Has the demerger helped the company??? What can be the reason for transferring main business into unlisted demerged entity??

Income tax search and seizure operation at various premises of the company: https://www.bseindia.com/xml-data/corpfiling/AttachLive/8c57bb68-56d0-4c41-9b48-70df848280f8.pdf

Is this a worry? Does anyone know more insight into this?

IT raids are not much of concern, however if it is other then tax evasion then it might be an overhang on the company.

The fall in profit and the CAPEX announced is however a matter of concern.

Disclosure : Invested 1% of my portfolio for tracking purpose.

Why is this stock falling continuously from 2018.

They transferred their main business to subsidiary in which Deepak fertilizer have 100% holding. As such it seems simple restructuring. But is there something more than obvious which market is aware.

Disclosure : Invested 1% of my portfolio for tracking purpose.

Read this release … BEARS are on hunt it seems . Lot of adverse news lately . Management has tried to combat it - but only time will tell who is right …

The huge capex planned by the company is a big negative on the company.

The rating agencies are also critical on its proposed CAPEX

Hi which capex plan are you referring to. The 560 cr new nitric acid plant in Dahej or 5270 cr future expansion of IPA, TAN and ammonia capacity planned till 2022?

I think this is the one being referred

Disclaimer: Tracking. Not invested

News of a small capital infusion through pref equity : https://www.equitybulls.com/admin/news2006/news_det.asp?id=257278 . Can this be considered positive news and promoter confidence?

These warrants were issued in Oct 2018. Since it was already known that they would be converted after one year, there will be no effect.

The promoters have to still infuse Rs 125 Cr for total subscription of warrants.

DFPCL major products :

Chemicals : Ammonia, Methanol, DNA, C NA, CO2, TAN, IPA, Propane, Bulk and Speciality Chemicals.

Bulk Fertilisers : NP, MOP, DAP, Ammonium Sulphate, Mixtures, SSP, Sulphur, Micronutrients, SSF, Bio Fertilisers, Fruits,Vegetables, Pesticides

Realty: Real Estate Business

Others :Windmill Power

Concentrated Nitric Acid 1,38,600 (Existing) 92,400 (Newly Commissioned)

(Production 2018-19 : 134019:Sales :123555 /Strong Nitric Acid Production 2018-19: 23598 ;Sales 23532)

Dilute Nitric Acid 7,02,900 (Existing) 1,48,500 (Newly Commisioned

(Production in 2018-19 : 690505; Sales :52114)

Methanol 1,00,000 -

(Production in 2018-19 : 51531)

Iso Propyl Alcohol 70,000

(Production in 2018-1962793)

Propane

Liquid CO2 66,000 -

(Production in 2018-19 : 28392)

(Production in 2018-19 : 690505)

Ammonia 125400 MT (Capacity)

- Nitric Acid

DFPCL is the largest manufacturer of Nitric Acid in India. Nitric Acid finds its applications in nitro aromatics, pharmaceuticals, dyes, steel rolling industry, defence and explosive industries. The Company has three integrated manufacturing plants located at Taloja (Maharashtra), Dahej (Gujarat) and Srikakulam (Andhra Pradesh) with a combined manufacturing capacity of 885 KTPA of diluted nitric acid (DNA) and 231 KTPA of concentrated nitric acid (CNA). Technical ammonium nitrate (TAN) and ammonium nitro phosphate (ANP) consume a significant portion of nitric acid as part of the manufacturing process captively and surplus nitric acid is sold to domestic companies.

Capacity Expansion:

DFPCL has successfully commenced the commercial production of nitric acid at Dahej, Gujarat in April 2019. The new facility has a total production capacity of 92 KTPA for CNA and 148 KTPA for DNA. The Company has already entered into agreements for 70% of the capacity and the project is expected to operate at full capacity in the near term. With these capacities, the Company’s market share is expected to increase to 54% during FY2020.

