It has pro as cons … Psychologically it means you will get less return on Fixed deposits , PPF etc . I am not sure EPFO , Pension funds will like that …

If it happens anytime soon - nifty PE will increase even further🙈

imo considering Nifty PE < 20 as a good bargain is being aggressive. PE 17 is not rare. Last decade, 2008 onwards, has been bullish. Has seen strong influx of funds. Therefore, we are inflicted by the Recency Bias.

US is a very different economy. Its indices are weighed in by Facebook, Apple, Google, Netflix and several other companies with technological bias. They can command a higher PE for the exclusivity of their product GLOBALLY. Nifty constituents are far from any such vantage point.

Having spoken to people in IT, they say TCS is not special at all in the US. It does nothing creative, only manual labour albeit in IT. It has no patents or any technology to call it its own. And it is the most respected company in Nifty.

Most other Nifty constituents have commoditized products, some of which command a premium due to its astute management. Thats it.

Point being there is no reason as such to believe that Nifty PE pattern will change with much significance.

It provides shovels for Tech Gold Rush.

Doing ordinary things very well has more probability of making money than doing extra-ordinary things. That is how they created 100B USD Mcap. Only company which is at same level in industry is Accenture.

Considering majority of household savings was locked up in RE, FD and gold. Now all of that is flowing in equity and MF, SIP.

Considering this trend to continue unabated for next decade, will this not prevent nifty PE to fall to average of 17. Why can’t PE of 22 be the new average?

IMHO it’s not related to recency bias. Market has become more efficient in the past 1 decade than it was in 1980s and 90s. So the index consisting the best companies of the country will be left undervalued only for a short period though few companies may remain undervalued for a relatively longer period.

In 2006, when I was initially listening to fund managers in media, there were hardly any who mentioned about parameters such as RoE, RoCE, D/E ratio, EV/EBITDA but only about P/E, P/B and EPS growth. Also, mutual funds were not getting SIP inflows like now. People’s faith in equity as asset class has increased and that in real estate and gold has decreased. If ETF also become more popular in India next decade like in developed markets, then getting NIFTY undervalued may become more difficult.

Morgan Stanley “Inflation targeting will likely reduce the volatility in the

inflation rate and, subsequently, in the growth rate. The cycle peak as

well as cycle average inflation could settle lower than history. To that

extent, India’s interest rates may peak at lower levels and nominal

growth may be lower than in the previous decade (we are forecasting

11% vs. 14% between 2004 and 2017). The concomitant impact is that

INR stock returns may compound at a slower pace than what we witnessed

in the past. USD returns could still be comparable with the

past since the pace of INR depreciation may also fall consequent to

lower inflation differentials with India’s trading partners. With the

asking rate of equity returns falling, India’s P/E multiple is likely to be

higher for longer.”

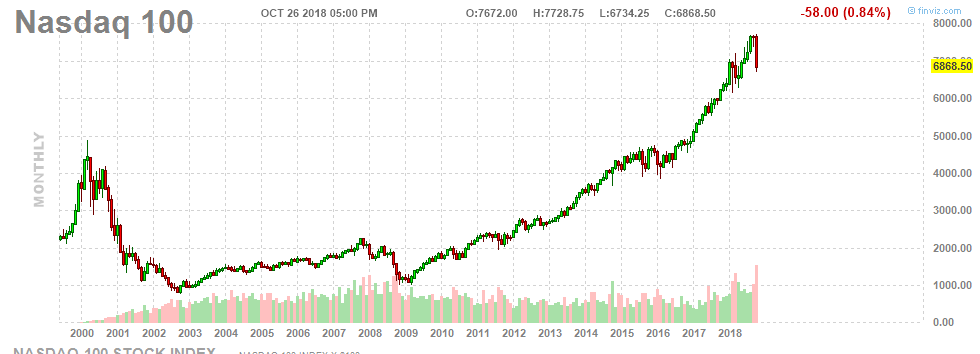

Nasdaq plunged from

-

5000 to 1000 when the Tech Bubble burst in 2000

-

2000 to 1000 during Lehman fiasco.

