Astra Microwave Products Ltd (Astra) designs, develops and manufactures sub-systems for defence and space applications. Its strong R&D, technical capability and established record places it ahead of its peers. Order book of more than 3x FY12 revenues provides visibility for the next two years. Healthy growth in defence capex and increase in the governmentâs focus on indigenous manufacturing will keep its order book healthy. However, increasing competition, volatile earnings and lack of succession plans are key risks. We initiate coverage on Astra with a fundamental grade of 4/5, indicating that its fundamentals are superior relative to other listed securities in India.

Strong R&D, experienced team and established track record provide an edge Astra has a strong R&D set-up with four in-house facilities and highly qualified and experienced personnel. The management team has over two decades of experience in DRDO and ISRO. By partnering with government agencies in many prestigious programmes, it has proved its technical capabilities. During any order bidding, technical competence weighs more than cost competitiveness, which gives Astra an edge over competitors.

Increasing defence capex and focus on indigenous manufacturing to drive growth India’s expenditure on defence equipment has increased at a CAGR of 12% over the past 10 years. In the Union Budget for FY13, the military spending has been increased by 17% to ~US$40 bn. Further, in order to improve self-dependency, the government has introduced an offset clause, which has created another opening for Indian players. Astra has already started benefitting from this; it recently bagged an order worth Rs 3,100 mn. Although competition is high, the companyâs strong record will ensure a steady flow of orders.

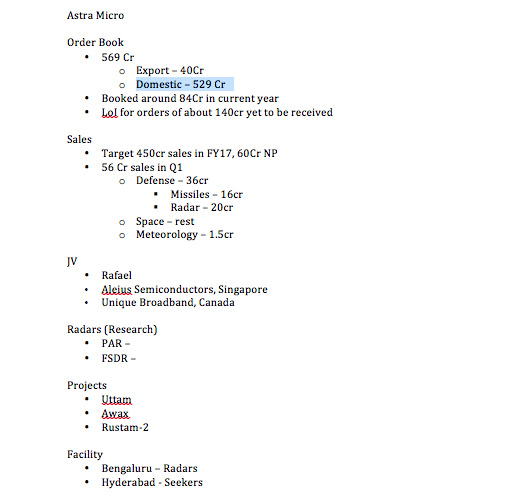

Current order book provides visibility for next two years Astraâs order book of Rs 7,300 mn, which is more than 3x FY12 revenues, provides visibility on its performance for the next two years. Further, we believe AESA radar (which CABS has productionised in association with Astra) will attract demand in the long term.

.

.