Outlook

The demand for CNA in the medium to long term is expected to increase significantly supported by the expanded capacities of major manufacturers in the aromatics segment in the Gujarat region. DFPCL would be able to provide improved service levels and deliveries in the region with increased proximity to major end-use industries with newly added capacities. Towards its commitment to provide unique and value-added offerings, the Company is also developing new grades of nitric acid, i.e. electronic grade and steel grade.

2. Methanol

Methanol is primarily used to produce formaldehyde, tert-amyl methyl ether (TAME) and methyl derivatives. It is also used as a solvent in the pharmaceutical and paint industries. DFPCL is one of the largest producers of methanol in India with an installed capacity of 100 KTPA at Taloja, Maharashtra. During the year, opportunistic production of methanol is undertaken as per availability of gas and pricing outlook in the market.

Outlook

Going forward, methanol market in India is projected to grow at a CAGR of 7% upto 2025. The Company will continue to strategically produce methanol in line with the market demand.

-

Liquid Carbon Dioxide (CO2)

DFPCL is one of the leading suppliers of Liquid Carbon Dioxide (LCO2) with an installed capacity of 66 KTPA. It is by product while making Ammonia. The Company manufactures food grade CO2 which is used as a key ingredient for dry ice and beverages. In addition, it is also used in

engineering industries as a shield gas for welding.

Outlook

The outlook of LCO2 continues to be positive on account of increasing demand in the end market industries.

- Iso Propyl Alcohol (IPA)

- DFPCL is the only manufacturer of IPA in India with an installed capacity of 70,000 MTPA.

- IPA finds applications in pharmaceuticals, coatings and inks, specialty chemicals and cosmetics.

- The company offers IPA with a minimum purity of 99.8%. Apart from the standard grade of IPA, the company also offers BP, USP, pharma and cosmetic grades. The company has also received FSAAI certification to provide Food grade IPA recently.

- IPA is sold in barrels as well as taker-load by DFPCL

- To service the customers in west and south region, apart from manufactured IPA, DFCPL imports IPA and has developed infrastructure for the same in Vizag, Hazira, JNPT and Kandla ports.IPA demand in India is majorly driven by the pharmaceutical sector. The total demand for IPA in India was around 170 KT in FY2019. Apart from pharmaceuticals, which accounts for 80% of total IPA demand, it also finds applications in inks and coatings, speciality chemicals and IPA derivatives. The Company is a preferred IPA supplier in the country and is associated with the leading pharmaceutical companies in India. In India, about 58% of IPA requirement is being met through imports primarily to fulfil the high demand from the growing pharmaceuticals sector.

Outlook

IPA demand is expected to grow to 180 KTPA by FY2020. During the year, IPA was available in surplus in the market due to global demand and supply situation which has created undue pressure on IPA pricing. In addition, there has been increasing supply of IPA from Chinese producers into the South East Asian and Indian markets. IPA is expected to continue to face challenges in the near term. The Company is also targeting on IPA drumming for better margins.

- PROPANE

- Propane is member of hydrocarbon group called alkane and is a byproduct of natural gas processing and petroleum refining.

- It is colourless, odourless and nontoxic gas. It is in gaseous form at standard temperature and pressure but can be liquefied when pressurised.

- DFPCL receives propylene with nearly 15-20% propane in the mixture. Before using propylene as raw material in IPA manufacturing, propane is separated from the same, which has min. of 97% purity.

- Propane is stored and transported in its compressed liquid form, but used most commonly in gaseous state.

- Propane finds its primary use in heating applications in resindential and commercial cooking to large industrial and manufacturing processes.

Uses

Nitric Acid

Widely used in the manufacture of Ammonium Nitrate and other explosives, Sodium Nitrate, Potassium Nitrate, Calcium Nitrate, Glyoxal, H-Acid, Nitrobenzene and other Nitro Derivatives, Dyes and Dye Intermediates, Drugs and Pharmaceuticals, Pickling of Steel and Metallurgy, Acrylic Fibre, Pesticides, etc.