It appears to be a strong possibility for NASDAQ to shave off a big chunk every once a decade or so.

Looking at the chart, this time around as well, there seems to be a plenty of gap on the downside. The “Orange Hatter” seems to be doing everything he can to fill this gap.

Just a thought which came to mind after I read about the gazillion $$ which investors lost in Apple’s recent collapse.

PS: In the last decade, with Tech Companies ruling the roost, calling the shots, dominating the Market Cap in S&P, it is likely that the PE will make wider swings… Hail Capitalism… ![]()

I am not sure last several posts are related to the thread. It needs to be moved to appropriate thread.

Regards,

Raj

It would help someone who is sincerely considering the topic of the thread.

If he enters now It would mentally prepare him for a wider/deeper drawdown. . Or may be chooses to wait for a lower PE.

The above article shows advantage of having two careers, I myself work full time in real estate and now pursuing investing as my second career option.One advantage is there is some synergy other is less pressure in both of my career.

I don’t think one needs to be a full time equity investor.

If one doesn’t love original career I doubt one will love equity investing career.

It is just attraction of easy money or escape route.

Other aspect is selling and buying equity does not add any value to society.

That is a very demeaning comment to the mutual fund and equity as an asset which is the reward a promoter enjoys and passes on to people who support his venture

Promoter can be there full time to run the venture but what will minority share holders do full time except for flipping stocks.

Contribution to society is not just by converting time into money. There are people who build society by writing acting teaching. Helping poor & needy can be a full time job…be creatkve. people who do job are not the only one who cteate society…Donate your time to build nation… if u are that smart an investor…get on board of the company. Show them how to create big & better business.

Debatable …

Seems acting cricket politics.other sports are not proffession. Real job if 9 to 5 office job. I agree

I have talked about career and not just 9-5 job and pointed to people who want to give up a career (which can be job in most of the cases) to take up full time investing career. I can guarantee that 99% are looking for a escape route. I see enough people glued to moneycontrol in offices when they should be focussing on their work.

You mean avg investor can get onto board by investing and guide company to create better biz. They might as well create their own biz. Don’t know of anyone except for likes of Damani and Jhunjhunwala.

I rest my case.

I agree it is not everyones cup of tea…but benchmark u r knowledge performance and if u have the capability to identify issues with the company brimg it up to their knowledge. As a small stock holder tecnicaly u r ignored silent partner. U buy business and management u like.

I am not a fulltime investor, but I have thought about going that route eventually. My thoughts are a little different.

-

When you are a full-time investor, you tend to have more time for family. You tend to have more time for your children and more time to take care of your health. You owe more to your family and yourself than to society.

-

To those who are so inclined, you can always contribute to “true service” with more time at hand as a fulltime investor. Additionally, If your pf is large, you can also set aside money for donations every month.

-

I believe every stock market participant has a purpose (even if it is only as little or trivial like what some of the so called day jobs provide). Stock market participants have been instrumental in the sensex rise from 3000 to 30,000. We have not only contributed to our own prosperity, but also to the prosperity of market participants who achieved important financial(life) goals. We also indirectly provide employment to the MF industry. We have also improved/enhanced borrowing capacity of some large companies. We weigh value, provide high valuations to the deserving, WE are “Mr Market” !!! and yes in some tiny way, we all contribute to the economy.

If I take a sub brokership or franchisee of a broker (say sharekhan/LKP/IIFL etc), will I be able to provide the following services in addition to just broking:

1.Institutional Dealer(ship)

2.Equity Research analyst / Research Analyst

3.Equity Adviser

4.Portfolio/Fund management

If the answer is a “no” to all the above four, what are the additional requirements for each of the four above? Thanks