Albert David Ltd (ADL), a part of the well-known Kolkata based ‘House of Kotharis’ is distinguished in the field of manufacturing Pharmaceutical Formulations, Infusion Solutions, Herbal Dosage Forms, Bulk Drugs, Disposable Syringes & Needles.

It made a modest start in 1924 with a single manufacturing facility. Today, it has three manufacturing units located in Kolkata in West Bengal, Ghaziabad in U.P. and Mandideep in M.P. Its Kolkata plant is USFDA approved whereas the other two plants are WHO CMP & ISO 9002 certified. Some of its bulk drugs are also certified by the UK and the European Council.

ADL has a strong presence in various drug therapeutic classes like Immunomodulators, Vitamins & Nutritional Supplements, NSAIDs, Apetite Stimulants, Liver Protective, Anti-Ulcerants, Laxatives, Anti-Arthiritic Preparations, Muscle Relaxants and Adaptogenics among others. In the current year, it introduced new formulations in segments like anti-asthmatics, anti-ulcerants, another proton pump inhibitor and nutritional supplements. It also plans to venture into the pre-probiotic, infertility and nutraceuticals market.

With an extensive network of 1600+ stockists, ADL’s products are available all across India. It also has a presence in South East Asia, Africa, Middle East, Europe, USA and Latin America, covering approximately 35 countries.

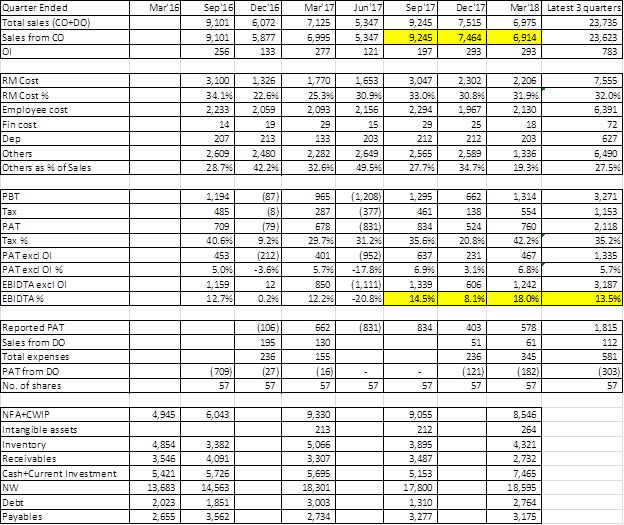

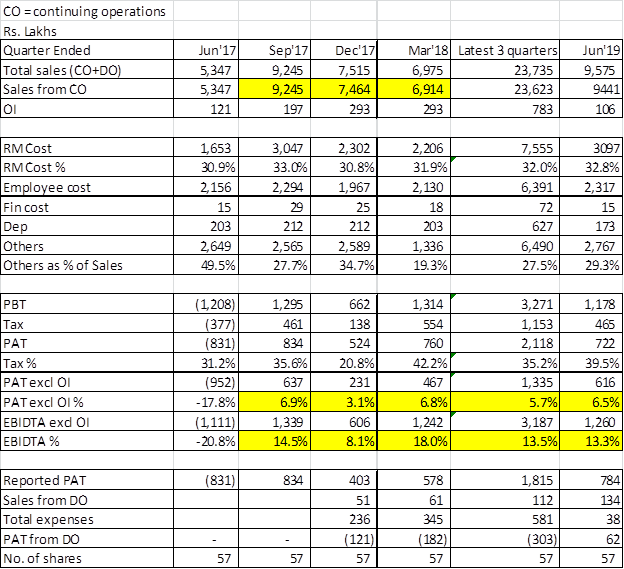

The Company expects to achieve a turnover of Rs.400 crore in FY17. Its market cap is closer to Rs.200 crore, which is cheap when compared to other small-cap and mid-cap pharma companies which trade at a market cap:sales ratio of between 2x to 3x as against ADL’s 0.5x. It reported an EPS of Rs.15 in H1 FY16 and is trading at a P/E of 11x if we annualized the performance.

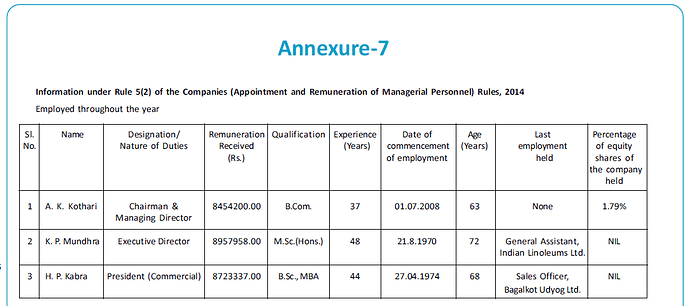

ADL has a small equity capital of Rs.5.71 crore supported by reserves of Rs.130 crore. The promoters hold 60.9% of the equity capital and the balance is held by the investing public.

Recently, the Company sold one of its brands ‘Actibile’ to Zydus Healthcare for Rs.55 crore. With a market cap of just Rs.177.7 crore and one of its brands reaping Rs.55 crore, the Company has made me take a tracking position in the stock.