Application overview

• Ammonium nitrate

• Adipic acid

• Toluene di-Isocynate (TDI)

• Nitrobenzene

• Others

End-user overview

• Explosives

• Fertilizers

• Chemicals

• Others

METHANOL :

Methanol economy in India

- Why Methanol?

- What India can do?

- Methanol Benefits in Transportation sector

- Methanol Benefits in Marine Sector

- Methanol in Railways

- Methanol & DME in Cooking fuel program

- Summary

India needs around 2900 cr litres of petrol and 9000 cr litres of diesel per year currently, the 6th highest consumer in the world and will double consumption and become 3rd largest consumer by 2030. Our import bill on account of crude stands at almost 6 lac crores.

Hydrocarbon Fuels have also adversely affected the environment with Green House Gas Emissions (GHG). India is the third highest energy related carbon dioxide emitter country in the world. Almost 30% pollution in cities like Delhi is from automobiles and the growing number of automobiles on the road will further worsen the pollution. The recent situation is alarming and time has come for the Govt to present a comprehensive road map to reduce the urban pollution in this country and stop pollution related deaths completely.

Hon’ble Prime Minister has set a goal for our Country to reduce the import bill by 10% by the year 2022. Crude oil imports drain our foreign exchange, putting enormous pressure on our currency & thereby weakening our bargaining power with the rest of the world.

Why Methanol?

Methanol is a clean burning drop in fuel which can replace both petrol & diesel in transportation & LPG, Wood, Kerosene in cooking fuel. It can also replace diesel in Railways, Marine Sector, Gensets, Power Generation and Methanol based reformers could be the ideal compliment to Hybrid and Electric Mobility. Methanol Economy is the ‘Bridge’ to the dream of a complete “Hydrogen based fuel systems”.

Methanol burns efficiently in all internal combustion engines, produces no particulate matter, no soot, almost nil SOX and NOX emissions (Near Zero Pollution) . The gaseous version of Methanol - DME can blend with LPG and can be excellent substitute for diesel in Large buses and trucks.

METHNAOL 15 (M15) in petrol will reduce pollution by 33% and diesel replacement by methanol will reduce by more than 80 %.

Methanol can be produced from Natural Gas, Indian High Ash Coal, Bio-mass, MSW, stranded and flared gases and India can achieve (through right technology adaptation} to produce Methanol @ Rs.19 a litre from Indian coal and all other feedstock. The best part world is already moving towards renewable methanol from C02 and the perpetual recycling of C02 into Methanol, say C02 emitted from Steel plants, Geothermal energy or any other source of C02, effectively “Air to Methanol”.

During the last few years, the use of methanol and DME as fuel has increased significantly. Methanol demand is growing at a robust 6 to 8 % annually. World has installed capacity of 120 MT of Methanol and will be about 200 MT by 2025.

Currently Methanol accounts for almost 9% of transport fuel in China. They have converted millions of vehicles running on Methanol. China alone produces 65% of world Methanol and it uses its coal to produce Methanol. Israel, Italy have adopted the Methanol 15% blending program with Petrol and fast moving towards M85 & M100. Japan, Korea have extensive Methanol & DME usage and Australia has adopted GEM fuels (Gasoline, Ethanol & Methanol) and blends almost 56% Methanol. Methanol has become the choice of fuel in Marine Sector worldwide and countries like Sweden are at the forefront of usage. Large passenger ships carrying more than 1500 people are already running on 100% Methanol. African and many Caribbean countries have adopted Methanol cooking fuel and across the world Gensets and industrial boilers are running on Methanol, instead of diesel.

Renewable Methanol by capturing C02 back from the atmosphere is becoming very popular and is seen by the world as the “Enduring Energy Solution known to Mankind”. Methanol is a significant solution to the burning problem of Urban pollution worldwide.

What India can do?

India has an installed Methanol Production capacity of 2 MT per annum. As per the plan prepared by NITI Aayog, using Indian High Ash coal, Stranded gas, and Biomass can produce 20 MT of methanol annually by 2025. India, with 125 Billion Tonnes of proven Coal reserves and 500 million tones of Biomass generated every year & the huge quantities of Stranded & Flared gases has a huge potential for ensuring energy security based on alternate feedstock and fuels.

