not get measured compared to the “cures” that happen once an outcome goes bad; which gets a lot of applause.