NITI Aaayog has drawn out a road map to substitute 10% of Crude imports by 2030, by Methanol alone. This requires approximately 30 MT of Methanol. Methanol & DME are substantially cheaper than Petrol and Diesel and India can look to reduce its fuel bill 30% by 2030.

NITI Aayog’s road map for Methanol Economy comprises:

- Production of methanol from Indian high ash coal from indigenous Technology , in Large quantities and adopting regional production strategies and produce Methanol in large quantities @ Rs. 19 a litre. India will adopt C02 capturing technology to make the use of coal fully environment friendly and our commitments to COP21.

- Bio-mass, Stranded Gas & MSW for methanol production. Almost 40% of Methanol Production can be through these feed stocks.

- Utilization of methanol as well as DME in transportation – rail, road, marine and defence. Industrial Boilers, Diesel Gensets & Power generation & Mobile towers are other applications.

- Utilization of methanol and DME as domestic cooking fuel - cook stoves. LPG - DME blending program.

- Utilization of methanol in fuel cell applications in Marine, Gensets and Transportation.

Methanol Benefits in Transportation sector

With very little modifications to existing engines (vehicles) and fuel distribution infrastructure, 15% of all vehicle fuels can be converted to Methanol & Di Methyl Ether (DME). India is shortly going to implement Methanol 15 % blending program with Petrol and cost of petrol is expected to come down immediately by 10% and M100 program for buses and trucks is also to be implemented shortly.

Global engine manufactures like Volvo, caterpillar, Mercedes and in collaboration with Indian players can manufacture these engines under the Make in India and will result in big FDI investments. The development of this sector will bring jobs in the engineering sector.

Methanol Benefits in Marine Sector

Worldwide due to emission regulations being implemented stringently by IMO (International Maritime Organisation), marine sector is shifting to Methanol as fuel of choice. Being a very efficient in liquid form and practically generating no SOx or NOx, Methanol is much cheaper than LNG and Bunker / Heavy Oil. Sweden has already about 17 boats, ferrys, barges and a 1500 passengers cruise ship running on Methanol.

India will convert about 50 Nos of vessels in the Port sector and various vessels owned by government entities to operate on Methanol. This opportunity will also be used to standardise all the marine regulations both sea and inland in parity with International Maritime Organization rules and with global standards.

Methanol in Railways

Indian Railways consumes about 3 billion litres a year and the annual diesel bill is in excess of Rs. 15000 Crores. A Methanol locomotive prototype is being implemented by Indian Railways under a grant by Department of Science & Technology and once all 6000 diesel engines are converted to methanol (at very minimal cost of less than 1 crore a engine), the annual diesel bill can be reduced by 50%. Methanol conversion program in railways is complimentary to the goals of electrification in Railways.

Methanol & DME in Cooking fuel program

The cooking fuel program of Methanol liquid fuel and LPG-DME blending is a low hanging fruit for India. A 20% blending program with LPG, without any infrastructure modifications would result in a immediate savings of Rs.6000 Crores a year. Lakhs of rural women will cook healthy and Methanol supplied in canisters would ensure fuel supply in the remotest part of North East and Himalayas.

Progress made thus far

India has successfully converted a two wheeler engine, a Genset, power weeder (agriculture equipment) and is in process of converting many IC engines to Methanol, including railways and marine. Focus is on augmenting Methanol production capacity of existing producers like GNFC, RCF & Assam Petro and through various routes of production, India will target a Methanol production of at least 5 million tons by 2021. PSU’s like BHEL, CIL & SAIL are contemplating to produce Methanol though the coal route and Oil PSU’s through the stranded gas route. BHEL at Trichy, the Talcher Fertilizer plant can also produce Methanol in Large quantities in a short period of time.

Summary

India by adopting Methanol can have its own indigenous fuel at the cost of approximately 19 Rs. A litre at least 30% cheaper than any available fuel. Methanol fuel can result in great environmental benefits and can be the answer to the burning Urban pollution issue. At least 20% diesel consumption can be reduced in next 5-7 years and will result in a savings of Rs 26000 Crores annually. Rs. 6000 Crores can be annually saved from reduced bill in LPG in the next 3 years itself. The Methanol blending program with Gasoline will further reduce our fuel bill by at least Rs 5000 Crores annually in next 3 years. Make in India program will get a further boost by both producing fuel indigenously and associated growth in automobile sector adding engineering jobs and also investments in Methanol based industries (FDI and Indian). However, Coal and Stranded Gas linkages are import policy initiatives to be taken.

The final roadmap for ‘Methanol Economy’ being worked out by NITI Aaayog is targeting an annual reduction of 100 Billion $ by 2030 in crude imports.

https://pib.gov.in/PressReleseDetail.aspx?PRID=1514452

ISO PROPANOL

The isopropanol market is currently witnessing an uptrend in demand. While some regions have realized self-sufficiency, there are still a few regions that rely heavily on imports. One such region in India, which is currently importing more than half its demand.

India’s supply dynamics are, however, expected to change in the coming years. This article aims to present the changing market dynamic scenario in the Indian isopropanol market and how this change is likely to affect India’s current batch of exporters. In addition, this article will also highlight the possible scenarios and opportunities that this change is likely to bring to the Asian isopropanol market.

Indian Isopropanol Market

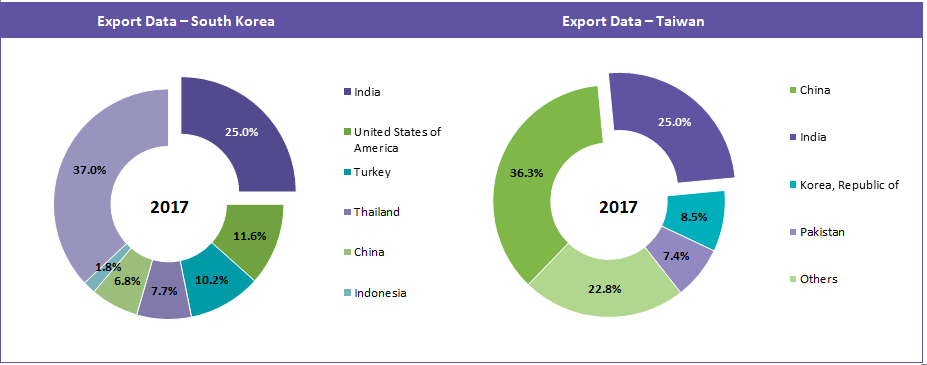

The Indian isopropanol market has been growing at a rate of 4-5 percent for the last couple of years and is expected to continue growing at the same rate until 2022. Driven mainly by the pharmaceutical segment, the supply to this market is import dependent, with the main importers being the Republic of Korea (South Korea) and Chinese Taipei (Taiwan). India is a major exporting destination for these two countries, details of which will be covered later on in the article.

The Indian market for isopropanol is a monopolistic market with Deepak Fertilizers producing 70,000 MT/year. However, this is expected to change soon.

Upcoming Capacities

By the end of the fiscal year in 2020, the capacity of the Indian isopropanol market is expected to increase by 214 percent. The capacity expansion is likely to be put into effect by Deepak Fertilizers and Balaji Amines Ltd. Deepak Fertilizers plans to expand its current installed facility by 100,000 MT/year to reach a total capacity of 170,000 MT/year; while Balaji Amines Ltd. is all set to set up a new acetone based isopropanol producing plant, which is anticipated to have a capacity of 50,000 MT/year, thereby making it the second largest isopropanol producing player in the region.

With these plants set to come online in 2020, the dynamic of the Indian isopropanol market is projected to take a new direction. India is anticipated to walk the path of self-sufficiency, leading to reduced imports from regions like South Korea and Taiwan. So what do these regions do with the isopropanol that now remains unwanted by India?

Dealing with the additional Isopropanol

The new capacity additions in India will not only re-shape the Indian isopropanol industry, but also the trade conduct of other regions (namely South Korea and Taiwan). In 2017, these regions exported around 54% and 68% of their total produced isopropanol, respectively. In addition, 25% of their export was shipped to India.

What Next?

There are two possible future scenarios: one from the perspective of buyers who are currently procuring isopropanol from these two regions; and the other for procurement managers who are looking to source isopropanol from China.

Let us look at both these scenarios:

Scenario 1:

In this scenario, we are looking at the purchasing managers who are procuring isopropanol from players like LCY Chemical, LG Chemical, and Isu Chemical Co Ltd. These players are the major manufacturers in the South Korean and Taiwan regions producing close to 90% of the regions’ isopropanol. The major portion of the isopropanol procured from these regions is consumed by the construction, pharmaceutical, and automobile industries which are growing at a rate of 3-5 percent.

Demand from the personal care segment is anticipated to witness an increase caused by a rise in disposable income.

So, with India out of the picture, and surplus isopropanol available from these players, procurement managers can leverage this scenario to lower the prices.

Scenario 2:

The U.S. – China Trade war has ramped up the import prices for isopropanol being shipped into China, and unfortunately for China, the U.S. is its second largest exporter. According to the ongoing trade conflict, current import duties imposed by the U.S. have increased by 12 percent, only to be further increased to 25 percent by the end of the first quarter in 2019.

The Chinese isopropanol market has witnessed an upstream growth in demand in the last couple of years and is anticipated to continue growing at a rate of 5-6 percent until 2022.

This increase in demand is likely from the growing construction and automobile industries. In addition, growing demand from the pharmaceutical industry is also contributing to the growing demand for isopropanol in China.

Despite sufficient capacity available to cater to the growing demand, China still imports around 113,000 MT of isopropanol to cater to the CPG industry. China’s demand for isopropanol from the CPG industry comes from its use of technical-grade isopropanol compared with pharma-grade isopropanol, as it is comparatively cheaper. The rest rely on imports for the same.

Rising disposable income and materialistic lifestyles have led to an increase in the adoption of cosmetics, thereby leading to an increase in isopropanol demand.

If the hike in import duties stays, then the capacity expansions in India are likely to be a boon for Chinese isopropanol buyers. With surplus supply available in the market from Taiwan and South Korea, purchase managers can look to these regions to safeguard their supply and to ensure that China need not procure isopropanol at higher rates from the U.S.

Conclusion

India’s road to self-sufficiency, once set in motion, is likely to unfold a series of events that are likely to present a plethora of opportunities to purchasing managers.

To begin with, India need not depend on imports the way it does now, thereby reducing its imports from countries like South Korea and Taiwan. This is likely to lead to a market surplus which can be exploited by purchase managers (old and new), thereby making this a WIN-WIN situation for all.

Concall Highlights

- Dumping of IPA from China.

- Nitric Acid plant capacity utilization touched 90%.

- Sale of Non Core Assets : Orissa Land, Gujrat Land, Pune Land.

but no fixed timeline. - Trading activity reduced substantially and only focussing on Trading of IPA.

- Company has discontinued manufacturing bulk fertiliser since Sept 2019 and only producing specialised fertiliser SMARTEK

- Methanol : Manufacturing activity only taken when delta of FG and RM (Natural Gas) is favorable. Only is back to back buyer commitment.

- Realty buisness still incurring losses, however losses are narrowing.

- Gross debt will increase in future due to ongoing CAPEX, however there will also be repayment of existing Term Loans. No guidance on debt Equity ration for FY 2020-21, 20-22.

- EC for ammonia plant will not be required as per clarification from MOEF, however approval from state authorities will be required. Ammonia Plant to start tentatively from Q3 22.

- Water issues in Q1/Q2 due to reduction in water supply by MIDC.This resulted in production loss.

- Acid segment : Low offtake due to Clogging of Mumbai -Manglore Highway due to heavy rains.

Flood situation in Customers plant in Dahej.

Hash action taken by GPCB ( Gujrat Pollution Controll Board). - Other income due to CAPITAL gains.

- Fertiliser segment : Inventory level high in market and rate was reduced by one of the Competitors. Inventory losses were also there.

- Ammonia Cost : USD 250 Middle east.

Phos Acid : USD 625

15 Subsidy outstanding : 263 Cr as on 30/09/2019.

Sale of non-core industrial land parcel in Dahej for 99.2 Crores

Consolidated Summary on Warrants, FCCB - CCD and NCD issued, Debt and pledge

Promoter Companies of DFPCL

Nova Synthetic Limited is the Promoting Holding Company of DFPCL with over 48% stake. Nova is also the Holding company of Robust Marketing, another Promoter Company of DFPCL but with less stake.

200 Cr of Funds to subscribe for Warrants of DFPCL at strike of INR 308 have been raised by Robust Marketing by way of NCDs at a certain coupon - by creating pledge on it’s Holding company Nova Synthetic’s assets (48% stake and some change here & there) as guarantee. Robust Marketing has land bank of 171 acres Non-Agricultural Land in Mangalore, and two buildings - in Mumbai and Delhi. NCD rated BB+ stable by Acruite.

IFC

IFC is subscribing in FCCB of $30 Million directly in DFPCL, which will be used for expansion in Industrial Chemicals - TAN and IPA.

Other tranche of $30 Million will be put in the subsidiary of DFPCL - Smartchem by issuing CCD for expansion mainly towards Ammonia project.

Ammonia Project

Smartchem has a step down subsidiary ; Performance Chemiserve ; a sort of SPV. Holding percentage - 85% with Smartchem, ~15% with Robust. Current business is Drumming of IPA. Within this subsidiary, lies the massive Ammonia project.

Little short of 3000 Cr is required to setup the entire capacity of 1500 MTPA. ~2100 Cr Long term Debt issued by Bank of Baroda, rest will be equity. Debt to be repaid in a tenure of 19 Years (some repayment tranches started kicking in FY 2018-19)

In FY 2018-19, ~300 Cr were invested by Smartchem for shares at a premium of ~INR 1,00,000 FV INR 10. There’s room for equity to fund the rest 500 odd Cr. May look for a strategic investor for this 500 Cr.

Ammonia Project has Post tax IRR of 15% with projected revenue pa of 1500 Cr ; payback in 5 Years. 70 or 90% (not sure of the number) ammonia will be locked for Smartchem/DFPCL.

On CPs

No outstanding commercial papers

Areas to look for

- Standalone debt (IC business) is 600 Cr ; is this old debt or new.

- Couldn’t find more details on commissioning of IPA and TAN expansion (though heard of resistance by locals of Paradeep, Orissa regarding TAN project and 1750 Cr capex plan for TAN) and debt repayment schedules. Expansion plan was of 2350 Cr for these two.

Conclusion

Promoters have too much skin in the game. Instills some level of confidence despite highly leveraged balance sheet.

Disclosure

Invested ; holding since over a year and accumulating

-

Is the Ammonia project completed as you have mentioned that

“Debt to be repaid in a tenure of 19 Years (some repayment tranches started kicking in FY 2018-19)” -

Has the Company indirectly created pledge of shares(of DFPCL) via its Promoter Companies.

- I don’t know. Guess will have to wait for AGM to get a hold on progress. However, I revisited the AR. On term loan by BoB, the repayment will start from June 2021. (Major misread on my part ; sincere apologies).

- No, there was a clarification submitted to the exchanges on this and the same was mentioned in the Q3 updates as well.

Deepak fertilizers has launched an handsanitizer product cororid. How the company is going to leverage it’s position as a manufacturer of IPA to selling it to end customers ? There seems to be a lot of brands in recent days in this space. Does cororid hold any advantage because brands like Dettol and other well known companies with established distribution network may do better.

Disc: Invested before the product launch